SunTrust 2012 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

146

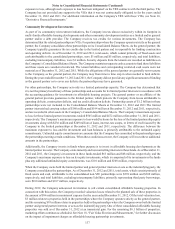

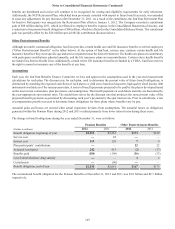

stock option exercise and employee termination. Through the repurchase of preferred stock issued to the U.S. Treasury in the first

quarter of 2011, the expected dividend yield was based on the current rate in effect at the grant date. Beginning in second quarter

2011, the Company began using the projected dividend to be paid as the dividend yield assumption. The risk-free interest rate is

derived from the U.S. Treasury yield curve in effect at the time of grant based on the expected life of the option.

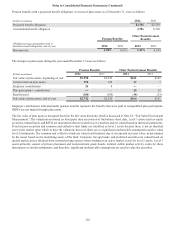

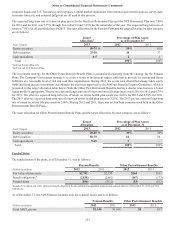

The weighted average fair values of options granted during 2012, 2011, and 2010 were $7.83, $10.51 and $12.78 per share,

respectively. The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model

based on the following assumptions:

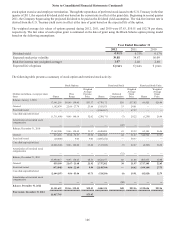

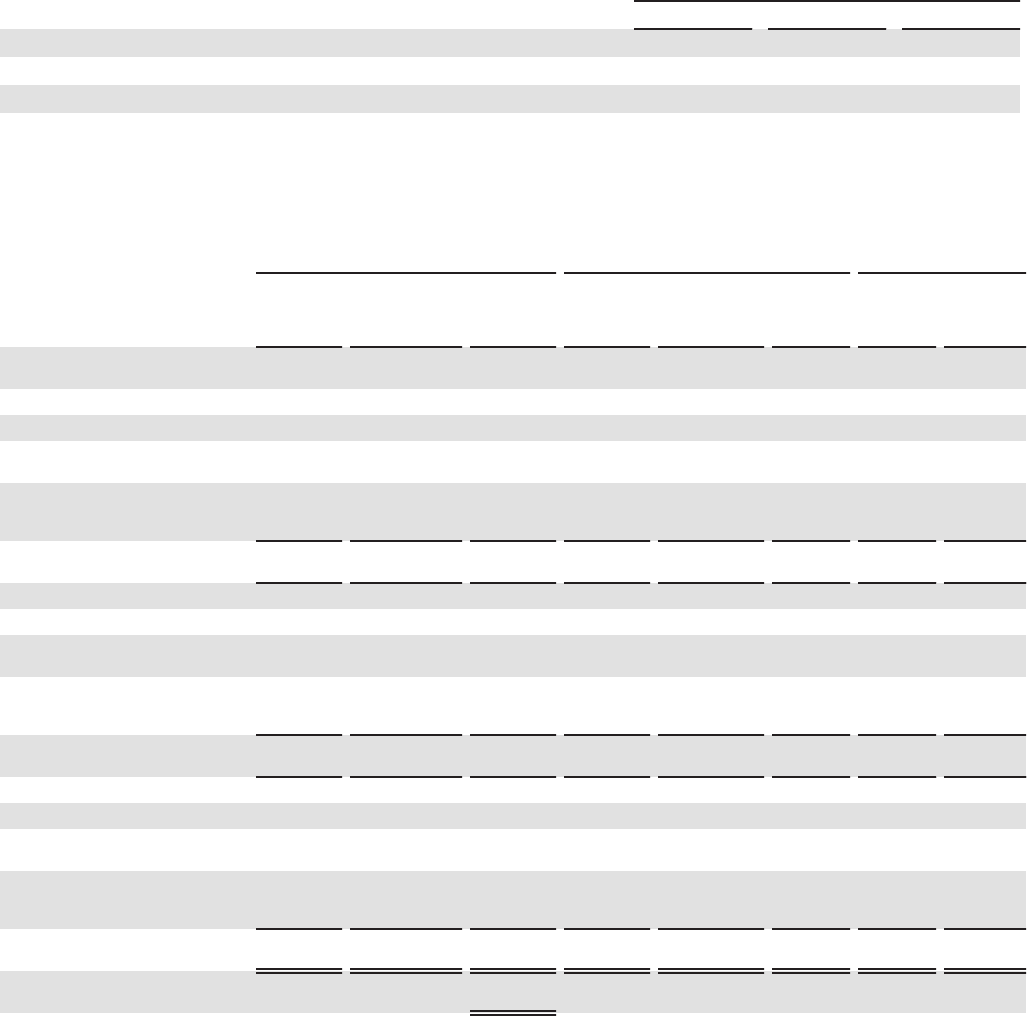

Year Ended December 31

2012 2011 2010

Dividend yield 0.91% 0.75% 0.17%

Expected stock price volatility 39.88 34.87 56.09

Risk-free interest rate (weighted average) 1.07 2.48 2.80

Expected life of options 6 years 6 years 6 years

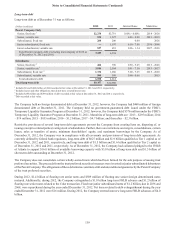

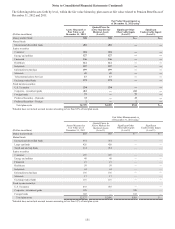

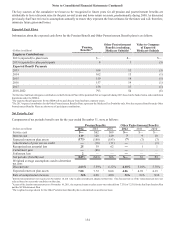

The following table presents a summary of stock option and restricted stock activity:

Stock Options Restricted Stock Restricted Stock Units

(Dollars in millions, except per share

data) Shares

Price

Range

Weighted

Average

Exercise

Price Shares

Deferred

Compensation

Weighted

Average

Grant

Price Shares

Weighted

Average

Grant

Price

Balance, January 1, 2010

17,661,216 $9.06 - 150.45 $53.17 4,770,172 $59 $37.02 66,420 $26.96

Granted 1,192,974 22.69 - 27.79 23.64 1,355,075 33 24.01 — —

Exercised/vested — — — (1,266,267) — 67.27 — —

Cancelled/expired/forfeited

(1,711,690) 9.06 - 140.14 52.62 (238,171) (7) 29.22 (1,230) 26.96

Amortization of restricted stock

compensation

— — — — (42) — — —

Balance, December 31, 2010

17,142,500 9.06 - 150.45 51.17 4,620,809 43 25.32 65,190 26.96

Granted 813,265 19.98 - 32.27 29.70 1,400,305 44 31.27 344,590 37.57

Exercised/vested (20,000) 9.06 9.06 (1,085,252) — 50.37 — —

Cancelled/expired/forfeited

(2,066,348) 9.06 - 140.40 63.40 (313,695) (7) 22.07 (4,305) 26.96

Amortization of restricted stock

compensation

— — — — (32) — — —

Balance, December 31, 2011

15,869,417 9.06 - 150.45 48.53 4,622,167 48 21.46 405,475 35.98

Granted 859,390 21.67 - 23.68 21.92 1,737,202 38 21.97 1,717,148 22.65

Exercised/vested (973,048) 9.06 - 22.69 9.90 (2,148,764) — 14.62 (109,149) 27.73

Cancelled/expired/forfeited (2,444,107) 9.06 - 85.06 45.73 (524,284) (8) 19.91 (82,828) 22.79

Amortization of restricted stock

compensation — — — — (30) — — —

Balance, December 31, 2012 13,311,652 $9.06 - 150.45 $50.15 3,686,321 $48 $25.56 1,930,646 $25.16

Exercisable, December 31, 2012 11,017,763 $55.45