Sallie Mae 2006 Annual Report Download - page 129

Download and view the complete annual report

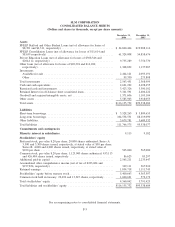

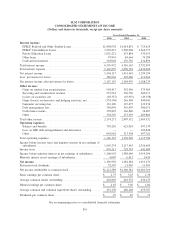

Please find page 129 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)

1. Organization and Business

SLM Corporation (“the Company”) is a holding company that operates through a number of subsidiaries.

The Company was formed 34 years ago as the Student Loan Marketing Association, a federally chartered

government-sponsored enterprise (the “GSE”), with the goal of furthering access to higher education by acting

as a secondary market for student loans. In 2004, the Company completed its transformation to a private

Company through its wind-down of the GSE. The GSE’s outstanding obligations were placed into a Master

Defeasance Trust Agreement as of December 29, 2004, which was fully collateralized by direct, noncallable

obligations of the United States.

The Company’s primary business is to originate and hold student loans by providing funding, delivery and

servicing support for education loans in the United States through its participation in the Federal Family Education

Loan Program (“FFELP”) and through offering non-federally guaranteed Private Education Loans. The Company

primarily markets its FFELP Stafford and Private Education Loans through on-campus financial aid offices. In

recent years, there has been a surge in FFELP Consolidation Loans which are marketed directly to FFELP Stafford

borrowers. The Company has also expanded its marketing of direct-to-consumer Private Education Loans.

The Company has expanded into a number of fee-based businesses, most notably its Debt Management

Operations (“DMO”) business, which is presented as a distinct segment in accordance with the Financial

Accounting Standards Board’s (“FASB”) Statement of Financial Accounting Standards (“SFAS”) No. 131 “Disclo-

sures about Segments of an Enterprise and Related Information.” The Company’s DMO business provides a wide

range of accounts receivable and collections services including student loan default aversion services, defaulted

student loan portfolio management services, contingency collections services for student loans and other asset

classes, and accounts receivable management and collection for purchased portfolios of receivables that are

delinquent or have been charged off by their original creditors as well as sub-performing and non-performing

mortgage loans.

The Company also earns fees for a number of services including student loan and guarantee servicing,

529 Savings Plan administration services, and for providing processing capabilities and information technology

to educational institutions. The Company also operates a consumer savings network through Upromise, Inc.

(“Upromise”) loyalty service.

2. Significant Accounting Policies

Consolidation

The consolidated financial statements include the accounts of SLM Corporation and its subsidiaries, after

eliminating the effects of intercompany accounts and transactions.

Financial Interpretation (“FIN”) No. 46(R), “Consolidation of Variable Interest Entities,” requires Variable

Interest Entities (“VIEs”) to be consolidated by their primary beneficiaries if they do not effectively disperse risks

among parties involved. A VIE exists when either the total equity investment at risk is not sufficient to permit the

entity to finance its activities by itself, or the equity investors lack one of three characteristics associated with

owning a controlling financial interest. Those characteristics are the direct or indirect ability to make decisions

about an entity’s activities that have a significant impact on the success of the entity, the obligation to absorb the

expected losses of an entity, and the rights to receive the expected residual returns of the entity.

As further discussed in Note 9, “Student Loan Securitization,” the Company does not consolidate any

qualifying special purpose entities (“QSPEs”) created for securitization purposes in accordance with

SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities — a Replacement of SFAS No. 125.” All of the Company’s off-balance sheet securitizations meet

F-10