SunTrust 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

140

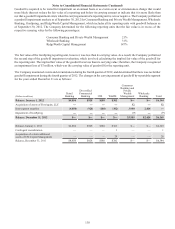

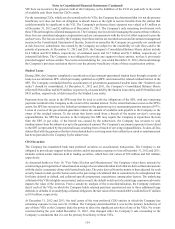

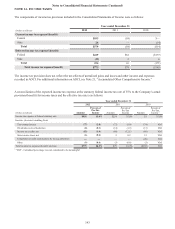

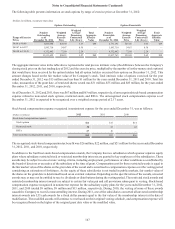

Contractual Commitments

In the normal course of business, the Company enters into certain contractual arrangements. Such arrangements include

obligations to make future payments on lease arrangements, contractual commitments for capital expenditures, and service

contracts. As of December 31, 2012, the Company had the following unconditional obligations:

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Operating lease obligations $214 $387 $331 $377 $1,309

Capital lease obligations 11 3 3 4 11

Purchase obligations 296 469 222 — 787

Total $311 $859 $556 $381 $2,107

1 Amounts do not include accrued interest.

2 Includes contracts with a minimum annual payment of $5 million or more.

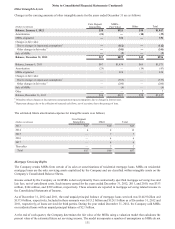

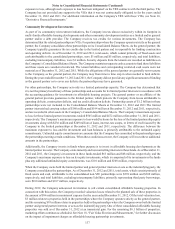

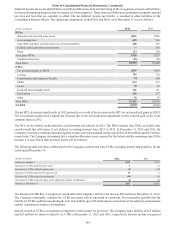

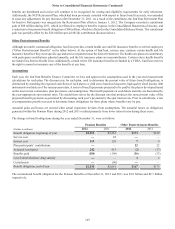

NOTE 12 – NET INCOME/(LOSS) PER COMMON SHARE

Equivalent shares of 23 million, 26 million, and 31 million related to common stock options and common stock warrants

outstanding as of December 31, 2012, 2011, and 2010, respectively, were excluded from the computations of diluted income/

(loss) per average common share because they would have been anti-dilutive. Further, for EPS calculation purposes, during

the year ended December 31, 2010 the impact of dilutive securities was excluded from the calculation because the Company

recognized a net loss available to common shareholders and the impact would have been anti-dilutive.

A reconciliation of the difference between average basic common shares outstanding and average diluted common shares

outstanding for the the years ended December 31, 2012, 2011, and 2010, is included below. Additionally, included below is

a reconciliation of net income to net income/(loss) available to common shareholders.

(In millions, except per share data) 2012 2011 2010

Net income $1,958 $647 $189

Preferred dividends (12)(7)(7)

Dividends and accretion of discount on preferred stock issued to the U.S. Treasury —(66)(267)

Accelerated accretion associated with repurchase of preferred stock issued to the

U.S. Treasury —(74) —

Dividends and undistributed earnings allocated to unvested shares (15)(5)(2)

Net income/(loss) available to common shareholders $1,931 $495 ($87)

Average basic common shares 534 524 495

Effect of dilutive securities:

Stock options 12 1

Restricted stock 32 3

Average diluted common shares 538 528 499

Net income/(loss) per average common share - diluted $3.59 $0.94 ($0.18)

Net income/(loss) per average common share - basic $3.62 $0.94 ($0.18)

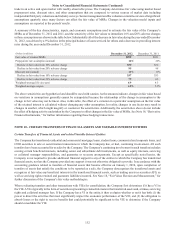

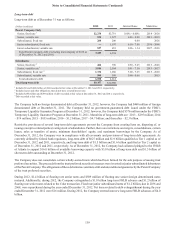

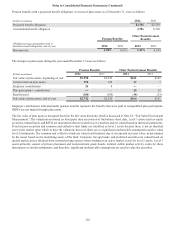

NOTE 13 – CAPITAL

During the year ended December 31, 2012, the Company submitted its 2012 CCAR capital plans for review by the Federal

Reserve. The Federal Reserve's review indicated that the Company's capital exceeded requirements throughout the Supervisory

Stress Test time horizon without any additional capital actions. Additionally, the Federal Reserve did not object to the Company

maintaining its quarterly common stock dividend of $0.05 per share and its plans to redeem certain trust preferred securities

at such time as their governing documents permit, including when these securities are no longer expected to qualify as Tier

1 capital. Accordingly, during the year ended December 31, 2012, the Company declared a quarterly common stock dividend

of $0.05 per share each quarter and redeemed $1.2 billion of outstanding trust preferred securities. As of December 31, 2012,