SunTrust 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

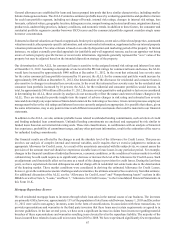

impact the accuracy of the assumptions underlying our mortgage repurchase reserve estimate. As previously discussed, the

level of repurchase requests we receive is dependent upon the actions of third parties and could differ from the assumptions

that we have made. Delinquency levels, delinquency roll rates, and our loss severity assumptions are all highly dependent

upon economic factors including changes in real estate values and unemployment levels which are, by nature, difficult to

predict. Loss severity assumptions could also be negatively impacted by delays in the foreclosure process which is a heightened

risk in some of the states where our loans sold were originated. Approximately 16% of the population of total loans sold

between January 1, 2006 and December 31, 2008 were sold to non-agency investors, some in the form of securitizations. Due

to the nature of these structures and the indirect ownership interests, the potential exists that investors, over time, will become

more successful in forcing additional repurchase demands. While we have used the best information available in estimating

the mortgage repurchase reserve liability, these and other factors, along with the discovery of additional information in the

future could result in changes in our assumptions which could materially impact our results of operations.

See "Noninterest Income" in this MD&A and Note 17, “Reinsurance Arrangements and Guarantees - Loan Sales,” to the

Consolidated Financial Statements in this Form 10-K for further discussion.

Legal and Regulatory Matters

We are parties to numerous claims and lawsuits arising in the course of our normal business activities, some of which involve

claims for substantial amounts, and the outcomes of which are not within our complete control or may not be known for

prolonged periods of time. Management is required to assess the probability of loss and amount of such loss, if any, in preparing

our financial statements.

We evaluate the likelihood of a potential loss from legal or regulatory proceedings to which we are a party. We record a liability

for such claims when a loss is considered probable and the amount can be reasonably estimated. The liability is recorded in

other liabilities in the Consolidated Balance Sheets and related expense is recorded in the applicable category of noninterest

expense, depending on the nature of the legal matter, in the Consolidated Statements of Income. Significant judgment may

be required in the determination of both probability and whether an exposure is reasonably estimable. Our estimates are

subjective based on the status of the legal or regulatory proceedings, the merits of our defenses, and consultation with in-

house and outside legal counsel. In many such proceedings, it is not possible to determine whether a liability has been incurred

or to estimate the ultimate or minimum amount of that liability until the matter is close to resolution. As additional information

becomes available, we reassess the potential liability related to pending claims and may revise our estimates.

Due to the inherent uncertainties of the legal and regulatory processes in the multiple jurisdictions in which we operate, our

estimates may be materially different than the actual outcomes, which could have material effects on our business, financial

conditions and results of operations. However, it is the opinion of management that liabilities arising from these claims in

excess of the amounts currently accrued, if any, will not have a material adverse impact to our financial condition, results of

operations, or cash flows. See Note 19, “Contingencies,” to the Consolidated Financial Statements in this Form 10-K for

further discussion.

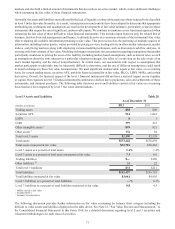

Estimates of Fair Value

Fair value is the price that could be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants. Certain of our assets and liabilities are measured at fair value on a recurring basis. Examples of recurring

uses of fair value include derivative instruments, AFS and trading securities, certain LHFI and LHFS, certain issuances of

long term debt and brokered CDs, and MSRs. We also measure certain assets at fair value on a non-recurring basis either

when such assets are carried at the LOCOM, to evaluate assets for impairment, or for disclosure purposes. Examples of these

non-recurring uses of fair value include certain LHFS, OREO, goodwill, intangible assets, nonmarketable equity securities,

certain partnership investments, and long-lived assets. Depending on the nature of the asset or liability, we use various valuation

techniques and assumptions when estimating fair value.

The objective of fair value is to use market-based inputs or assumptions, when available, to estimate the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date. Where observable market prices from transactions for identical assets or liabilities are not available, we identify what

we believe to be similar assets or liabilities. If observable market prices are unavailable or impracticable to obtain for any

such similar assets or liabilities, we look to other techniques by obtaining third party quotes or using modeling techniques,

such as discounted cash flows, while attempting to utilize market observable assumptions to the extent available. Absent

current market activity in that specific instrument or a similar instrument, the resulting valuation approach may require making

a number of significant judgments in the estimation of fair value. Market conditions during the credit crisis led to limited or

nonexistent trading in certain of the financial asset classes that we have owned. Although market conditions have improved

and we have seen the return of liquidity in certain markets, we continue to experience a low level of activity in a number of