Sallie Mae 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BUSINESS SEGMENTS

We provide our array of credit products and related services to the higher education and consumer credit

communities and others through two primary business segments: our Lending business segment and our DMO

business segment. These defined business segments operate in distinct business environments and have unique

characteristics and face different opportunities and challenges. They are considered reportable segments under

the FASB’s SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information,” based on

quantitative thresholds applied to the Company’s financial statements. In addition, within our Corporate and

Other business segment, we provide a number of complementary products and services to financial aid offices

and schools that are managed within smaller operating segments, the most prominent being our Guarantor

Servicing and Loan Servicing businesses. In accordance with SFAS No. 131, we include in Note 18 to our

consolidated financial statements, “Segment Reporting,” separate financial information about our operating

segments.

Management, including the Company’s chief operating decision maker, evaluates the performance of the

Company’s operating segments based on their profitability as measured by “Core Earnings.” Accordingly, we

provide information regarding the Company’s reportable segments in this report based on “Core Earnings.”

“Core Earnings” are the primary financial performance measures used by management to develop the

Company’s financial plans, track results, and establish corporate performance targets and incentive compensa-

tion. While “Core Earnings” are not a substitute for reported results under generally accepted accounting

principles in the United States (“GAAP”), the Company relies on “Core Earnings” in operating its business

because “Core Earnings” permit management to make meaningful period-to-period comparisons of the

operational and performance indicators that are most closely assessed by management. Management believes

this information provides additional insight into the financial performance of the core business activities of our

operating segments. (See “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDI-

TION AND RESULTS OF OPERATIONS — BUSINESS SEGMENTS” for a detailed discussion of our “Core

Earnings,” including a table that summarizes the pre-tax differences between “Core Earnings” and GAAP by

business segment and the limitations to this presentation.)

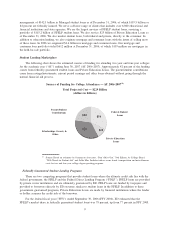

We generate most of our earnings in our Lending business from the spread between the yield we receive

on our Managed portfolio of student loans and the cost of funding these loans less the provisions for loan

losses. We incur servicing, selling and administrative expenses in providing these products and services, and

provide for loan losses. On our income statement, prepared in accordance with GAAP, this spread income is

reported as “net interest income” for on-balance sheet loans, and as “gains on student loan securitizations” and

“servicing and securitization revenue” for off-balance sheet loans in which we maintain a Retained Interest.

Total “Core Earnings” revenues for this segment were $2.4 billion in 2006.

In our DMO business segment, we provide a wide range of accounts receivable and collections services

including student loan default aversion services, defaulted student loan portfolio management services,

contingency collections services for student loans and other asset classes, and accounts receivable management

and collection for purchased portfolios of receivables that are delinquent or have been charged off by their

original creditors as well as sub-performing and non-performing mortgage loans. In the purchased receivables

business, we focus on a variety of consumer debt types with emphasis on charged-off credit card receivables

and distressed mortgage receivables. We purchase these portfolios at a discount to their face value, and then

use both our internal collection operations coupled with third party collection agencies to maximize the

recovery on these receivables. In 2006, we began purchasing charged-off consumer receivables in Europe

through our United Kingdom subsidiary, Arrow Global Ltd.

LENDING BUSINESS SEGMENT

In our Lending business segment, we originate and acquire both federally guaranteed student loans, which

are administered by the U.S. Department of Education (“ED”), and Private Education Loans, which are not

federally guaranteed. Borrowers use Private Education Loans primarily to supplement guaranteed loans in

meeting the cost of education. We manage the largest portfolio of FFELP and Private Education Loans in the

student loan industry, serving nearly 10 million student and parent customers through our ownership and

8