Sallie Mae 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

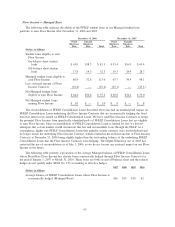

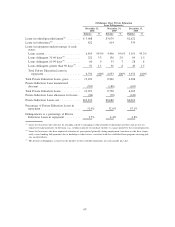

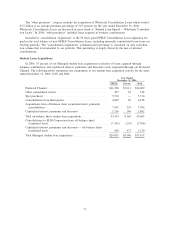

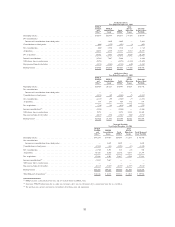

Total Loan Net Charge-offs

The following tables summarize the net charge-offs for all loan types on-balance sheet and on a Managed

Basis for the years ended December 31, 2006, 2005 and 2004.

Total on-balance sheet loan net charge-offs

2006 2005 2004

Years Ended

December 31,

Private Education Loans ....................................... $137 $135 $ 96

FFELP Stafford and Other Student Loans........................... 5 4 7

Mortgage and consumer loans ................................... 5 5 6

Total on-balance sheet loan net charge-offs ......................... $147 $144 $109

Total Managed loan net charge-offs

2006 2005 2004

Years Ended

December 31,

Private Education Loans ....................................... $161 $137 $102

FFELP Stafford and Other Student Loans........................... 8 4 19

Mortgage and consumer loans ................................... 5 5 6

Total Managed loan net charge-offs ............................... $174 $146 $127

The decrease in FFELP Stafford and Other Student Loans charge-offs in 2005 is due to the Company

earning the EP designation in the fourth quarter of 2004.

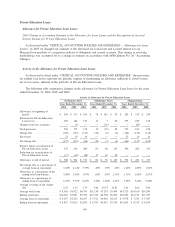

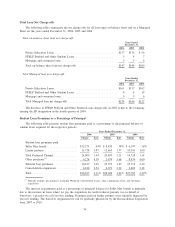

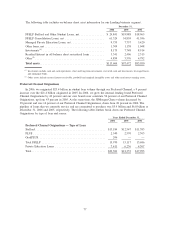

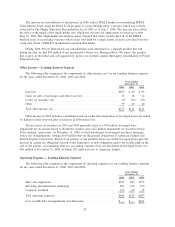

Student Loan Premiums as a Percentage of Principal

The following table presents student loan premiums paid as a percentage of the principal balance of

student loans acquired for the respective periods.

Volume Rate Volume Rate Volume Rate

2006 2005 2004

Years Ended December 31,

Student loan premiums paid:

Sallie Mae brands ................... $12,271 .94% $ 8,430 .38% $ 6,197 .36%

Lender partners ..................... 11,738 1.97 12,463 1.77 10,541 1.60

Total Preferred Channel ............... 24,009 1.44 20,893 1.21 16,738 1.14

Other purchases

(1)

................... 6,228 4.39 2,479 3.68 8,436 4.60

Subtotal base purchases ............... 30,237 2.05 23,372 1.47 25,174 2.30

Consolidation originations ............. 4,188 2.54 4,672 2.32 2,609 2.18

Total ............................. $34,425 2.11% $28,044 1.61% $27,783 2.29%

(1)

Primarily includes spot purchases (including Wholesale Consolidation Loans), other commitment clients, and subsidiary

acquisitions.

The increase in premiums paid as a percentage of principal balance for Sallie Mae brands is primarily

due to the increase in loans where we pay the origination fee and/or federal guaranty fee on behalf of

borrowers, a practice we call zero-fee lending. Premiums paid on lender partners were similarly impacted by

zero-fee lending. The borrower origination fee will be gradually phased out by the Reconciliation Legislation

from 2007 to 2010.

74