SunTrust 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

154

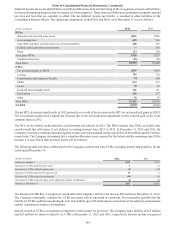

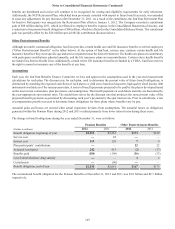

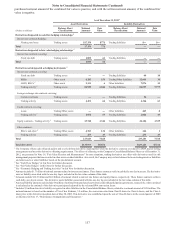

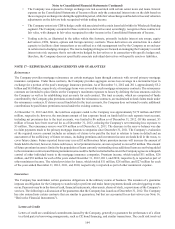

The key sources of the cumulative net losses to be recognized in future years for all pension and postretirement benefits are

attributable to lower discount rates for the past several years and lower return on assets, predominantly during 2008. As discussed

previously, SunTrust reviews its assumptions annually to ensure they represent the best estimates for the future and will, therefore,

minimize future gains and losses.

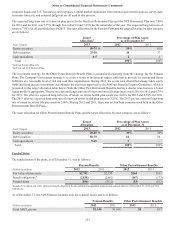

Expected Cash Flows

Information about the expected cash flows for the Pension Benefit and Other Postretirement Benefit plans is as follows:

(Dollars in millions)

Pension

Benefits1,2

Other Postretirement

Benefits (excluding

Medicare Subsidy) 3

Value to Company

of Expected

Medicare Subsidy

Employer Contributions

2013 (expected) to plan trusts $— $— $—

2013 (expected) to plan participants 8 1 (3)

Expected Benefit Payments

2013 164 15 (3)

2014 162 15 (1)

2015 159 14 (1)

2016 157 14 (1)

2017 158 13 (1)

2018-2022 793 54 (6)

1At this time, SunTrust anticipates contributions to the Retirement Plan will be permitted (but not required) during 2013 based on the funded status and contribution

limitations under the ERISA.

2The expected benefit payments for the SERP will be paid directly from SunTrust corporate assets.

3The 2013 expected contribution for the Other Postretirement Benefits Plans represents the Medicare Part D subsidy only. Note that expected benefits under Other

Postretirement Benefits Plans are shown net of participant contributions.

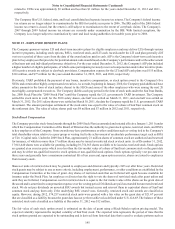

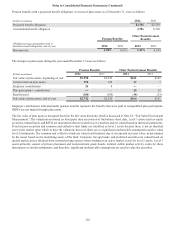

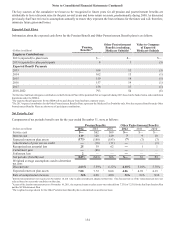

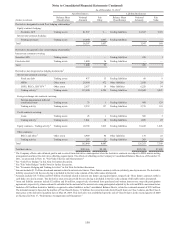

Net Periodic Cost

Components of net periodic benefit cost for the year ended December 31, were as follows:

Pension Benefits Other Postretirement Benefits

(Dollars in millions) 2012 2011 2010 2012 2011 2010

Service cost $— $62 $69 $— $— $—

Interest cost 119 128 129 79 10

Expected return on plan assets (173) (188) (183) (7) (7) (7)

Amortization of prior service credit —(16) (11) —— (1)

Recognized net actuarial loss 25 39 62 —1 1

Curtailment gain —(88) — —— —

Settlement loss 2— — —— —

Net periodic (benefit)/cost ($27) ($63) $66 $— $3 $3

Weighted average assumptions used to determine

net cost:

Discount rate 4.63% 5.59% 16.32% 4.10% 5.10% 5.70%

Expected return on plan assets 7.00 7.72 28.00 4.06 34.39 34.39 3

Rate of compensation increase N/A 4.00 4.00 N/A N/A N/A

1Interim remeasurement was required on November 14, 2011 due to plan amendments adopted at that time. The discount rate as of the remeasurement date was

selected based on economic conditions on that date.

2As part of the interim remeasurement on November 14, 2011, the expected return on plan assets was reduced from 7.75% to 7.25% for the SunTrust Pension Plan

and the NCF Retirement Plan.

3The weighted average shown for the Other Postretirement Benefit plan is determined on an after-tax basis.