SunTrust 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

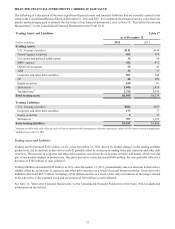

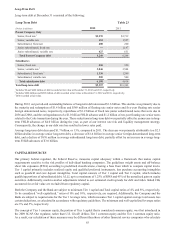

and valuation assumptions related to securities AFS, see Note 5, "Securities Available for Sale," and the “Trading Assets and

Securities Available for Sale” section of Note 18, “Fair Value Election and Measurement,” to the Consolidated Financial

Statements in this Form 10-K.

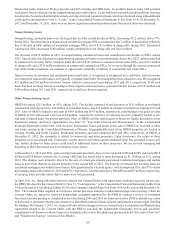

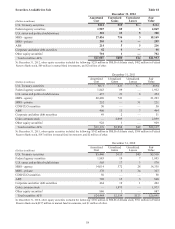

For the year ended December 31, 2012, the average yield on a FTE basis for the securities AFS portfolio was 2.97%, compared

with 3.26% for the year ended December 31, 2011. Prepayments and maturities of higher yielding securities, reinvestment

of principal cash flow at lower yields, and the foregone dividend income on the Coke common stock, drove the decline in

yield on securities AFS. Our total investment securities portfolio had an effective duration of 2.2 years as of December 31,

2012, compared to 2.3 years as of December 31, 2011. Effective duration is a measure of price sensitivity of a bond portfolio

to an immediate change in market interest rates, taking into consideration embedded options. An effective duration of 2.2

years suggests an expected price change of 2.2% for a one percent instantaneous change in market interest rates.

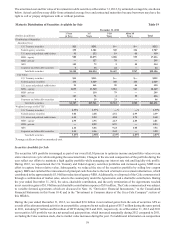

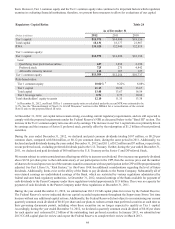

The credit quality and liquidity profile of the securities portfolio remained strong at December 31, 2012, and, consequently,

we have the flexibility to respond to changes in the economic environment and take actions as opportunities arise to manage

our interest rate risk profile and balance liquidity against investment returns. Over the longer term, the size and composition

of the investment portfolio will reflect balance sheet trends and our overall liquidity and interest rate risk management

objectives. Accordingly, the size and composition of the investment portfolio could change meaningfully over time.

INVESTMENT IN COMMON SHARES OF THE COCA-COLA COMPANY

Background

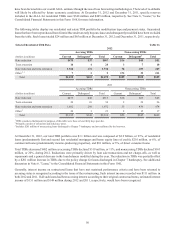

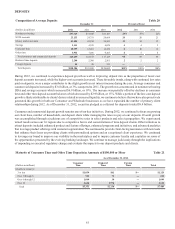

Prior to September 2012, we had owned common shares of Coke since 1919, when one of our predecessor institutions

participated in the underwriting of Coke's IPO and received common shares of Coke in lieu of underwriting fees. These shares

grew in value over the past 93 years and were classified as securities AFS with unrealized gains, net of tax, recorded as a

component of shareholders' equity. Because of the low accounting cost basis of these shares, we accumulated significant

unrealized gains in shareholders' equity. As of December 31, 2011, we owned 30 million Coke shares with an accounting cost

basis of approximately $69,000 and a fair market value of $2.1 billion. On August 10, 2012, we received an additional 30

million Coke shares as a result of the Coke Stock Split. In September 2012, we divested our ownership of Coke shares through

sales in the market, sales to the counterparty under the Agreements discussed below, and a charitable contribution of 1 million

shares.

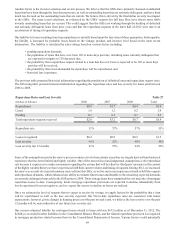

Termination of Agreements Involving Coca-Cola Stock

In 2008, we entered into two Agreements with an unaffiliated third party. Pursuant to the terms of the Agreements, we were

to deliver to the counterparty either a variable number of our shares in Coke or an equivalent amount of cash in lieu of such

shares on the 2014 and 2015 settlement dates. The counterparty was to deliver to us cash of no less than a floor price of

approximately $19 per Coke share, or approximately $1.16 billion in the aggregate (the “Minimum Proceeds”), and no more

than a ceiling price of approximately $33 per Coke share (prices are adjusted for the Coke Stock Split). Because we expected

to sell our shares around the settlement date, either under the terms of the Agreements or in another market transaction, the

Federal Reserve granted us Tier 1 common capital credit of approximately $730 million, which was reflective of the after-

tax value of the Coke shares at the floor price. By retaining the shares from 2008 until the termination of the Agreement, we

were able to continue receiving the Coke dividends and participate in the price appreciation of the Coke shares.

We reevaluated these holdings in light of the regulatory proposal regarding Basel III, which, as proposed, would increase the

risk-weighted assets of equity holdings and introduce potential volatility to our regulatory capital ratios via fluctuations in

AOCI, and the negative implications associated with equity securities in assumed adverse economic scenarios within future

CCAR assessments. Following this review, we and the counterparty accelerated the termination of the Agreements.

Contemporaneously with entering into the Agreements in 2008, the Coke Counterparty invested in senior unsecured promissory

notes issued by the Bank and SunTrust (collectively, the “Notes”) in a private placement in an aggregate principal amount

equal to the Minimum Proceeds. Upon termination of the Agreements, we also repurchased the Notes from the Coke

Counterparty, resulting in a $2 million loss recorded as an extinguishment of debt in our Consolidated Statements of Income.

As a result of the Coke stock sales, charitable contribution, termination of the Agreements, and repurchase of the Notes, we

recorded a pre-tax gain of approximately $1.9 billion in 2012.