SunTrust 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

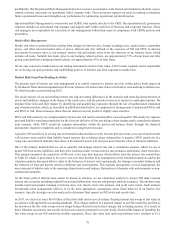

monitoring of net borrowed funds dependence and available sources of contingent liquidity. These sources of contingent

liquidity include available cash reserves; the ability to sell, pledge, or borrow against unencumbered securities in the Bank’s

investment portfolio; capacity to borrow from the FHLB system; and the capacity to borrow at the Federal Reserve discount

window. The following table presents year end and average balances from these four sources as of and for the years ended

December 31, 2012 and 2011. We believe these contingent liquidity sources exceed any contingent liquidity needs.

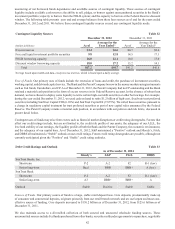

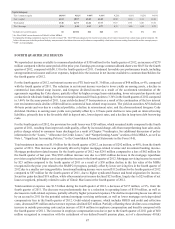

Contingent Liquidity Sources Table 32

December 31, 2012 December 31, 2011

(Dollars in billions) As of Average for the

Year Ended ¹ As of

Average for the

Year Ended ¹

Excess reserves $3.4 $2.6 $0.7 $2.6

Free and liquid investment portfolio securities 9.8 12.8 14.5 17.1

FHLB borrowing capacity 16.0 12.1 10.8 13.0

Discount window borrowing capacity 18.0 17.2 15.2 14.1

Total $47.2 $44.7 $41.2 $46.8

1Average based upon month-end data, except excess reserves, which is based upon a daily average.

Uses of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment securities,

working capital, and debt and capital service. The Bank and the Parent Company borrow in the money markets using instruments

such as Fed funds, Eurodollars, and CP. As of December 31, 2012, the Parent Company had no CP outstanding and the Bank

retained a material cash position in the form of excess reserves in its Federal Reserve account. In the absence of robust loan

demand, we have chosen to deploy some liquidity to retire certain high-cost debt securities or other borrowings. For example,

during the year ended December 31, 2012, we used cash on hand to retire $1.2 billion of high-cost, fixed-rate trust preferred

securities including SunTrust Capital VIII (6.10%) and SunTrust Capital IX (7.875%). We called these securities pursuant to

a change in regulatory capital treatment for trust preferred securities as part of new capital rules announced by the Federal

Reserve. The Parent Company retains a material cash position, in accordance with our policies and risk limits, discussed in

greater detail below.

Contingent uses of funds may arise from events such as financial market disruptions or credit rating downgrades. Factors that

affect our credit ratings include, but are not limited to, the credit risk profile of our assets, the adequacy of our ALLL, the

level and stability of our earnings, the liquidity profile of both the Bank and the Parent Company, the economic environment,

and the adequacy of our capital base. As of December 31, 2012, S&P maintained a "Positive" outlook and Moody’s, Fitch,

and DBRS all maintained a “Stable” outlook on our credit ratings. Future credit rating downgrades are possible, although not

currently anticipated given the "Positive" and “Stable” credit rating outlooks.

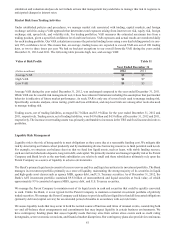

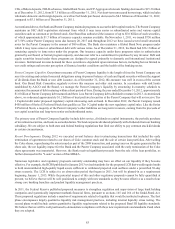

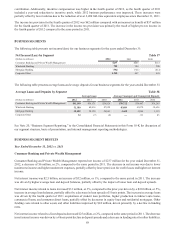

Debt Credit Ratings and Outlook Table 33

As of December 31, 2012

Moody’s S&P Fitch DBRS

SunTrust Banks, Inc.

Short-term P-2 A-2 F2 R-1 (low)

Senior long-term Baa1 BBB BBB+ A (low)

SunTrust Bank

Short-term P-2 A-2 F2 R-1 (low)

Senior long-term A3 BBB+ BBB+ A

Outlook Stable Positive Stable Stable

Sources of Funds. Our primary source of funds is a large, stable retail deposit base. Core deposits, predominantly made up

of consumer and commercial deposits, originate primarily from our retail branch network and are our largest and most cost-

effective source of funding. Core deposits increased to $130.2 billion as of December 31, 2012, from $125.6 billion as of

December 31, 2011.

We also maintain access to a diversified collection of both secured and unsecured wholesale funding sources. These

uncommitted sources include Fed funds purchased from other banks, securities sold under agreements to repurchase, negotiable