SunTrust 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

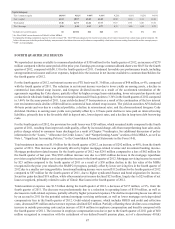

contribution. Additionally, incentive compensation was higher in the fourth quarter of 2012, as the fourth quarter of 2011

included a year-end reduction to incentive pools, while 2012 business performance was improved. These increases were

partially offset by lower salaries due to the reduction of over 2,400 full-time equivalent employees since December 31, 2011.

The income tax provision for the fourth quarter of 2012 was $62 million compared with an income tax benefit of $57 million

for the fourth quarter of 2011. The increase in the income tax provision was primarily the result of higher pre-tax income in

the fourth quarter of 2012 compared to the same period in 2011.

BUSINESS SEGMENTS

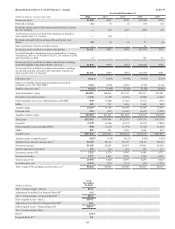

The following table presents net income/(loss) for our business segments for the years ended December 31:

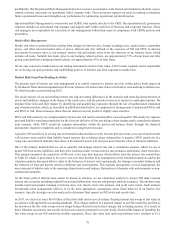

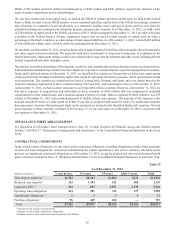

Net Income/(Loss) by Segment Table 37

(Dollars in millions) 2012 2011 2010

Consumer Banking and Private Wealth Management $237 $243 $115

Wholesale Banking 789 384 280

Mortgage Banking (702) (721) (812)

Corporate Other 1,520 447 465

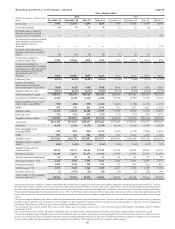

The following table presents average loans and average deposits for our business segments for the years ended December 31:

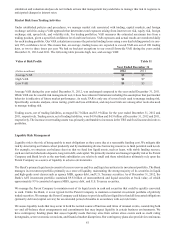

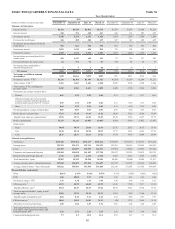

Average Loans and Deposits by Segment Table 38

Average Loans Average Consumer and Commercial Deposits

(Dollars in millions) 2012 2011 2010 2012 2011 2010

Consumer Banking and Private Wealth Management $41,190 $39,171 $36,929 $76,722 $76,407 $74,295

Wholesale Banking 51,380 48,016 47,959 45,889 43,070 39,656

Mortgage Banking 30,289 29,128 29,043 3,638 3,084 3,135

Corporate Other 34 (7) (6) —111 43

See Note 20, “Business Segment Reporting,” to the Consolidated Financial Statements in this Form 10-K for discussion of

our segment structure, basis of presentation, and internal management reporting methodologies.

BUSINESS SEGMENT RESULTS

Year Ended December 31, 2012 vs. 2011

Consumer Banking and Private Wealth Management

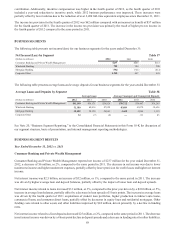

Consumer Banking and Private Wealth Management reported net income of $237 million for the year ended December 31,

2012, a decrease of $6 million, or 2%, compared to the same period in 2011. The decrease in net income was due to lower

noninterest income and higher noninterest expenses, partially offset by lower provision for credit losses and higher net interest

income.

Net interest income was $2.5 billion, an increase of $32 million, or 1%, compared to the same period in 2011. The increase

was driven by higher average loan and deposit balances, partially offset by the impact of lower loan and deposit spreads.

Net interest income related to loans increased $31 million, or 3%, compared to the prior year driven by a $2.0 billion, or 5%,

increase in average loan balances, partially offset by a decrease in loan spreads of 5 basis points. The increase in average loans

was driven by the fourth quarter of 2011 acquisitions of student loan portfolios, higher production in indirect auto loans,

commercial loans, and consumer direct loans, partially offset by decreases in equity lines and residential mortgages. Other

funding costs related to other assets and other liabilities improved by $24 million, driven primarily by a decline in funding

rates.

Net interest income related to client deposits decreased $25 million, or 2%, compared to the same period in 2011. The decrease

in net interest income was driven by a 4 basis point decline in deposit spreads and a decrease in funding rates for other liabilities.