SunTrust 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

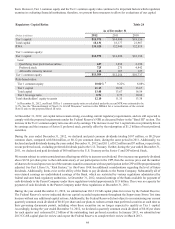

BCBS has also stated that from time to time it may require an additional, counter-cyclical capital buffer on top of Basel III

standards.

In June 2012, the Federal Reserve, FDIC, and OCC issued several joint NPRs to address the implementation of the proposed

Basel III regulatory capital framework for U.S. financial institutions, including proposed minimum capital requirements,

definitions of qualifying capital instruments, and risk-weighted asset calculations. As proposed, we expect that our risk-

weighted assets will increase primarily due to increased risk-weightings for residential mortgages, commercial real estate

loans, and home equity loans, and this will result in a decline in our capital ratios. Under current rules (Basel I), our Tier 1

common equity ratio was 10.04% at December 31, 2012. We continue to analyze the NPR; however, as currently proposed,

we estimate our current Basel III Tier 1 common ratio, on a fully phased-in basis, would be approximately 8.2%, which would

be in compliance with the proposed requirements. See "Reconcilement of Non-U.S. GAAP Measures - Annual" in this MD&A

for a reconciliation of the current Basel I ratio to the proposed Basel III ratio. Further, the NPR indicates a phase-in for the

new capital rules with the proposed risk-weightings requirement not becoming effective until 2015. Notwithstanding the

uncertainty surrounding the timing and content of the final rule, our current Tier 1 common ratio estimate calculated using

the NPR assumptions does not include the effect of any mitigating actions we may undertake to offset some of the anticipated

impact of the proposed capital changes. Our estimate of the current period Tier 1 common ratio under the NPR was calculated

using the assumptions prescribed in the NPR, which can be found on the Federal Reserve's website. The agencies are continuing

to evaluate the feedback received on the NPR and will consider the feedback when drafting a final rule, which could take

several quarters to complete. Accordingly, the final rule may differ from the current NPR. We monitor our capital structure

to ensure it complies with current regulatory and prescribed operating levels and are taking into account these proposed

regulations in our capital and strategic planning.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are described in detail in Note 1, “Significant Accounting Policies,” to the Consolidated

Financial Statements in this Form 10-K and are integral to understanding our financial performance. We have identified certain

accounting policies as being critical because (1) they require judgment about matters that are highly uncertain and (2) different

estimates that could be reasonably applied would result in materially different assessments with respect to ascertaining the

valuation of assets, liabilities, commitments, and contingencies. A variety of factors could affect the ultimate value that is

obtained either when earning income, recognizing an expense, recovering an asset, valuing an asset or liability, or reducing

a liability. Our accounting and reporting policies are in accordance with U.S. GAAP, and they conform to general practices

within the financial services industry. We have established detailed policies and control procedures that are intended to ensure

that these critical accounting estimates are well controlled, applied consistently from period to period, and the process for

changing methodologies occurs in an appropriate manner. The following is a description of our current critical accounting

policies.

Contingencies

We face uncertainty with respect to the ultimate outcomes of various contingencies including the Allowance for Credit Losses,

mortgage repurchase reserves, and legal and regulatory matters.

Allowance for Credit Losses

The Allowance for Credit Losses is composed of the ALLL and the reserve for unfunded commitments. The ALLL represents

our estimate of probable losses inherent in the existing loan portfolio. The ALLL is increased by the provision for credit losses

and reduced by loans charged off, net of recoveries. The ALLL is determined based on our review and evaluation of larger

loans that meet our definition of impairment and the current risk characteristics of pools of homogeneous loans (i.e., loans

having similar characteristics) within the loan portfolio and our assessment of internal and external influences on credit quality

that are not fully reflected in the historical loss or risk-rating data.

Large commercial nonaccrual loans and certain commercial, consumer, and residential loans whose terms have been modified

in a TDR, are individually evaluated to determine the amount of specific allowance required using the most probable source

of repayment, including the present value of the loan's expected future cash flows, the fair value of the underlying collateral

less costs of disposition, or the loan's estimated market value. In these measurements, we use assumptions and methodologies

that are relevant to estimating the level of impairment and unrealized losses in the portfolio. To the extent that the data

supporting such assumptions has limitations, our judgment and experience play a key role in enhancing the specific ALLL

estimates. Key judgments used in determining the ALLL include internal risk ratings, market and collateral values, discount

rates, loss rates, and our view of current economic conditions.