Sallie Mae 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

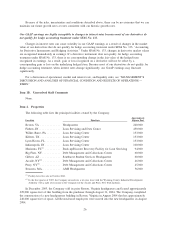

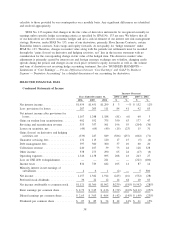

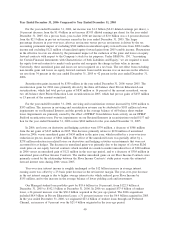

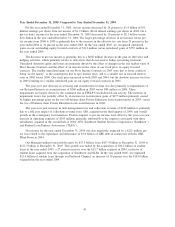

Item 6. Selected Financial Data

Selected Financial Data 2002-2006

(Dollars in millions, except per share amounts)

The following table sets forth selected financial and other operating information of the Company. The

selected financial data in the table is derived from the consolidated financial statements of the Company. The

data should be read in conjunction with the consolidated financial statements, related notes, and “MANAGE-

MENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERA-

TIONS” included in this Form 10-K.

2006 2005 2004 2003 2002

Operating Data:

Net interest income ......................... $ 1,454 $ 1,451 $ 1,299 $ 1,326 $ 1,425

Net income . . . ............................ 1,157 1,382 1,914 1,534 792

Basic earnings per common share, before cumulative

effect of accounting change ................. 2.73 3.25 4.36 3.08 1.69

Basic earnings per common share, after cumulative

effect of accounting change ................. 2.73 3.25 4.36 3.37 1.69

Diluted earnings per common share, before

cumulative effect of accounting change ......... 2.63 3.05 4.04 2.91 1.64

Diluted earnings per common share, after cumulative

effect of accounting change ................. 2.63 3.05 4.04 3.18 1.64

Dividends per common share .................. .97 .85 .74 .59 .28

Return on common stockholders’ equity .......... 32% 45% 73% 66% 46%

Net interest margin ......................... 1.54 1.77 1.92 2.53 2.92

Return on assets ........................... 1.22 1.68 2.80 2.89 1.60

Dividend payout ratio ....................... 37 28 18 19 17

Average equity/average assets.................. 3.98 3.82 3.73 4.19 3.44

Balance Sheet Data:

Student loans, net .......................... $ 95,920 $82,604 $65,981 $50,047 $42,339

Total assets . . . ............................ 116,136 99,339 84,094 64,611 53,175

Total borrowings ........................... 108,087 91,929 78,122 58,543 47,861

Stockholders’ equity......................... 4,360 3,792 3,102 2,630 1,998

Book value per common share ................. 9.24 7.81 6.93 5.51 4.00

Other Data:

Off-balance sheet securitized student loans, net ..... $ 46,172 $39,925 $41,457 $38,742 $35,785

31