Sallie Mae 2006 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

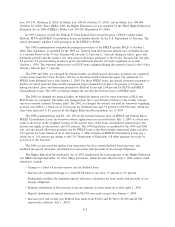

Guarantor Funding

In addition to providing the primary guarantee on FFELP loans, guarantee agencies are charged with

responsibility for maintaining records on all loans on which they have issued a guarantee (“account

maintenance”), assisting lenders to prevent default by delinquent borrowers (“default aversion”), post-default

loan administration and collections and program awareness and oversight. These activities are funded by

revenues from the following statutorily prescribed sources plus earnings on investments.

Source Basis

Insurance Premium ................ Upto1%oftheprincipal amount guaranteed, withheld

(Changes to Federal Default Fee July 1,

2006)

from the proceeds of each loan disbursement.

Loan Processing and Issuance Fee ..... .4%oftheprincipal amount guaranteed in each fiscal year, paid by

the Department of Education.

Account Maintenance Fee ........... .10% of the original principal amount of loans outstanding, paid by

the Department of Education.

Default Aversion Fee ............... 1%oftheoutstanding amount of loans submitted by a lender for

default aversion assistance, minus 1% of the unpaid principal and

interest paid on default claims, which is, paid once per loan by

transfers out of the Student Loan Reserve Fund.

Collection Retention ............... 23%oftheamount collected on loans on which reinsurance has

been paid (18.5% collected for a defaulted loan that is purchased

by a lender for rehabilitation or consolidation), withheld from gross

receipts. Guarantor retention of collection fees on defaulted FFELP

Consolidation Loans is reduced from 18.5% to 10% (effective

October 1, 2006), and reduced to zero beginning October 1, 2009

on default consolidations that exceed 45 percent of an agency’s

total collections on defaulted loans.

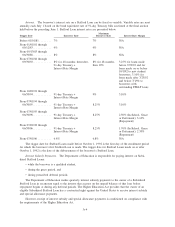

The Act requires guaranty agencies to establish two funds: a Student Loan Reserve Fund and an Agency

Operating Fund. The Student Loan Reserve Fund contains the reinsurance payments received from the

Department, Insurance Premiums and the complement of the reinsurance on recoveries. The fund is federal

property and its assets may only be used to pay insurance claims and to pay Default Aversion Fees. Recoveries

on defaulted loans are deposited into the Agency Operating Fund. The Agency Operating Fund is the

guarantor’s property and is not subject to as strict limitations on its use.

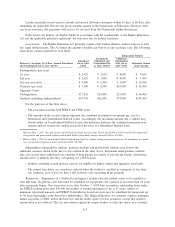

If the Department of Education determines that a guarantor is unable to meet its insurance obligations,

the holders of loans guaranteed by that guarantor may submit claims directly to the Department and the

Department is required to pay the full guarantee payments due, in accordance with guarantee claim processing

standards no more stringent than those applied by the terminated guarantor. However, the Department’s

obligation to pay guarantee claims directly in this fashion is contingent upon its making the determination

referred to above.

A-12