SunTrust 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

135

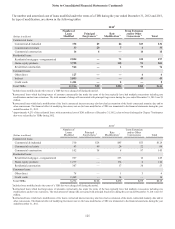

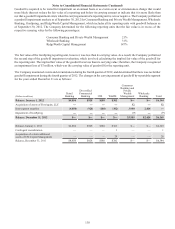

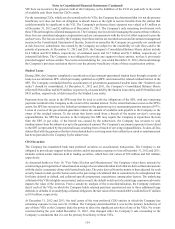

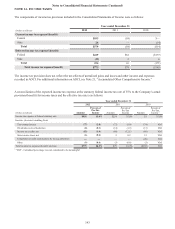

The following tables present certain information for the years ended December 31, related to the Company’s asset transfers

in which it has continuing economic involvement.

(Dollars in millions) 2012 2011 2010

Cash flows on interests held1:

Residential Mortgage Loans $27 $48 $66

Commercial and Corporate Loans 11 4

Student Loans —— 8

CDO Securities 22 2

Total cash flows on interests held $30 $51 $80

Servicing or management fees1:

Residential Mortgage Loans $3 $3 $4

Commercial and Corporate Loans 10 10 12

Student Loans —— $1

Total servicing or management fees $13 $13 $17

1 The transfer activity is related to unconsolidated VIEs.

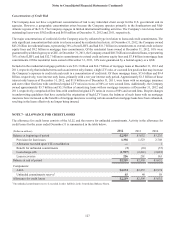

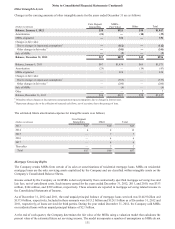

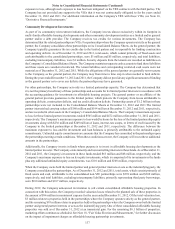

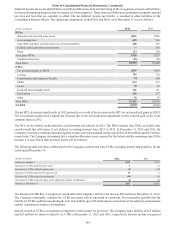

Portfolio balances and delinquency balances based on accruing loans 90 days or more past due and all nonaccrual loans as

of December 31, 2012 and 2011, and net charge-offs related to managed portfolio loans (both those that are owned or

consolidated by the Company and those that have been transferred) for the years ended December 31, 2012 and 2011, are

as follows:

Portfolio Balance1Past Due2Net Charge-offs

December 31,

2012 December 31,

2011 December 31,

2012 December 31,

2011

Year Ended December 31

(Dollars in millions) 2012 2011

Type of loan:

Commercial $58,888 $55,872 $320 $938 $303 $663

Residential 43,199 46,660 1,941 3,079 1,285 1,257

Consumer 19,383 19,963 68 914 93 120

Total loan portfolio 121,470 122,495 2,329 4,931 1,681 2,040

Managed securitized loans:

Commercial 1,767 1,978 23 43 ——

Residential 104,877 114,342 2,186 33,310 330 50

Total managed loans $228,114 $238,815 $4,538 $8,284 $1,711 $2,090

1Excludes $3,399 million and $2,353 million of loans held for sale at December 31, 2012 and 2011, respectively.

2Excludes $38 million and $3 million of past due loans held for sale at December 31, 2012 and 2011, respectively.

3Excludes loans that have completed the foreclosure or short sale process (i.e., involuntary prepayments).

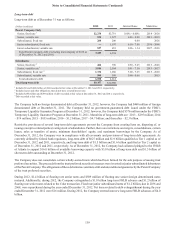

Other Variable Interest Entities

In addition to the Company’ s involvement with certain VIEs related to transfers of financial assets, the Company also has

involvement with VIEs from other business activities.

Three Pillars Funding, LLC

The Company previously assisted in providing liquidity to select corporate clients by directing them to a multi-seller

CP conduit, Three Pillars. Three Pillars provided financing for direct purchases of financial assets originated and

serviced by the Company’s corporate clients by issuing CP. In January 2012, the Company initiated the process of

liquidating Three Pillars. As of June 30, 2012, all commitments and outstanding loans of Three Pillars were transferred

to the Bank and Three Pillars' CP was repaid in full.

The Company determined that Three Pillars was a VIE as Three Pillars did not issue sufficient equity at risk. In

accordance with the VIE consolidation guidance, the Company determined that it was the primary beneficiary of

Three Pillars as certain subsidiaries had both the power to direct its significant activities and own potentially significant

VIs. The assets and liabilities of Three Pillars were consolidated by the Company at their unpaid principal amounts

at January 1, 2010; upon consolidation, the Company recorded an allowance for loan losses on $1.7 billion of secured