SunTrust 2012 Annual Report Download - page 180

Download and view the complete annual report

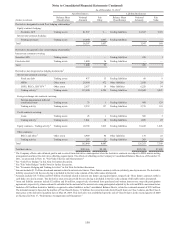

Please find page 180 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

164

• The Company was exposed to foreign exchange rate risk associated with certain senior notes and loans. Interest

expense on the Consolidated Statements of Income reflects only the contractual interest rate on the debt based on

the average spot exchange rate during the applicable period, while fair value changes on the derivatives and valuation

adjustments on the debt are both recognized within trading income.

• The Company enters into CDS to hedge credit risk associated with certain loans held within its Wholesale Banking

segment. The Company accounts for these contracts as derivatives and, accordingly, recognizes these contracts at

fair value, with changes in fair value recognized in other income in the Consolidated Statements of Income.

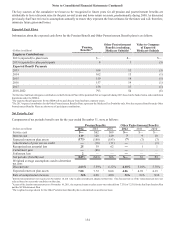

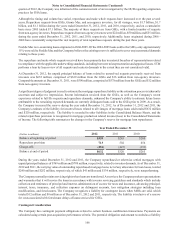

• Trading activity, as illustrated in the tables within this footnote, primarily includes interest rate swaps, equity

derivatives, CDS, futures, options and foreign currency contracts. These derivatives are entered into in a dealer

capacity to facilitate client transactions or are utilized as a risk management tool by the Company as an end user

in certain macro-hedging strategies. The macro-hedging strategies are focused on managing the Company’s overall

interest rate risk exposure that is not otherwise hedged by derivatives or in connection with specific hedges and,

therefore, the Company does not specifically associate individual derivatives with specific assets or liabilities.

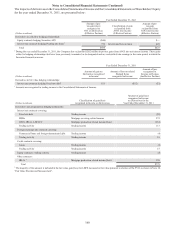

NOTE 17 – REINSURANCE ARRANGEMENTS AND GUARANTEES

Reinsurance

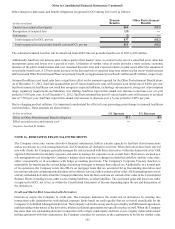

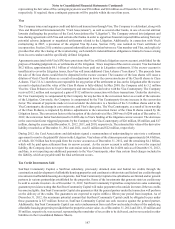

The Company provides mortgage reinsurance on certain mortgage loans through contracts with several primary mortgage

insurance companies. Under these contracts, the Company provides aggregate excess loss coverage in a mezzanine layer in

exchange for a portion of the pool’s mortgage insurance premium. As of December 31, 2012 and 2011, approximately $5.2

billion and $8.0 billion, respectively, of mortgage loans were covered by such mortgage reinsurance contracts. The reinsurance

contracts are intended to place limits on the Company’s maximum exposure to losses by defining the loss amounts ceded to

the Company as well as by establishing trust accounts for each contract. The trust accounts, which are comprised of funds

contributed by the Company plus premiums earned under the reinsurance contracts, are maintained to fund claims made under

the reinsurance contracts. If claims exceed funds held in the trust accounts, the Company does not intend to make additional

contributions beyond future premiums earned under the existing contracts.

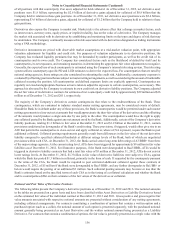

At December 31, 2012 and 2011, the total loss exposure ceded to the Company was approximately $179 million and $309

million, respectively; however, the maximum amount of loss exposure based on funds held in each separate trust account,

including net premiums due to the trust accounts, was limited to $6 million as of December 31, 2012. Of this amount, $3

million of losses have been reserved for as of December 31, 2012, reducing the Company’s net remaining loss exposure to

$3 million. The reinsurance reserve was $38 million as of December 31, 2011. The decrease in the reserve balance was due

to claim payments made to the primary mortgage insurance companies since December 31, 2011. The Company’s evaluation

of the required reserve amount includes an estimate of claims to be paid by the trust in relation to loans in default and an

assessment of the sufficiency of future revenues, including premiums and investment income on funds held in the trusts, to

cover future claims. Future reported losses may exceed $3 million since future premium income will increase the amount of

funds held in the trust; however, future cash losses, net of premium income, are not expected to exceed $3 million. The amount

of future premium income is limited to the population of loans currently outstanding since additional loans are not being added

to the reinsurance contracts and future premium income could be further curtailed to the extent the Company agrees to relinquish

control of other individual trusts to the mortgage insurance companies. Premium income, which totaled $11 million, $26

million, and $38 million for each of the years ended December 31, 2012, 2011, and 2010, respectively, is reported as part of

other noninterest income. The related provision for losses, which totaled $11 million, $28 million, and $27 million for each

of the years ended December 31, 2012, 2011, and 2010, respectively, is reported as part of other noninterest expense.

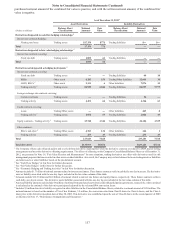

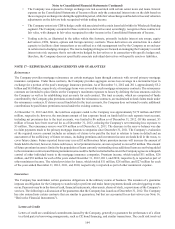

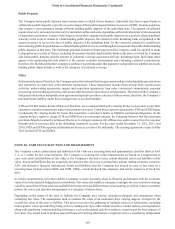

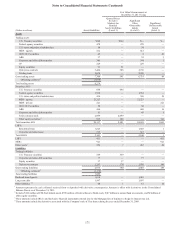

Guarantees

The Company has undertaken certain guarantee obligations in the ordinary course of business. The issuance of a guarantee

imposes an obligation for the Company to stand ready to perform and make future payments should certain triggering events

occur. Payments may be in the form of cash, financial instruments, other assets, shares of stock, or provisions of the Company’ s

services. The following is a discussion of the guarantees that the Company has issued as of December 31, 2012. The Company

has also entered into certain contracts that are similar to guarantees, but that are accounted for as derivatives (see Note 16,

“Derivative Financial Instruments”).

Letters of Credit

Letters of credit are conditional commitments issued by the Company, generally to guarantee the performance of a client

to a third party in borrowing arrangements, such as CP, bond financing, and similar transactions. The credit risk involved