Sallie Mae 2006 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

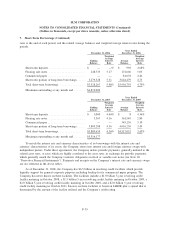

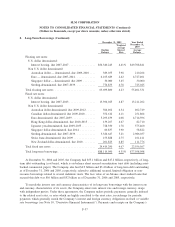

8. Long-Term Borrowings (Continued)

interest rate and foreign currency swaps are not reflected in the tables above. The Company swaps all foreign

currency denominated debt to U.S dollars except when funding foreign denominated assets.

Included in long-term debt is $2 billion aggregate principal amount of 32-year unsecured senior

convertible debentures that are convertible, under certain conditions, into shares of SLM common stock, at an

initial conversion price of $65.98. The investors generally can only convert the debentures if the Company’s

stock price has appreciated to 130 percent of the conversion price ($85.77) for a prescribed period, or the

Company calls the debentures. The convertible debentures bear interest at a floating rate equal to three-month

LIBOR minus .05 percent, until July 25, 2007, after which, the debentures can pay additional contingent

interest under certain circumstances. Beginning on July 25, 2007, the Company may call the debentures and

the investors may put the debentures, subject to certain conditions. Since the investors do not have the

unilateral right to put the bonds to the Company, they are classified as long-term in the Company’s balance

sheet.

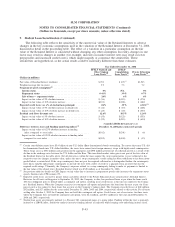

At December 31, 2006, the Company had outstanding long-term borrowings with call features totaling

$11.4 billion, and had $5.8 billion of outstanding long-term borrowings that are putable by the investor to the

Company prior to the stated maturity date. Generally, these instruments are callable and putable at the par

amount. As of December 31, 2006, the stated maturities (for putable debt, the stated maturity date is the put

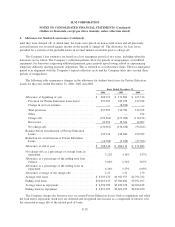

date) and maturities if accelerated to the call dates for long-term borrowings are shown in the following table:

Stated

Maturity

(1)

Maturity to

Call Date

(1)

December 31, 2006

Year of Maturity

2007 . . ............................................. $ 4,156,247 $ 8,045,376

2008 . . ............................................. 14,389,052 14,943,505

2009 . . ............................................. 15,294,665 15,832,060

2010 . . ............................................. 10,818,992 10,828,479

2011 . . ............................................. 11,040,837 11,189,886

2012 . . ............................................. 6,131,996 6,140,539

2013-2047 ........................................... 41,621,551 36,473,495

103,453,340 103,453,340

SFAS No. 133 (gains) losses on derivative hedging activities ...... 1,105,191 1,105,191

$104,558,531 $104,558,531

(1)

The Company views its on-balance sheet securitization trust debt as long-term based on the contractual maturity dates and

projects the expected principal paydowns based on the Company’s current estimates regarding loan prepayment speeds. The pro-

jected principal paydowns of $4.2 billion shown in year 2007 relate to the on-balance sheet securitization trust debt.

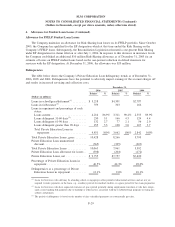

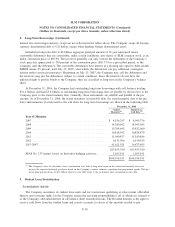

9. Student Loan Securitization

Securitization Activity

The Company securitizes its student loan assets and for transactions qualifying as sales retains a Residual

Interest and servicing rights (as the Company retains the servicing responsibilities), all of which are referred to

as the Company’s Retained Interest in off-balance sheet securitized loans. The Residual Interest is the right to

receive cash flows from the student loans and reserve accounts in excess of the amounts needed to pay

F-38

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)