Sallie Mae 2006 Annual Report Download - page 164

Download and view the complete annual report

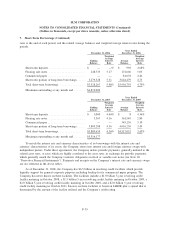

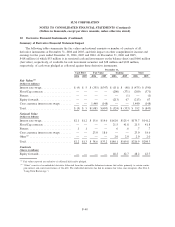

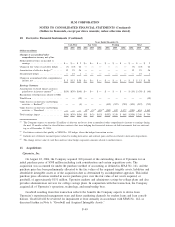

Please find page 164 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10. Derivative Financial Instruments (Continued)

swaps executed to hedge these instruments. Management believes certain derivative transactions entered into

as hedges, primarily Floor Income Contracts, equity forward contracts, and basis swaps and Eurodollar futures

contracts, are economically effective; however, those transactions generally do not qualify for hedge account-

ing under SFAS No. 133 (as discussed below) and thus may adversely impact earnings.

By using derivative instruments, the Company is exposed to both market and credit risk. Market risk is

the chance of financial loss resulting from changes in interest rates, foreign exchange rates and/or stock prices.

Credit risk is the risk that a counterparty will not perform its obligations under a contract and it is limited to

the loss of the fair value gain in a derivative that the counterparty owes the Company. When the fair value of

a derivative contract is negative, the Company owes the counterparty and, therefore, has no credit risk. The

Company minimizes the credit risk in derivative instruments by entering into transactions with highly rated

counterparties that are reviewed periodically by the Company’s credit department. The Company also

maintains a policy of requiring that all derivative contracts be governed by an International Swaps and

Derivative Association Master Agreement. Depending on the nature of the derivative transaction, bilateral

collateral arrangements may be required as well. When the Company has more than one outstanding derivative

transaction with a counterparty, and there exists legally enforceable netting provisions with the counterparty

(i.e. a legal right to offset receivable and payable derivative contracts), the “net” mark-to-market exposure

represents the netting of the positive and negative exposures with the same counterparty. When there is a net

negative exposure, the Company considers its exposure to the counterparty to be zero. At December 31, 2006

and 2005 the Company had a net positive exposure (derivative gain positions to the Company less collateral

which has been posted by counterparties to the Company) related to corporate derivatives of $97 million and

$12 million, respectively.

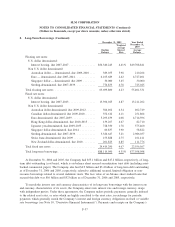

The Company’s on-balance sheet securitization trusts have $10.3 billion of Euro and British Pound

Sterling denominated bonds outstanding as of December 31, 2006. To convert these non-U.S. dollar denomi-

nated bonds into U.S. dollar liabilities, the trusts have entered into foreign-currency swaps with highly-rated

counterparties. As of December 31, 2006, the net positive exposure on these swaps is $1.0 billion. As

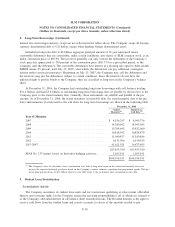

previously discussed, the Company’s corporate derivatives contain provisions which require collateral to be

posted on a regular basis for changes in market values. The on-balance sheet trusts’ derivatives are structured

such that swap counterparties are required to post collateral if their credit rating has been withdrawn or is

below a certain level. If the swap counterparty does not post the required collateral or is downgraded further,

the counterparty must find a suitable replacement counterparty or provide the trust with a letter of credit or a

guaranty from an entity that has the required credit ratings. In addition to the credit rating requirement, trusts

issued after November 2005 require the counterparty to post collateral due to a net positive exposure on cross-

currency interest rate swaps, irrespective of their counterparty rating. The trusts, however, are not required to

post collateral to the counterparty. As of December 31, 2006, counterparties have posted $101 million of

collateral due to a net positive exposure from changes in market value and have posted $0 related to any credit

rating downgrade as no downgrade triggers have been met. Ultimately, the Company’s exposure related to a

swap counterparty failing to make its required payments is limited to the trust assets (primarily student loans

and cash) which collateralize the outstanding bonds in the trust. Because the bonds outstanding generally are

at parity with the assets that collateralize the bonds, even in periods of great stress in the foreign currency

markets, the likelihood of a material loss is remote.

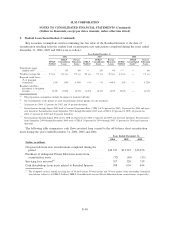

SFAS No. 133

Derivative instruments that are used as part of the Company’s interest rate and foreign currency risk

management strategy include interest rate swaps, basis swaps, cross-currency interest rate swaps, interest rate

futures contracts, and interest rate floor and cap contracts with indices that relate to the pricing of specific

F-45

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)