Sallie Mae 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

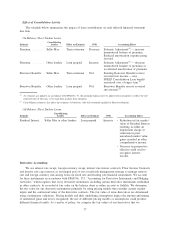

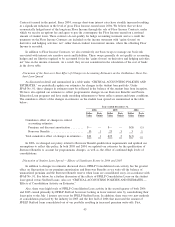

Effect of Consolidation Activity

The schedule below summarizes the impact of loan consolidation on each affected financial statement

line item.

On-Balance Sheet Student Loans

Estimate

Consolidating

Lender Effect on Estimate CPR Accounting Effect

Premium ........ Sallie Mae Term extension Decrease Estimate Adjustment

(1)

— increase

unamortized balance of premium.

Reduced amortization expense going

forward.

Premium ........ Other lenders Loan prepaid Increase Estimate Adjustment

(1)

— decrease

unamortized balance of premium or

accelerated amortization of premium.

Borrower Benefits. . Sallie Mae Term extension N/A Existing Borrower Benefits reserve

reversed into income — new

FFELP Consolidation Loan benefit

amortized over a longer term.

(2)

Borrower Benefits. . Other lenders Loan prepaid N/A Borrower Benefits reserve reversed

into income.

(2)

(1)

As estimates are updated, in accordance with SFAS No. 91, the premium balance must be adjusted from inception to reflect the new

expected term of the loan, as if it had been in place from inception.

(2)

Consolidation estimates also affect the estimates of borrowers who will eventually qualify for Borrower Benefits.

Off-Balance Sheet Student Loans

Estimate

Consolidating

Lender Effect on Estimate CPR Accounting Effect

Residual Interest. . Sallie Mae or other lenders Loan prepaid Increase • Reduction in fair market

value of Residual Interest

resulting in either an

impairment charge or

reduction in prior

unrealized market value

gains recorded in other

comprehensive income.

• Decrease in prospective

effective yield used to

recognize interest

income.

Derivative Accounting

We use interest rate swaps, foreign currency swaps, interest rate futures contracts, Floor Income Contracts

and interest rate cap contracts as an integral part of our overall risk management strategy to manage interest

rate and foreign currency risk arising from our fixed rate and floating rate financial instruments. We account

for these instruments in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” which requires that every derivative instrument, including certain derivative instruments embedded

in other contracts, be recorded at fair value on the balance sheet as either an asset or liability. We determine

the fair value for our derivative instruments primarily by using pricing models that consider current market

inputs and the contractual terms of the derivative contracts. The fair value of some derivatives are determined

using counterparty valuations. Pricing models and their underlying assumptions impact the amount and timing

of unrealized gains and losses recognized; the use of different pricing models or assumptions could produce

different financial results. As a matter of policy, we compare the fair values of our derivatives that we

37