SunTrust 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

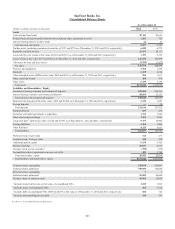

94

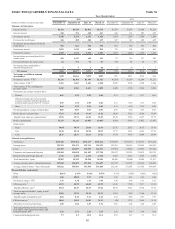

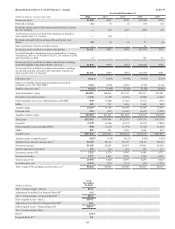

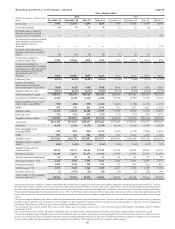

Reconcilement of Non-U.S. GAAP Measures – Annual, continued

(Dollars in millions)

For the year ended

December 31, 2012

Net income available to common shareholders $1,931

Gains on sale of Coke common stock (1,239)

Coke stock contribution expense 24

Losses on sales of loans and write-down of certain affordable

housing investments being marketed for sale 236

Mortgage repurchase provision on GSE loans 226

Net income available to common shareholders, excluding strategic

actions12 $1,178

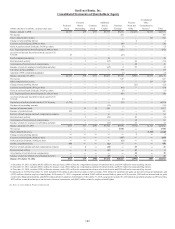

For the year ended

December 31, 2012

(Dollars in millions) Income Expense

Net interest income - FTE $5,225 $—

Noninterest income/noninterest expense 5,373 6,323

Gains on sale of Coke common stock (1,938) —

Coke stock contribution expense — (38)

Losses on sales of loans and write-down of certain affordable

housing investments being marketed for sale 92 (96)

Mortgage repurchase provision on GSE loans 371 —

Impairment/amortization of goodwill/intangible assets — (46)

Revenue - FTE/noninterest expense, excluding the impact of

strategic actions and impairment/amortization of goodwill/

intangible assets13 $9,123 $6,143

Efficiency ratio 259.67%

Impact of excluding impairment/amortization of goodwill/

intangible assets other than MSRs (0.43)

Tangible efficiency ratio 359.24

Impact of excluding gains on sale of Coke common stock 13.24

Impact of excluding Coke stock contribution expense (0.37)

Impact of excluding losses on sales of loans and write-down of

certain affordable housing investments being marketed for sale (1.42)

Impact of excluding mortgage repurchase provision on GSE loans (3.34)

Adjusted tangible efficiency ratio13 67.35%

ROA 1.11%

Impact of excluding gains on sale of Coke common stock (0.70)

Impact of excluding Coke stock contribution expense 0.01

Impact of excluding losses on sales of loans and write-down of

certain affordable housing investments being marketed for sale 0.13

Impact of excluding mortgage repurchase provision on GSE loans 0.13

Adjusted ROA14 0.68%

Net income/(loss) per average common share, diluted $3.59

Impact of excluding gains on sale of Coke common stock (2.30)

Impact of excluding Coke stock contribution expense 0.04

Impact of excluding losses on sales of loans and write-down of

certain affordable housing investments being marketed for sale 0.44

Impact of excluding mortgage repurchase provision on GSE loans 0.42

Adjusted net income/(loss) per average common share, diluted 12, 15 $2.19

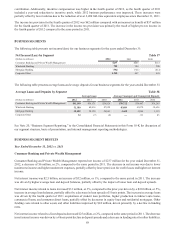

1We present net income/(loss) available to common shareholders that excludes the portion of the impairment charges on goodwill and intangible assets allocated to the common

shareholders and net income/(loss) to common shareholders that excludes the accelerated accretion associated with the repurchase of preferred stock issued to the U.S. Treasury.

We believe these measures are useful to investors, because removing the non-cash impairment charge and non-cash accelerated accretion provides a more representative view of

normalized operations and the measure also allows better comparability with peers in the industry who also provide a similar presentation when applicable. In addition, we use

this measure internally to analyze performance.

2Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments.

We believe this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-

exempt sources.