Sallie Mae 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I.

Item 1. Business

INTRODUCTION TO SLM CORPORATION

SLM Corporation, more commonly known as Sallie Mae, is the market leader in education finance. SLM

Corporation is a holding company that operates through a number of subsidiaries. (References in this Annual

Report to “the Company” refer to SLM Corporation and its subsidiaries). At December 31, 2006, we had

approximately 11,000 employees.

Our primary business is to originate and hold student loans by providing funding, delivery and servicing

support for education loans in the United States through our participation in the Federal Family Education

Loan Program (“FFELP”) and through offering non-federally guaranteed Private Education Loans. We

primarily market our FFELP Stafford and Private Education Loans through on-campus financial aid offices. In

recent years, the industry has moved toward a direct-to-consumer marketing model as evidenced by the surge

in FFELP Consolidation Loans which are marketed directly to FFELP Stafford borrowers. We have also

expanded our direct-to-consumer marketing of Private Education Loans.

We have used both internal growth and strategic acquisitions to attain our leadership position in the

education finance marketplace. Our sales force, which delivers our products on campuses across the country, is

the largest in the student loan industry. The core of our marketing strategy is to promote our on-campus

brands, which generate student loan originations through our Preferred Channel. Loans generated through our

Preferred Channel are more profitable than loans acquired through other acquisition channels because we own

them earlier in the student loan’s life and generally incur lower costs to acquire such loans. We have built

brand leadership through the Sallie Mae name, the brands of our subsidiaries and those of our lender partners.

These sales and marketing efforts are supported by the largest and most diversified servicing capabilities in the

industry, providing an unmatched array of services to financial aid offices.

We have expanded into a number of fee-based businesses, most notably, our Debt Management

Operations (“DMO”) business, which is presented as a distinct segment in accordance with the Financial

Accounting Standards Board’s (“FASB”) Statement of Financial Accounting Standards (“SFAS”) No. 131,

“Disclosures about Segments of an Enterprise and Related Information.” Our DMO business provides a wide

range of accounts receivable and collections services including student loan default aversion services, defaulted

student loan portfolio management services, contingency collections services for student loans and other asset

classes, and accounts receivable management and collection for purchased portfolios of receivables that are

delinquent or have been charged off by their original creditors. We also purchase and manage portfolios of

sub-performing and non-performing mortgage loans.

We also earn fees for a number of services including student loan and guarantee servicing, 529 Savings

Plan Administration services, and for providing processing capabilities and information technology to

educational institutions. We also operate a consumer savings network through Upromise, Inc. (“Upromise”)

loyalty service.

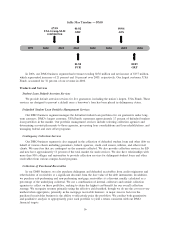

In December 2004, we completed the Wind-Down of the GSE through the defeasance of all remaining

GSE debt obligations and dissolution of the GSE’s federal charter. The liquidity provided to the Company by

the GSE has been replaced primarily by securitizations. In addition to securitizations, we have access to a

number of additional sources of liquidity including an asset-backed commercial paper program, unsecured

revolving credit facilities, and other unsecured corporate debt and equity security issuances.

On August 22, 2006, the Company completed the acquisition of Upromise. Upromise is the leading

provider of saving for college programs. Through its Upromise affiliates, the company administers 529

college-savings plans and assists its members with automatic savings through rebates on everyday purchases.

7