SunTrust 2012 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

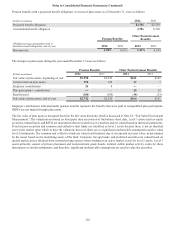

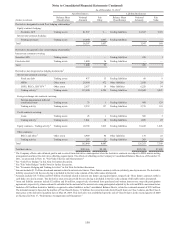

Notes to Consolidated Financial Statements (Continued)

148

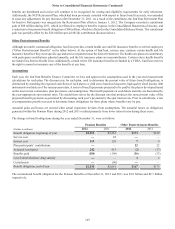

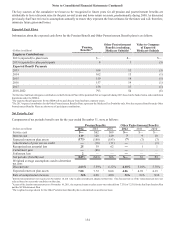

Retirement Plans

Defined Contribution Plan

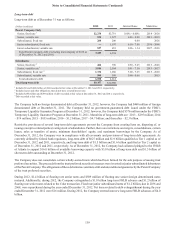

SunTrust's employee benefit program includes a qualified defined contribution plan. For 2012, the plan provided a dollar for dollar

match on the first 6% of eligible pay that a participant, including executive participants, elected to defer to the 401(k) plan.

Compensation expense related to this plan for the year ended December 31, 2012 was $96 million. SunTrust also maintains the

SunTrust Banks, Inc. Deferred Compensation Plan in which key executives of the Company are eligible. In accordance with the

terms of the plan, the matching contribution to the Deferred Compensation Plan is the same percentage of match as provided in

the 401(k) Plan subject to such limitations as may be imposed by the plans' provisions and applicable laws and regulations. Effective

January 1, 2012, the Company's 401(k) plan and the Deferred Compensation Plan were amended to permit an additional

discretionary Company contribution equal to a fixed percentage of eligible pay, as defined in the respective plan. For the 2012

performance year, the Company will make a discretionary contribution on March 15, 2013, in the amount of 2% of 2012 eligible

pay to the 401(k) Plan and the Deferred Compensation Plan, which is an estimated $38 million.

During 2011 and 2010 the Company's 401(k) plan and the Deferred Compensation Plan provided a dollar for dollar match on the

first 5% of eligible pay that a participant elected to defer to the 401(k) plan. Compensation expense related to the 401(k) plan for

the years ended December 31, 2011 and 2010 totaled $81 million and $74 million, respectively, excluding the special contribution

during 2011 described below. Effective January 1, 2011, employees hired on or after January 1, 2011 will vest in all Company 401

(k) matching contributions and matching contributions under the Deferred Compensation Plan upon completion of two years of

vesting service. During 2011, the Company's 401(k) plan and the Deferred Compensation Plan were amended to provide for a

special one-time contribution equal to 5% of eligible 2011 earnings, which was $28 million, for employees who have: (1) at least

20 years of service as of December 31, 2011, or (2) 10 years of service and the sum of age and service equaled or exceeded 60 as

of December 31, 2011. This contribution was made subsequent to the retirement pension benefit curtailment described below.

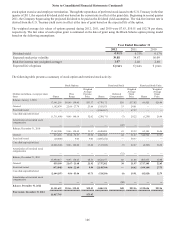

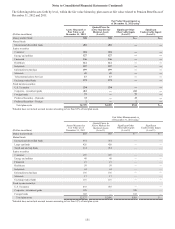

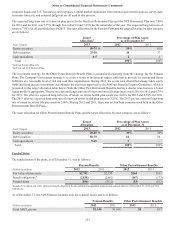

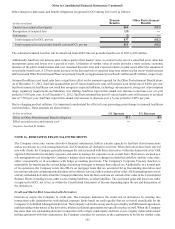

Noncontributory Pension Plans

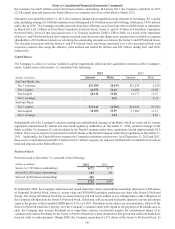

SunTrust maintains a funded, noncontributory qualified retirement plan (the "Retirement Plan") covering employees meeting

certain service requirements. The plan provides benefits based on salary and years of service and, effective January 1, 2008, either

a traditional pension benefit formula, a cash balance formula (the Personal Pension Account) or a combination of both. Participants

are 100% vested after 3 years of service. The interest crediting rate applied to each Personal Pension Account was 3% for 2012.

SunTrust monitors the funded status of the plan closely and due to the current funded status, SunTrust did not make a contribution

for the 2012 plan year.

SunTrust also maintains unfunded, noncontributory nonqualified supplemental defined benefit pension plans that cover key

executives of the Company (the "SERP", the "ERISA Excess Plan", and the "Restoration Plan"). The plans provide defined benefits

based on years of service and salary. SunTrust's obligations for these nonqualified supplemental defined benefit pension plans are

included within the qualified Pension Plans in the tables presented in this section under “Pension Benefits”.

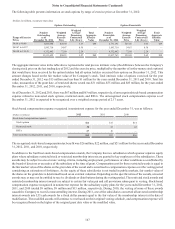

On December 31, 2010, the Company adopted the SunTrust Banks, Inc. Restoration Plan (the “Restoration Plan”) effective

January 1, 2011. The Restoration Plan is a nonqualified defined benefit cash balance plan designed to restore benefits to certain

employees that are limited under provisions of the Internal Revenue Code and are not otherwise provided for under the ERISA

Excess Plan. The benefit formula under the Restoration Plan is the same as the Personal Pension Account under the Retirement

Plan.

On October 1, 2004, SunTrust acquired NCF. Prior to the acquisition, NCF sponsored a funded qualified retirement plan, an

unfunded nonqualified retirement plan for some of its participants, and certain other postretirement health benefits for its employees.

Similar to the SunTrust Retirement Plan, due to the current funded status of the NCF qualified Retirement Plan, SunTrust did not

make a contribution for the 2012 plan year.

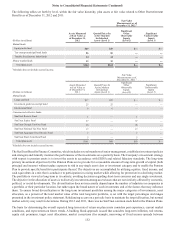

Effective January 1, 2011, a separate retirement plan was created exclusively for inactive and retired employees (“SunTrust Banks,

Inc. Retirement Plan for Inactive Participants”). Obligations and related plan assets were transferred from the SunTrust Banks,

Inc. Retirement Plan to the new separate retirement plan. As described in the following paragraph, effective January 1, 2012, the

plans were combined into one Retirement Plan.

The Retirement Plan, the SERP, the ERISA Excess Plan, and the Restoration Plan were each amended on November 14, 2011 to

cease all future benefit accruals. As a result, the traditional pension benefit formulas (final average pay formulas) will not reflect

future salary increases and benefit service after December 31, 2011, and compensation credits under the Personal Pension Accounts

(cash balance formula) will cease. However, interest credits under the Personal Pension Accounts will continue to accrue until