SunTrust 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

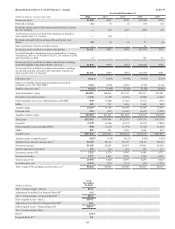

7We present a tangible book value per common share that excludes the after-tax impact of purchase accounting intangible assets and also excludes preferred stock from tangible

equity. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity as well as preferred stock

(the level of which may vary from company to company), it allows investors to more easily compare our book value on common stock to other companies in the industry.

8We present total revenue- FTE excluding net securities gains. Total Revenue is calculated as net interest income - FTE plus noninterest income. Net interest income is presented

on an FTE basis, which adjusts for the tax-favored status of net interest income from certain loans and investments. We believe this measure to be the preferred industry measurement

of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. We also believe that noninterest income without net

securities gains is more indicative of our performance because it isolates income that is primarily client relationship and client transaction driven and is more indicative of normalized

operations.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

See “Market Risk Management” in the MD&A, which is incorporated herein by reference.

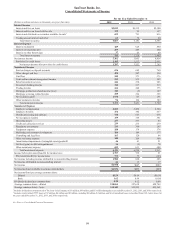

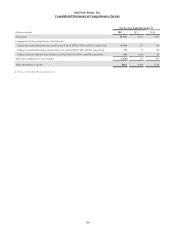

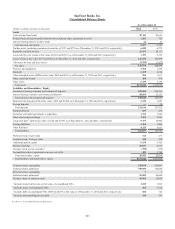

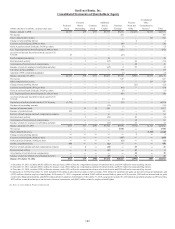

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of SunTrust Banks, Inc.

We have audited the accompanying consolidated balance sheets of SunTrust Banks, Inc. (the Company) as of December 31,

2012 and 2011, and the related consolidated statements of income, comprehensive income, shareholders' equity and cash flows

for each of the three years in the period ended December 31, 2012. These financial statements are the responsibility of the

Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).

Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures

in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial

position of SunTrust Banks, Inc. at December 31, 2012 and 2011, and the consolidated results of its operations and its cash

flows for each of the three years in the period ended December 31, 2012, in conformity with U.S. generally accepted accounting

principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United

States), SunTrust Banks, Inc.'s internal control over financial reporting as of December 31, 2012, based on criteria established

in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission

and our report dated February 27, 2013 expressed an unqualified opinion thereon.

Atlanta, Georgia

February 27, 2013