SunTrust 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

resources to the implementation of regulatory rules as they become finalized and effective. See additional discussion in the "Capital

Resources" section of this MD&A.

In 2011, the Federal Reserve conducted a horizontal review of the nation's largest mortgage loan servicers, including us. Following

this review, we and other servicers entered into a Consent Order with the Federal Reserve. We describe the Consent Order in Note

19, “Contingencies,” to the Consolidated Financial Statements in this Form 10-K and "Nonperforming Assets" in this MD&A.

The Consent Order required us to improve certain mortgage servicing and foreclosure processes and to retain an independent

foreclosure consultant to conduct a review of residential foreclosure actions pending during 2009 and 2010 to identify any errors,

misrepresentations or deficiencies, determine whether any instances so identified resulted in financial injury, and prepare a written

report detailing the findings. On January 7, 2013, we, along with nine other mortgage servicers, entered into an Acceleration and

Remediation Agreement with the OCC and the Federal Reserve to amend the 2011 Consent Order. This agreement ends the

independent foreclosure review process created by the Consent Order, replacing it with an accelerated remediation program.

Pursuant to the agreement, we will make a cash payment of $63 million to fund lump-sum payments to borrowers who faced a

foreclosure action on their primary residence between January 1, 2009 and December 31, 2010, and will commit $100 million to

affect loss mitigation or other foreclosure prevention actions. The impact of the cash payment is included in our consolidated

financial results at December 31, 2012, and we expect that our existing ALLL or other activities will be sufficient to provide for

the loss mitigation or other foreclosure prevention actions. Lump-sum payments to borrowers will be administered by an

independent agent approved by the Federal Reserve. The amount of payment to a borrower will be determined pursuant to a

Financial Remediation Framework jointly established by the OCC and the Federal Reserve based on circumstances surrounding

the foreclosure activity. As a result of the agreement, we will no longer be required to incur the consulting and legal costs of the

independent third parties providing file review, borrower outreach, and legal services associated with the Consent Order foreclosure

file review. We continue to work on compliance with remaining aspects of the Federal Reserve’s Consent Order. We also continue

with settlement discussions with the U.S. and States Attorneys General related to mortgage servicing claims as discussed in Note

19, "Contingencies" to the Consolidated Financial Statements in this Form 10-K. We have accrued for the anticipated cost of

resolving these and other potential claims in our financial results.

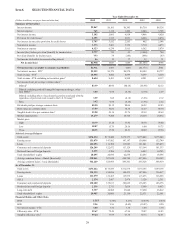

Capital

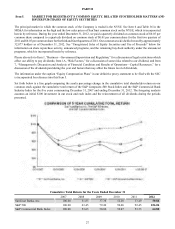

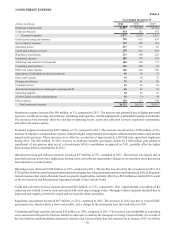

Our capital remained strong at December 31, 2012, as earnings drove our Tier 1 common equity ratio to 10.04% compared to

9.22% at December 31, 2011. Our Tier 1 capital and total capital ratios were 11.13% and 13.48%, respectively, compared to 10.90%

and 13.67%, respectively, at December 31, 2011. The decline in total capital from prior year was primarily due to the redemption

of trust preferred securities. In addition to strong earnings, our capital was further strengthened due to the issuance of $450 million

of additional preferred stock. Overall, our capital remains strong and well above the requirements to be considered “well capitalized”

according to current and proposed regulatory standards. See additional discussion of our capital and liquidity position in the “Capital

Resources” and “Liquidity Risk” sections of this MD&A.

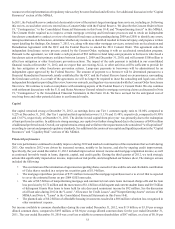

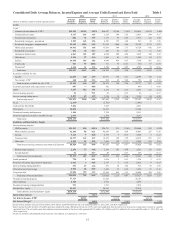

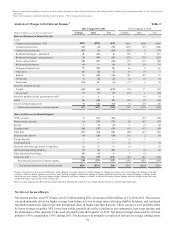

Financial performance

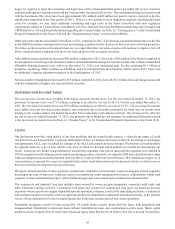

Our core performance continued to steadily improve during 2012 and marked a continuation of the momentum that we built during

2011. Our results in 2012 were driven by increased revenue, notably in fee income, and also by ongoing credit improvement.

Specifically, the year ended December 31, 2012 included improved net interest income and mortgage origination income, as well

as continued favorable trends in loans, deposits, capital, and credit quality. During the third quarter of 2012, we took strategic

actions that significantly impacted net income, improved our risk profile, and strengthened our balance sheet. The strategic actions

included the following:

• The acceleration of the termination of agreements regarding shares owned in Coke and the sale and charitable contribution

of Coke shares resulted in a net pre-tax securities gain of $1.9 billion.

• The mortgage repurchase provision of $371 million increased the mortgage repurchase reserve to a level that is expected

to cover the estimated losses on pre-2009 GSE loans sales.

• The sale of $0.5 billion of nonperforming mortgage and commercial real estate loans increased charge-offs and the loan

loss provision by $172 million and the movement of $1.4 billion of delinquent and current student loans and $0.5 billion

of delinquent Ginnie Mae loans to loans held for sale decreased noninterest income by $92 million. See the discussion

of all loan sales during 2012 in the "Loans", "Allowance for Credit Losses", and "Nonperforming Assets" sections of this

MD&A and Note 6, "Loans" in the Consolidated Financial Statements in this Form 10-K.

• The planned sale of $0.2 billion of affordable housing investments resulted in a $96 million valuation loss recognized in

other noninterest expense.

Net income available to common shareholders during the year ended December 31, 2012, was $1.9 billion, or $3.59 per average

diluted common share, compared to $495 million, or $0.94 per average diluted common share for the year ended December 31,

2011. The year ended December 30, 2010 was a net loss available to common shareholders of $87 million, or a loss of $0.18 per