SunTrust 2012 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

188

petition for rehearing or rehearing en banc, which was denied. Plaintiffs have filed a petition for a writ of certiorari to the

U.S. Supreme Court, which also was denied.

The second of these cases, Bickerstaff v. SunTrust Bank, was filed in the Fulton County State Court on July 12, 2010, and an

amended complaint was filed on August 9, 2010. Plaintiff asserts that all overdraft fees charged to his account which related

to debit card and ATM transactions are actually interest charges and therefore subject to the usury laws of Georgia. Plaintiff

has brought claims for violations of civil and criminal usury laws, conversion, and money had and received, and purports to

bring the action on behalf of all Georgia citizens who have incurred such overdraft fees within the last four years where the

overdraft fee resulted in an interest rate being charged in excess of the usury rate. SunTrust has filed a motion to compel

arbitration. On March 16, 2012, the Court entered an order holding that SunTrust's arbitration provision is enforceable but

that the named plaintiff in the case had opted out of that provision pursuant to its terms. The court explicitly stated that it was

not ruling at that time on the question of whether the named plaintiff could proceed with the case as a class rather than as an

individual action. SunTrust has filed an appeal of this decision, but this appeal was dismissed based on a finding that leave

to appeal was improvidently granted. The parties now are conducting discovery in anticipation of a motion for class certification.

The third of these cases, Byrd v. SunTrust Bank, was filed on April 23, 2012, in the United States District Court for the Western

District of Tennessee. This case is substantially similar to the Bickerstaff matter described above. SunTrust has filed a Motion

to Compel Arbitration.

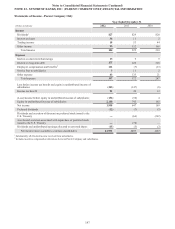

SunTrust Mortgage, Inc. v. United Guaranty Residential Insurance Company of North Carolina

STM filed suit in the Eastern District of Virginia in July of 2009 against United Guaranty Residential Insurance Company of

North Carolina (“UGRIC”) seeking payment of denied mortgage insurance claims on second lien mortgages. STM's claims

were in two counts. Count One involved a common reason for denial of claims by UGRIC for a group of loans. Count Two

involved a group of loans with individualized reasons for the claim denials asserted by UGRIC. UGRIC counterclaimed for

declaratory relief involving interpretation of the insurance policy involving certain caps on the amount of claims covered, and

whether STM was obligated to continue to pay premiums after any caps were met. The Court granted STM's motion for

summary judgment as to liability on Count One and, after a trial on damages, awarded STM $34 million along with $6 million

in prejudgment interest on August 19, 2011. The Court stayed Count Two pending final resolution of Count One. On September

13, 2011, the Court awarded an additional $5 million to the Count One judgment for fees on certain issues. On UGRIC's

counterclaim, the Court agreed that UGRIC's interpretation was correct regarding STM's continued obligations to pay premiums

in the future after coverage caps are met. However, on August 19, 2011, the Court found for STM on its affirmative defense

that UGRIC can no longer enforce the contract due to its prior breaches and, consequently, denied UGRIC's request for a

declaration that it was entitled to continue to collect premiums after caps are met.

On February 1, 2013, the Fourth Circuit Court of Appeals (i) upheld the judgment to STM of $45 million ($34 million in

claims, $6 million in interest and $5 million in additional fees); and (ii) vacated the ruling in STM's favor regarding the defense

STM asserted to UGRIC's claim that STM owes continued premium after the limits of liability on the insurance are reached.

STM expects that further proceedings in the District Court will be conducted regarding STM's defense to UGRIC's claims

for additional premiums. On February 15, 2013, UGRIC filed a motion asking the U.S. Fourth Circuit Court of Appeals to

re-hear its appeal.

Lehman Brothers Holdings, Inc. Litigation

Beginning in October 2008, STRH, along with other underwriters and individuals, were named as defendants in several

individual and putative class action complaints filed in the U.S. District Court for the Southern District of New York and state

and federal courts in Arkansas, California, Texas and Washington. Plaintiffs allege violations of Sections 11 and 12 of the

Securities Act of 1933 for allegedly false and misleading disclosures in connection with various debt and preferred stock

offerings of Lehman Brothers Holdings, Inc. ("Lehman Brothers") and seek unspecified damages. All cases have now been

transferred for coordination to the multi-district litigation captioned In re Lehman Brothers Equity/Debt Securities Litigation

pending in the U.S. District Court for the Southern District of New York. Defendants filed a motion to dismiss all claims

asserted in the class action. On July 27, 2011, the District Court granted in part and denied in part the motion to dismiss the

class claims against STRH and the other underwriter defendants. A settlement with the class plaintiffs was approved by the

Court on December 15, 2011. The class notice and opt-out process is complete and the class settlement approval process has

been completed. A number of individual lawsuits and smaller putative class actions remained pending following the class

settlement. After motions to dismiss in these cases, a few individual actions have survived and will move forward into discovery.

SunTrust Shareholder Derivative Litigation

On September 9, 2011, the Company and several current and former executives and members of the Board were named in a

shareholder derivative action filed in the Superior Court of Fulton County, Georgia, Sharon Benfield v. James M. Wells, III.

et al., and on December 19, 2011, the Company and several current and former executives and members of the Board were