SunTrust 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

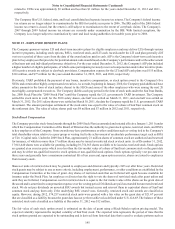

Notes to Consolidated Financial Statements (Continued)

138

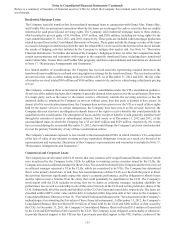

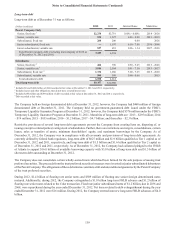

Registered and Unregistered Funds Advised by RidgeWorth

RidgeWorth, a registered investment advisor and majority owned subsidiary of the Company, serves as the investment

advisor for various private placement, common and collective funds, and registered mutual funds (collectively the

“Funds”). The Company evaluates these Funds to determine if the Funds are VIEs. In February 2010, the FASB

issued guidance that defers the application of the existing VIE consolidation guidance for investment funds meeting

certain criteria. All of the registered and unregistered Funds advised by RidgeWorth meet the scope exception criteria

and thus are not evaluated for consolidation under the guidance. Accordingly, the Company continues to apply the

consolidation guidance in effect prior to the issuance of the existing guidance to interests in funds that qualify for

the deferral.

The Company has concluded that some of the Funds are VIEs. However, the Company has concluded that it is not

the primary beneficiary of these funds as the Company does not absorb a majority of the expected losses nor expected

returns of the funds. The Company’s exposure to loss is limited to the investment advisor and other administrative

fees it earns and if applicable, any equity investments. The total unconsolidated assets of these funds as of

December 31, 2012 and 2011, were $372 million and $1.1 billion, respectively.

The Company does not have any contractual obligation to provide monetary support to any of the Funds. The Company

did not provide any significant support, contractual or otherwise, to the Funds during the years ended December 31,

2012 and 2011.

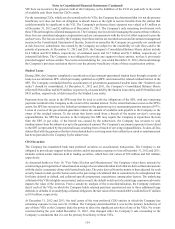

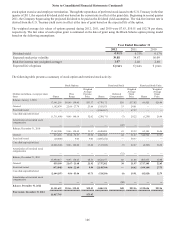

NOTE 11 - BORROWINGS AND CONTRACTUAL COMMITMENTS

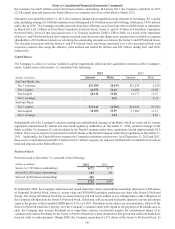

Short-term borrowings

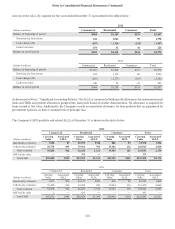

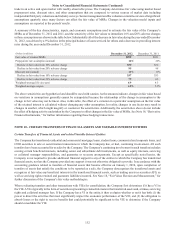

Other short-term borrowings as of December 31 was as follows:

2012 2011

(Dollars in millions) Balance Interest

Rate Balance Interest

Rate

FHLB advances $1,500 0.34% $7,000 0.14%

Master notes 1,512 0.30 1,710 0.40

Dealer collateral 282 0.17 265 various

Other 9 2.70 8 2.70

Total other short-term borrowings $3,303 $8,983

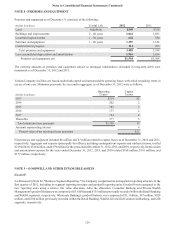

The average balances of other short-term borrowings for the years ended December 31, 2012 and 2011 were $7.0 billion and

$3.5 billion, respectively, while the maximum amounts outstanding at any month-end during the years ended December 31,

2012 and 2011 were $10.7 billion and $9.0 billion, respectively. As of December 31, 2012, the Company had collateral pledged

to the Federal Reserve discount window to support $23.8 billion of available, unused borrowing capacity.