SunTrust 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

as of December 31, 2012. For additional information, refer to Note 14, “Income Taxes,” to the Consolidated Financial

Statements in this Form10-K.

Pension Accounting

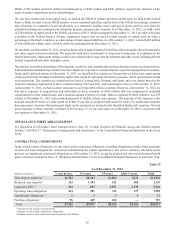

Several variables affect the annual cost for our retirement programs. The main variables are: (1) size and characteristics of

the eligible population, (2) discount rate, (3) expected long-term rate of return on plan assets, (4) recognition of actual asset

returns, (5) other actuarial assumptions, and (6) healthcare cost for post-retirement benefits. Below is a brief description of

each variable and the effect it has on our pension costs and post-retirement costs. See Note 15, “Employee Benefit Plans,” to

the Consolidated Financial Statements in this Form 10-K for additional information.

Size and Characteristics of the Employee Population

Pension cost is directly related to the number of employees eligible to participate in the plan and other factors including

historical compensation, age, years of employment, and benefit terms. A curtailment of all pension benefit accruals was

effective December 31, 2011. Prior to the pension curtailment, most participants who had 20 or more years of service as of

December 31, 2007 received benefits based on a traditional pension formula with benefits linked to their final average pay

and years of service. Most other participants received a traditional pension for periods prior to 2008 plus a cash balance benefit

based on annual compensation and interest credits earned after 2007.

Discount Rate

The discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is

determined by matching the expected cash flows of each plan to a yield curve based on long-term, high quality fixed income

debt instruments available as of the measurement date. The discount rate for each plan is reset annually or upon occurrence

of an event that triggers a measurement to reflect current market conditions. If we were to assume a 0.25% increase/decrease

in the discount rate for all retirement and other postretirement plans and keep all other assumptions constant, the benefit cost

would decrease/increase by less than $1 million.

Expected Long-term Rate of Return on Plan Assets

Expected returns on plan assets are computed using long-term rate of return assumptions which are selected after considering

plan investments, historical returns, and potential future returns. Our 2012 pension costs reflect an assumed long-term rate

of return on plan assets of 7.00%.

Any differences between expected and actual returns are included in the unrecognized net actuarial gain or loss amount. We

amortize gains/losses in pension expense when the total unamortized amount exceeds 10% of plan assets or the projected

benefit obligations, whichever is greater. All pension gains or losses are being amortized over participants' average expected

future lifetime, which is approximately 35 years. See Note 15, “Employee Benefit Plans,” to the Consolidated Financial

Statements in this Form 10-K for details on changes in the pension benefit obligation and the fair value of plan assets.

If we were to assume a 0.25% increase/decrease in the expected long-term rate of return for the retirement and other

postretirement plans, holding all other actuarial assumptions constant, the benefit cost would decrease/increase by

approximately $7 million.

Recognition of Actual Asset Returns

Accounting guidance allows for the use of an asset value that smooths investment gains and losses over a period up to five

years. However, we have elected to use a preferable method in determining pension cost. This method uses the actual market

value of the plan assets. Therefore, we will experience more variability in the annual pension cost, as the asset values will be

more volatile than companies who elected to “smooth” their investment experience.

Other Actuarial Assumptions

To estimate the projected benefit obligation, actuarial assumptions are required about factors such as mortality rate, retirement

rate, and disability rate. These factors do not tend to change significantly over time, so the range of assumptions, and their

impact on pension cost, is generally limited. We annually review the assumptions used based on historical and expected future

experience.