Sallie Mae 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Purchased Paper

Our purchased paper collection business is comprised of the purchase of delinquent and charged off

consumer receivables, primarily credit cards and the purchase of distressed mortgage receivables. Since these

businesses operate in different segments of the marketplace with the primary distinguishing factor being the

existence of collateral for the mortgage receivable, we have broken out their results separately in the

presentations below.

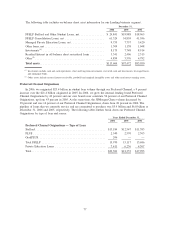

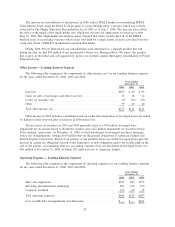

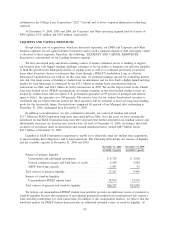

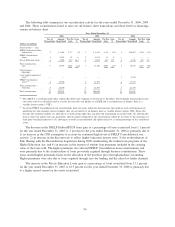

Non-Mortgage

2006 2005 2004

(1)

Years Ended

December 31,

Face value of purchases .................................... $3,438 $2,826 $426

Purchase price ........................................... 278 198 19

% of face value purchased .................................. 8.1% 7.0% 4.5%

Gross Cash Collections (“GCC”) .............................. $ 348 $ 250 $ 59

Collections revenue. ....................................... 199 157 39

%ofGCC .............................................. 56% 63% 66%

Carrying value ........................................... $ 274 $ 158 $ 52

(1)

AFS was purchased in September 2004, so the results for that year reflect only three months of activity.

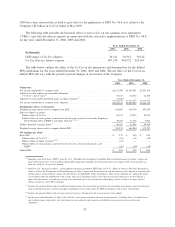

The amount of face value of purchases in any quarter is a function of a combination of factors including

the amount of receivables available for purchase in the marketplace, average age of each portfolio, the asset

class of the receivables, and competition in the marketplace. As a result, the percentage of principal purchased

will vary from quarter to quarter. The decrease in purchase paper revenue as a percentage of GCC can

primarily be attributed to the increase in new portfolio purchases in the second half of 2005. Typically,

revenue recognition based on a portfolio’s effective yield rate is a lower percentage of cash collections in the

early stages of servicing a portfolio. On both December 22, 2005, and December 29, 2006, we acquired an

additional 12 percent ownership stake in AFS, increasing our ownership first to 76 percent and then to

88 percent.

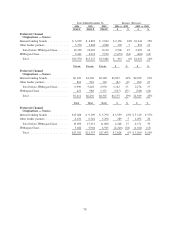

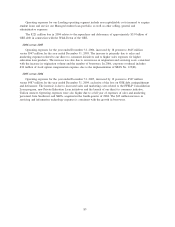

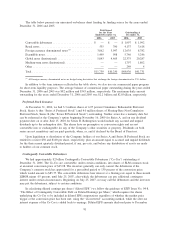

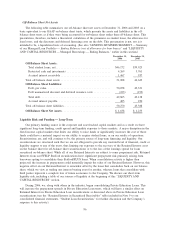

Mortgage/Properties

On August 31, 2005, we acquired 100 percent of GRP, a debt management company that acquires and

manages portfolios of sub-performing and non-performing mortgage loans, substantially all of which are

secured by one-to-four family residential real estate. GRP was purchased in August 2005, so the results for

that year ended reflect only four months of activity.

2006 2005

Years Ended

December 31,

Face value of purchases .............................................. $556 $165

Collections revenue ................................................. 40 10

Collateral value of purchases .......................................... 607 195

Purchase price ..................................................... 462 141

% of collateral value ................................................ 76% 72%

Carrying value of purchases ........................................... $518 $298

The purchase price for sub-performing and non-performing mortgage loans is generally determined as a

percentage of the underlying collateral. Fluctuations in the purchase price as a percentage of collateral value

can be caused by a number of factors including cash flow characteristics, targeted yield, expected holding

period, the percentage of second mortgages in the portfolio and the level of private mortgage insurance

associated with particular assets.

86