SunTrust 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

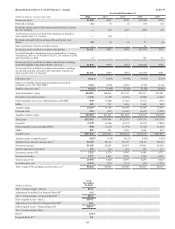

93

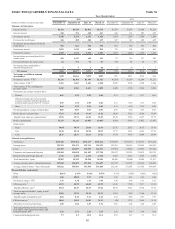

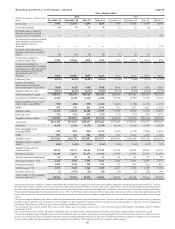

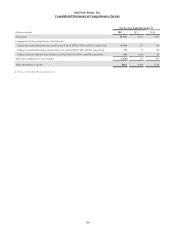

Reconcilement of Non-U.S. GAAP Measures – Annual Table 39

Year Ended December 31

(Dollars in millions, except per share data) 2012 2011 2010 2009 2008

Net income/(loss) $1,958 $647 $189 ($1,564) $796

Preferred dividends (12) (7) (7) (14) (22)

Dividends and accretion of discount on preferred stock issued to

the U.S. Treasury —(66) (267) (266) (27)

Accelerated accretion associated with repurchase of preferred

stock issued to the U.S. Treasury —(74) — — —

Dividends and undistributed earnings allocated to unvested

shares (15) (5) (2) 17 (6)

Gain on purchase of Series A preferred stock ———94—

Net income/(loss) available to common shareholders $1,931 $495 ($87) ($1,733) $741

Goodwill/intangible impairment charges attributable to common

shareholders, after tax of $0 million in 2012, $36 million in 2009,

and $18 million in 2008 7— — 715 27

Net income/(loss) available to common shareholders excluding

goodwill/intangible impairment charges, after tax 1$1,938 $495 ($87) ($1,018) $768

Net income/(loss) available to common shareholders excluding

accelerated accretion associated with repurchase of preferred

stock issued to the U.S. Treasury 1$1,931 $569 ($87) ($1,733) $741

Efficiency ratio 259.67% 72.49% 67.94% 79.07% 63.83%

Impact of excluding impairment/amortization of goodwill/

intangible assets other than MSRs (0.43) (0.50) (0.58) (9.72) (1.32)

Tangible efficiency ratio 359.24% 71.99% 67.36% 69.35% 62.51%

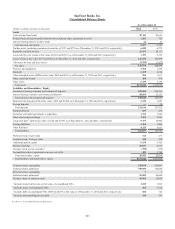

Total shareholders’ equity $20,985 $20,066 $23,130 $22,531 $22,501

Goodwill, net of deferred taxes 4(6,206) (6,190) (6,189) (6,204) (6,941)

Other intangible assets, net of deferred taxes, and MSRs 5(949) (1,001) (1,545) (1,671) (978)

MSRs 899 921 1,439 1,540 810

Tangible equity 14,729 13,796 16,835 16,196 15,392

Preferred stock (725) (275) (4,942) (4,917) (5,222)

Tangible common equity $14,004 $13,521 $11,893 $11,279 $10,170

Total assets $173,442 $176,859 $172,874 $174,165 $189,138

Goodwill (6,369) (6,344) (6,323) (6,319) (7,044)

Other intangible assets including MSRs (956) (1,017) (1,571) (1,711) (1,035)

MSRs 899 921 1,439 1,540 810

Tangible assets $167,016 $170,419 $166,419 $167,675 $181,869

Tangible equity to tangible assets 68.82% 8.10% 10.12% 9.66% 8.46%

Tangible book value per common share 7$25.98 $25.18 $23.76 $22.59 $28.69

Net interest income $5,102 $5,065 $4,854 $4,466 $4,620

Taxable-equivalent adjustment 123 114 116 123 117

Net interest income-FTE 5,225 5,179 4,970 4,589 4,737

Noninterest income 5,373 3,421 3,729 3,710 4,473

Total revenue-FTE 10,598 8,600 8,699 8,299 9,210

Securities gains, net (1,974) (117) (191) (98) (1,073)

Total revenue-FTE excluding securities gains, net 8$8,624 $8,483 $8,508 $8,201 $8,137

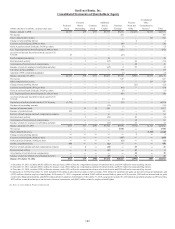

(Dollars in billions)

As of

December

31, 2012

Tier 1 Common Equity - Basel I $13.5

Adjustments from Basel I to Proposed Basel III 9(0.2)

Tier 1 Common Equity - Proposed Basel III 10 $13.3

Risk-weighted Assets - Basel I $134.5

Adjustments from Basel I to Proposed Basel III 11 26.2

Risk-weighted Assets - Proposed Basel III $160.7

Tier 1 Common Equity Ratio:

Basel I 10.0%

Proposed Basel III 10 8.2