SunTrust 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

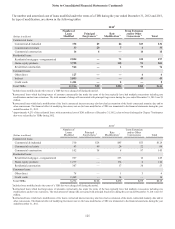

Notes to Consolidated Financial Statements (Continued)

131

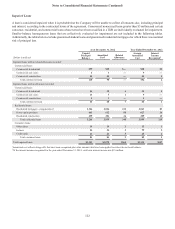

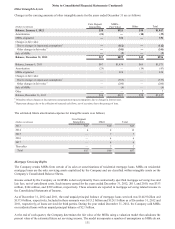

Other Intangible Assets

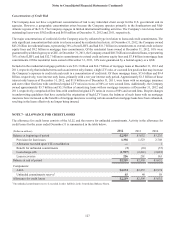

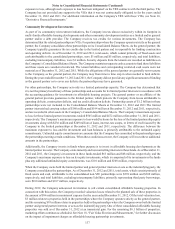

Changes in the carrying amounts of other intangible assets for the years ended December 31 are as follows:

(Dollars in millions)

Core Deposit

Intangibles

MSRs -

Fair Value Other Total

Balance, January 1, 2012 $38 $921 $58 $1,017

Amortization (21) — (18) (39)

MSRs originated — 336 — 336

Changes in fair value:

Due to changes in inputs and assumptions 1— (112) — (112)

Other changes in fair value 2— (241) — (241)

Sale of MSRs — (5) — (5)

Balance, December 31, 2012 $17 $899 $40 $956

Balance, January 1, 2011 $67 $1,439 $65 $1,571

Amortization (29) — (14) (43)

MSRs originated — 224 — 224

Changes in fair value:

Due to changes in inputs and assumptions 1— (533) — (533)

Other changes in fair value 2— (200) — (200)

Sale of MSRs — (9) — (9)

Other — — 7 7

Balance, December 31, 2011 $38 $921 $58 $1,017

1 Primarily reflects changes in discount rates and prepayment speed assumptions, due to changes in interest rates.

2 Represents changes due to the collection of expected cash flows, net of accretion, due to the passage of time.

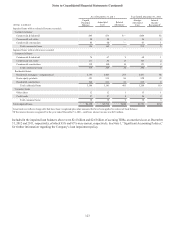

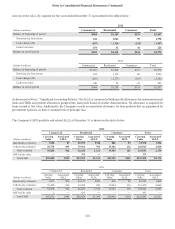

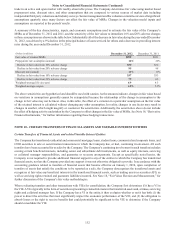

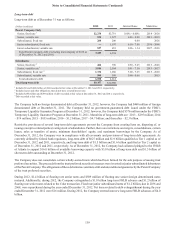

The estimated future amortization expense for intangible assets is as follows:

(Dollars in millions)

Core Deposit

Intangibles Other Total

2013 $13 $10 $23

2014 4 8 12

2015 —77

2016 —44

2017 —44

Thereafter —77

Total $17 $40 $57

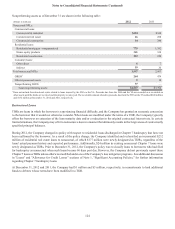

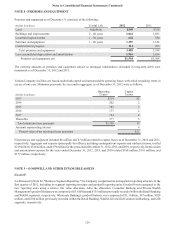

Mortgage Servicing Rights

The Company retains MSRs from certain of its sales or securitizations of residential mortgage loans. MSRs on residential

mortgage loans are the only servicing assets capitalized by the Company and are classified within intangible assets on the

Company’s Consolidated Balance Sheets.

Income earned by the Company on its MSRs is derived primarily from contractually specified mortgage servicing fees and

late fees, net of curtailment costs. Such income earned for the years ended December 31, 2012, 2011, and 2010, was $333

million, $364 million, and $399 million, respectively. These amounts are reported in mortgage servicing related income in

the Consolidated Statements of Income.

As of December 31, 2012 and 2011, the total unpaid principal balance of mortgage loans serviced was $144.9 billion and

$157.8 billion, respectively. Included in these amounts were $113.2 billion and $124.1 billion as of December 31, 2012 and

2011, respectively, of loans serviced for third parties. During the year ended December 31, 2012, the Company sold MSRs

on residential loans with an unpaid principal balance of $2.1 billion.

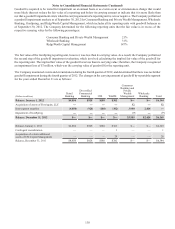

At the end of each quarter, the Company determines the fair value of the MSRs using a valuation model that calculates the

present value of the estimated future net servicing income. The model incorporates a number of assumptions as MSRs do not