SunTrust 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

The loan types comprising our consumer loan segment include guaranteed student loans, other direct (consisting primarily

of direct auto loans, loans secured by negotiable collateral, and private student loans), indirect (consisting of loans secured

by automobiles, marine, or recreational vehicles), and consumer credit cards. The composition of our loan portfolio at December

31 is shown in the following table:

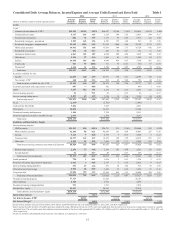

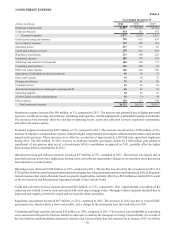

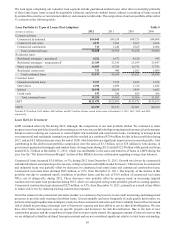

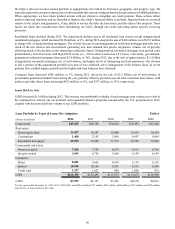

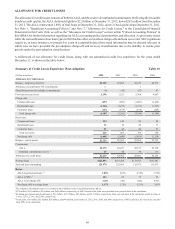

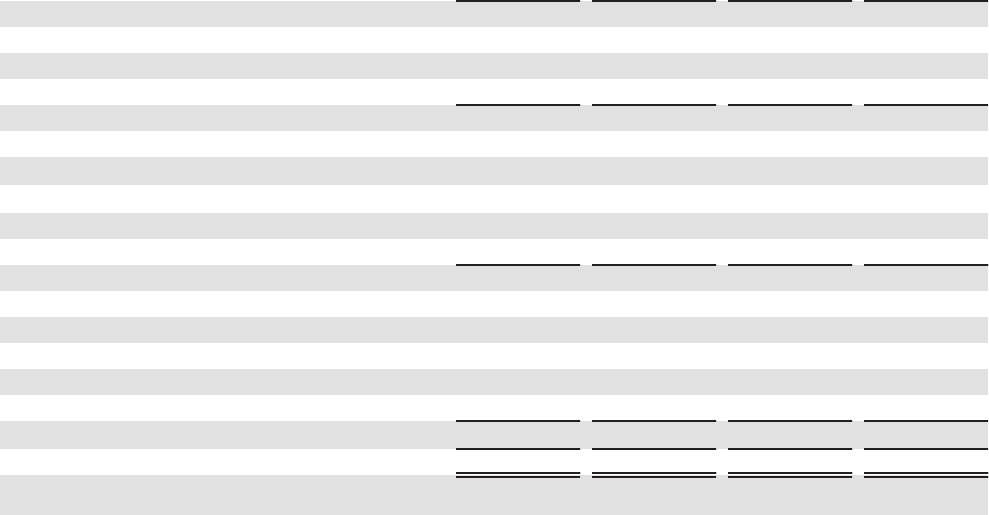

Loan Portfolio by Types of Loans (Post-Adoption) Table 5

(Dollars in millions) 2012 2011 2010 2009

Commercial loans:

Commercial & industrial $54,048 $49,538 $44,753 $44,008

Commercial real estate 4,127 5,094 6,167 6,694

Commercial construction 713 1,240 2,568 4,984

Total commercial loans 58,888 55,872 53,488 55,686

Residential loans:

Residential mortgages - guaranteed 4,252 6,672 4,520 949

Residential mortgages - nonguaranteed123,389 23,243 23,959 25,847

Home equity products 14,805 15,765 16,751 17,783

Residential construction 753 980 1,291 1,909

Total residential loans 43,199 46,660 46,521 46,488

Consumer loans:

Guaranteed student loans 5,357 7,199 4,260 2,786

Other direct 2,396 2,059 1,722 1,484

Indirect 10,998 10,165 9,499 6,665

Credit cards 632 540 485 566

Total consumer loans 19,383 19,963 15,966 11,501

LHFI $121,470 $122,495 $115,975 $113,675

LHFS $3,399 $2,353 $3,501 $4,670

1Includes $379 million, $431 million, $488 million, and $437 million of loans carried at fair value at December 31, 2012, 2011, 2010, and 2009,

respectively.

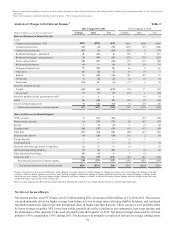

Loans Held for Investment

LHFI remained relatively flat during 2012; although, the composition of our loan portfolio shifted. We continued to make

progress in our loan portfolio diversification strategy, as we were successful in both growing targeted commercial and consumer

balances and in reducing our exposure to certain higher risk residential and construction loans. Continuing to manage down

our commercial and residential construction portfolios resulted in a combined $754 million decline in these portfolios during

2012 and an $8.5 billion decrease since the end of 2008, which has driven a significant improvement in our risk profile. Also

contributing to this shift in loan portfolio composition were the sales of $3.3 billion, net of $78 million in write-downs, in

government-guaranteed mortgages and student loans. Average loans during 2012 totaled $122.9 billion while period-end loans

totaled $121.5 billion at December 31, 2012, which was attributable to the sales and transfers of loans to LHFS during the

year. See the "Net Interest Income/Margin" section of this MD&A for more information regarding average loan balances.

Commercial loans increased $3.0 billion, or 5%, during 2012 from December 31, 2011. Growth was driven by commercial

and industrial loans encompassing a diverse array of large corporate and middle market borrowers. This increase in commercial

and industrial loans was partially offset by decreases in commercial real estate loans and commercial construction loans.

Commercial real estate loans declined $967 million, or 19%, from December 31, 2011. The majority of the decline in this

portfolio was due to continued runoff, resolution of problem loans, and the sale of $161 million of commercial real estate

NPLs, net of charge-offs, during 2012. These decreases were partially offset by progress made in increasing targeted

commercial real estate loan production during 2012, where we anticipate seeing some portfolio growth in coming quarters.

Commercial construction loans decreased $527 million, or 43%, from December 31, 2011, primarily as a result of our efforts

to reduce risk levels by reducing existing construction exposure.

Given the stresses in the commercial real estate market, we continue to be proactive in our credit monitoring and management

processes to provide early warning of problem loans. At least annually and more frequently if credit quality deteriorates, we

perform a thorough liquidity and contingency analysis of our commercial real estate portfolio to identify loans with an increased

risk of default by providing a thorough view of borrowers' capacity and their ability to service their debt obligations. We also

have strict limits and exposure caps on specific projects and borrowers for risk diversification. Due to the lack of new

construction projects and the completion of many that were previously started, the aggregate amount of interest reserves that

we are obligated to fund has declined from prior periods and are not considered significant relative to total loans outstanding.