SunTrust 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

markets and also hold a limited amount of instruments that do not have an active market, which creates additional challenges

when estimating the fair value of these financial instruments.

Generally, the assets and liabilities most affected by the lack of liquidity or observable market are those required to be classified

as level 3 in the fair value hierarchy. As a result, various processes and controls have been adopted to determine that appropriate

methodologies, techniques and assumptions are used in the development of fair value estimates, particularly related to those

instruments that require the use of significant, unobservable inputs. We continue to maintain a cross-functional approach when

estimating the fair value of these difficult to value financial instruments. This includes input from not only the related line of

business, but also from risk management and finance, to ultimately arrive at a consensus estimate of the instrument's fair value

after evaluating all available information pertaining to fair value. This process involves the gathering of multiple sources of

information, including broker quotes, values provided by pricing services, trading activity in other similar instruments, market

indices, and pricing matrices along with employing various modeling techniques, such as discounted cash flow analyses, in

arriving at the best estimate of fair value. Modeling techniques incorporate our assessments regarding assumptions that market

participants would use in pricing the asset or the liability, including market-based assumptions, such as interest rates, as well

as assumptions about the risks inherent in a particular valuation technique, the effect of a restriction on the sale or use of an

asset, market liquidity, and the risk of nonperformance. In certain cases, our assessments with respect to assumptions that

market participants would make may be inherently difficult to determine, and the use of different assumptions could result

in material changes to these fair value measurements. We used significant unobservable inputs to fair value, on a recurring

basis, for certain trading assets, securities AFS, portfolio loans accounted for at fair value, IRLCs, LHFS, MSRs, and certain

derivatives. Overall, the financial impact of the level 3 financial instruments did not have a material impact on our liquidity

or capital. Our exposure to level 3 financial instruments continues to decline due to paydowns, sales and settlements of these

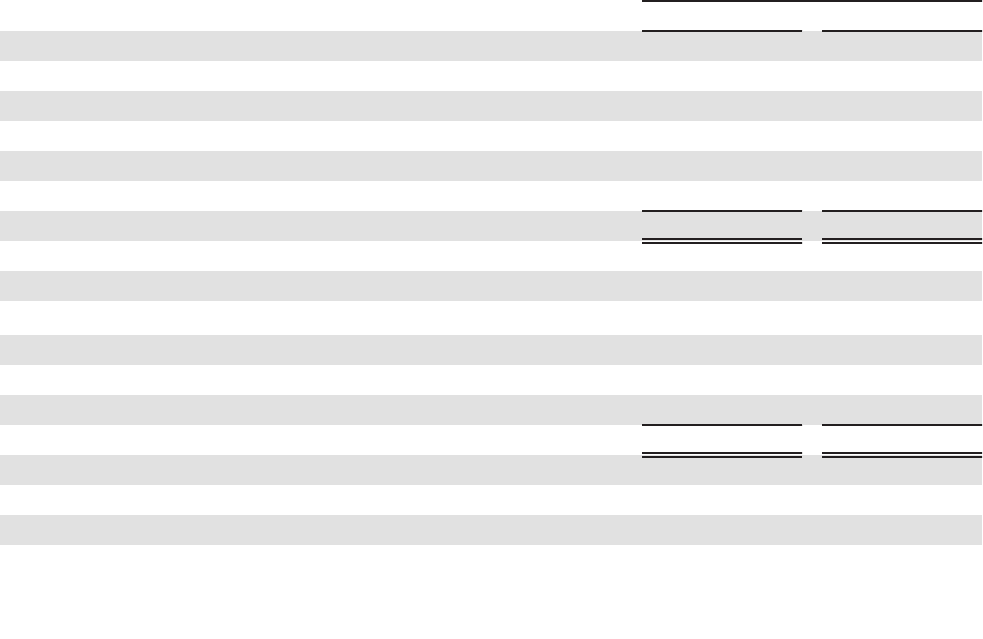

instruments, and minimal purchases. The following table discloses assets and liabilities carried at fair value on a recurring

basis that have been impacted by level 3 fair value determinations.

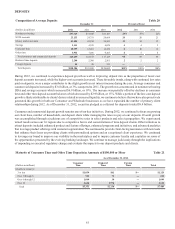

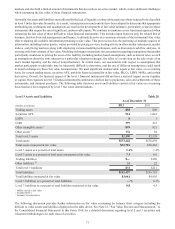

Level 3 Assets and Liabilities Table 28

As of December 31

(Dollars in millions) 2012 2011

Trading assets $58 $49

Securities AFS 914 1,041

LHFS 81

LHFI 379 433

Other intangible assets 1899 921

Other assets 2132 84

Total level 3 assets $2,390 $2,529

Total assets $173,442 $176,859

Total assets measured at fair value $32,701 $38,445

Level 3 assets as a percent of total assets 1.4% 1.4%

Level 3 assets as a percent of total assets measured at fair value 7.3 6.6

Trading liabilities $— $189

Other liabilities 2,3 31 22

Total level 3 liabilities $31 $211

Total liabilities $152,457 $156,793

Total liabilities measured at fair value $3,661 $4,905

Level 3 liabilities as a percent of total liabilities —% 0.1%

Level 3 liabilities as a percent of total liabilities measured at fair value 0.8 4.3

1 MSRs carried at fair value

2 Includes IRLCs

3 Includes Visa derivative

The following discussion provides further information on fair value accounting by balance sheet category including the

difficult to value assets and liabilities displayed in the table above. See Note 18, “Fair Value Election and Measurement,” to

the Consolidated Financial Statements in this Form 10-K for a detailed discussion regarding level 2 and 3 securities and

valuation methodologies for each class of securities.