SunTrust 2012 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

191

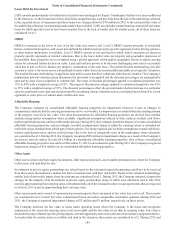

On March 12, 2012, the Court granted in part and denied in part the motion to dismiss. The Company filed a subsequent

motion to dismiss the remainder of the case on the ground that the Court lacked subject matter jurisdiction over the remaining

claims. On October 30, 2012, the Court dismissed all claims in this action. Immediately thereafter, plaintiffs' counsel initiated

a substantially similar lawsuit against the Company substituting two new plaintiffs. SunTrust intends to file a motion to dismiss

in this action.

SunTrust Mortgage Reinsurance Class Actions

STM and Twin Rivers Insurance Company ("Twin Rivers") have been named as defendants in two putative class actions

alleging that the companies entered into illegal “captive reinsurance” arrangements with private mortgage insurers. More

specifically, plaintiffs allege that SunTrust’s selection of private mortgage insurers who agree to reinsure loans referred to

them by SunTrust with Twin Rivers results in illegal “kickbacks” in the form of the insurance premiums paid to Twin Rivers.

Plaintiffs contend that this arrangement violates the Real Estate Settlement Procedures Act (“RESPA”) and results in unjust

enrichment to the detriment of borrowers. The first of these cases, Thurmond, Christopher, et al. v. SunTrust Banks, Inc. et

al., was filed in February 2011 in the U.S. District Court for the Eastern District of Pennsylvania. This case was stayed by the

Court pending the outcome of Edwards v. First American Financial Corporation, a captive reinsurance case that was pending

before the U.S. Supreme Court at the time. The second of these cases, Acosta, Lemuel & Maria Ventrella et al. v. SunTrust

Bank, SunTrust Mortgage, Inc., et al., was filed in the U.S. District Court for the Central District of California in December

2011. This case was stayed pending a decision in the Edwards case also. In June 2012, the U.S. Supreme Court withdrew its

grant of certiorari in Edwards and, as a result, the stays in these cases were lifted. The plaintiffs in Acosta voluntarily dismissed

this case. A motion to dismiss is pending in the Thurmond case.

United States and States Attorneys General Mortgage Servicing Claims

In January, 2012, the Company commenced discussions related to a mortgage servicing settlement with the U.S., through the

Department of Justice, and Attorneys General for several states regarding various potential claims relating to the Company's

mortgage servicing activities. While these discussions are continuing, the Company has not reached any agreement with such

parties. The Company has estimated the cost of resolving these and potential similar claims, including the costs of such a

settlement, borrower-specific actions, and/or legal matters to defend such claims if they are not settled, and accrued this

expense in its financial results.

False Claim Act Litigation

SunTrust Mortgage is a defendant in a qui tam lawsuit brought in the U.S. District Court for the Northern District of Georgia

under the federal False Claims Act, United States ex rel. Bibby & Donnelly v. Wells Fargo, et al. This lawsuit originally was

filed under seal, but the second amended complaint was unsealed by the District Court in October 2011. The plaintiffs, who

allege that they are officers of a mortgage broker, allege that numerous mortgage originators, including SunTrust Mortgage,

made false statements to the U.S. Department of Veterans Affairs in order to obtain loan guarantees by the VA under its Interest

Rate Reduction Refinancing Loans ("IRRRL") program. Plaintiffs allege that the mortgage originators charged fees in

connection with these loans that were not permitted under the IRRRL program and made false statements to the VA to the

effect that the loans complied with all applicable regulations or program requirements. According to Plaintiffs, by doing so,

the originators caused the VA to pay, among other costs, amounts to honor the loan guarantees to which they were not entitled.

Plaintiffs have sued on their own behalf and on behalf of the U.S., and seek, among other things, unspecified damages equal

to the loss that SunTrust Mortgage allegedly caused the U.S. (trebled under the False Claims Act), statutory civil penalties of

between $5,500 and $11,000 per violation, injunctive relief, and attorneys' fees. To date, the U.S. has not joined in the

prosecution of this action. SunTrust Mortgage and other defendants have filed motions to dismiss. SunTrust Mortgage and

the relators have reached an agreement to settle this dispute that is awaiting bankruptcy court approval.

HUD Investigation

On April 25, 2012, the Company was informed of the commencement of an investigation by the HUD relating generally to

origination practices for FHA loans. The Company continues to cooperate with the investigation.