Sallie Mae 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. Goodwill and Acquired Intangible Assets (Continued)

recognized an intangible impairment of $21 million due to changes in projected interest rates used to initially

value the intangible asset and to a regulatory change that restricts the loans on which the Company is entitled

to earn a 9.5 percent yield. This impairment charge was recorded to operating expense in the Lending

segment.

On August 31, 2005, the Company acquired 100 percent controlling interest in GRP/AG Holdings, LLC

and its subsidiaries (collectively, “GRP”) for a purchase price of approximately $137 million including cash

consideration and certain acquisition costs. GRP engages in the acquisition and resolution of distressed

residential mortgage loans and foreclosed residential properties. In the third quarter of 2006, the Company

finalized its purchase price allocation for GRP, which resulted in an excess purchase price over the fair value

of net assets acquired, or goodwill, of $53 million.

In 2005, the Company acquired one debt management company and closed on the second step of the

acquisitions of a majority owned debt management company and a majority owned student lending business as

described in Note 11, “Acquisitions.” During 2005, the Company also finalized the purchase price allocations

associated with its 2004 acquisitions, respectively, and adjusted goodwill for certain earn-out payments and

allocations associated with these prior acquisitions.

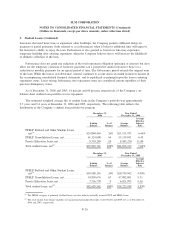

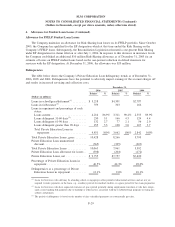

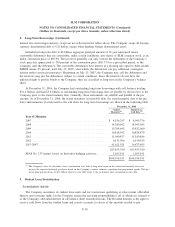

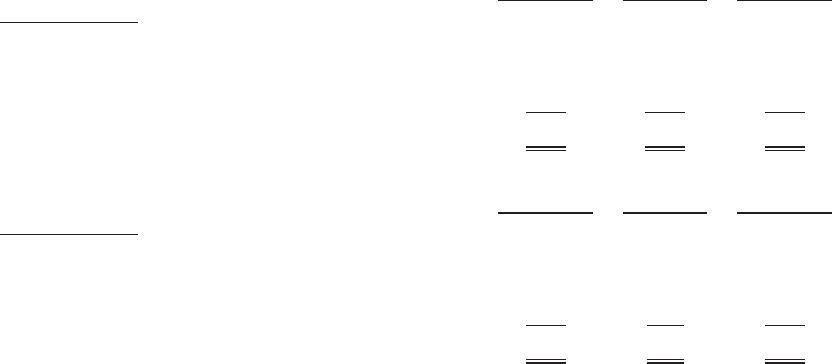

A summary of changes in the Company’s goodwill by reportable segment is as follows:

December 31,

2005 Acquisitions

December 31,

2006

(Dollars in millions)

Lending ..................................... $410 $ (4) $406

Debt Management Operations ..................... 299 50 349

Corporate and Other ............................ 64 151 215

Total ........................................ $773 $197 $970

December 31,

2004 Acquisitions

December 31,

2005

(Dollars in millions)

Lending ..................................... $440 $(30) $410

Debt Management Operations ..................... 206 93 299

Corporate and Other ............................ 57 7 64

Total ........................................ $703 $ 70 $773

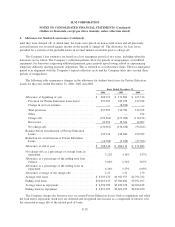

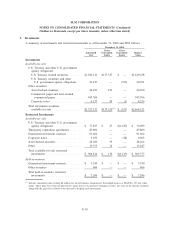

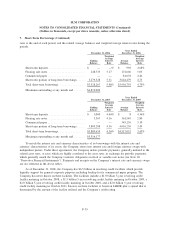

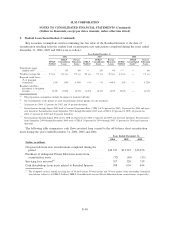

7. Short-Term Borrowings

Short-term borrowings have a remaining term to maturity of one year or less. The following tables

summarize outstanding short-term borrowings at December 31, 2006 and 2005, the weighted average interest

F-34

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)