SunTrust 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

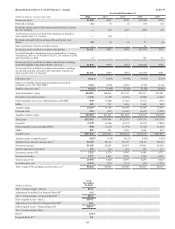

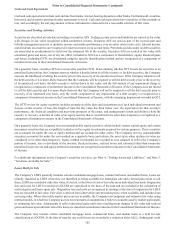

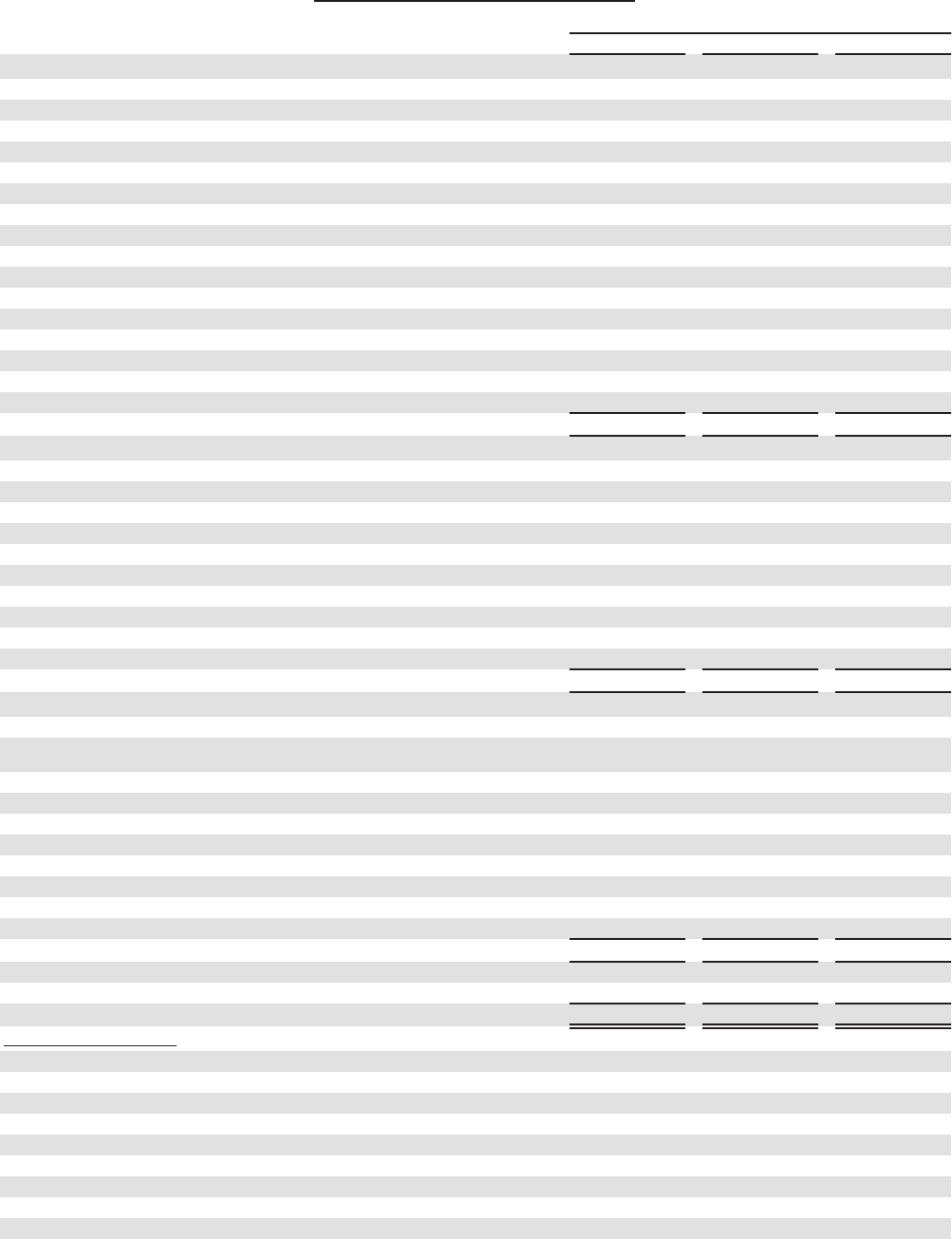

103

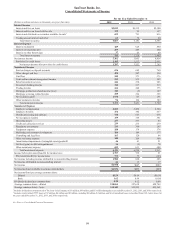

SunTrust Banks, Inc.

Consolidated Statements of Cash Flows

Year Ended December 31

(Dollars in millions) 2012 2011 2010

Cash Flows from Operating Activities

Net income including income attributable to noncontrolling interest $1,984 $660 $206

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation, amortization, and accretion 757 760 803

Goodwill impairment 7— —

Origination of mortgage servicing rights (336) (224) (289)

Provisions for credit losses and foreclosed property 1,535 1,664 2,831

Mortgage repurchase provision 713 502 456

Deferred income tax expense/(benefit) 194 83 (171)

Stock option compensation and amortization of restricted stock compensation 35 44 66

Net loss/(gain) on extinguishment of debt 16 (3) 70

Net securities gains (1,974) (117) (191)

Net gain on sale of loans held for sale, loans, and other assets (1,063) (408) (597)

Gain on pension curtailment —(88) —

Net decrease in loans held for sale 194 2,234 1,003

Net decrease/(increase) in other assets 974 (497) (341)

Net (decrease)/increase in other liabilities (1,026) 18 372

Net cash provided by operating activities 2,010 4,628 4,218

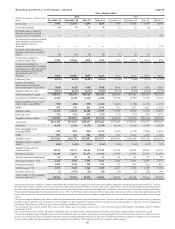

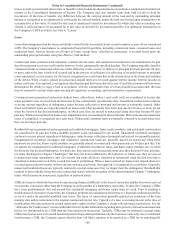

Cash Flows from Investing Activities

Proceeds from maturities, calls, and paydowns of securities available for sale 7,371 5,557 5,597

Proceeds from sales of securities available for sale 4,300 12,557 17,465

Purchases of securities available for sale (5,814) (18,872) (20,920)

Proceeds from maturities, calls, and paydowns of trading securities 3139 99

Proceeds from sales of trading securities —102 132

Net increase in loans, including purchases of loans (6,400) (11,034) (4,566)

Proceeds from sales of loans 4,916 747 936

Capital expenditures (206) (131) (252)

Payments related to acquisitions, including contingent consideration (12) (24) (10)

Proceeds from the sale of other real estate owned and other assets 585 628 800

Net cash provided by/(used in) investing activities 4,743 (10,331) (719)

Cash Flows from Financing Activities

Net increase in total deposits 4,394 4,878 1,182

Net (decrease)/increase in funds purchased, securities sold under agreements

to repurchase, and other short-term borrowings (5,972) 6,650 (1,295)

Proceeds from the issuance of long-term debt 4,000 1,749 500

Repayment of long-term debt (5,772) (4,571) (5,246)

Proceeds from the issuance of common stock —1,017 —

Proceeds from the issuance of preferred stock 438 103 —

Repurchase of preferred stock —(4,850) —

Purchase of outstanding warrants —(11) —

Common and preferred dividends paid (119) (131) (259)

Stock option activity 26 — —

Net cash (used in)/provided by financing activities (3,005) 4,834 (5,118)

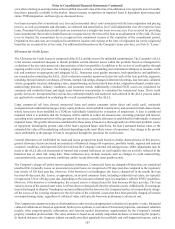

Net increase/(decrease) in cash and cash equivalents 3,748 (869) (1,619)

Cash and cash equivalents at beginning of period 4,509 5,378 6,997

Cash and cash equivalents at end of period $8,257 $4,509 $5,378

Supplemental Disclosures:

Interest paid $774 $1,138 $1,537

Income taxes paid 607 68 33

Income taxes refunded (1) (1) (435)

Loans transferred from loans held for sale to loans 71 63 213

Loans transferred from loans to loans held for sale 3,695 754 346

Loans transferred from loans and loans held for sale to other real estate owned 399 725 1,063

Amortization of deferred gain on sale/leaseback of premises 67 59 59

Accretion of discount for preferred stock issued to the U.S. Treasury —80 25

Total assets of newly consolidated VIEs during 2010 —— 2,541

See Notes to Consolidated Financial Statements.