SunTrust 2012 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

142

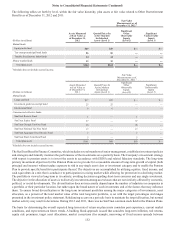

September 2011, the Series A Preferred Stock became redeemable at the Company’s option at a redemption price equal to

$100,000 per share, plus any declared and unpaid dividends. Except in certain limited circumstances, the Series A Preferred

Stock does not have any voting rights.

In December 2011, the Company authorized 5,010 shares and issued 1,025 shares of Perpetual Preferred Stock, Series B, no

par value and $100,000 liquidation preference per share (the Series B Preferred Stock). The Series B Preferred Stock has no

stated maturity and will not be subject to any sinking fund or other obligation of the Company. Dividends on the shares are

noncumulative and, if declared, will accrue and be payable quarterly at a rate per annum equal to the greater of three-month

LIBOR plus 0.65%, or 4.00%. Shares of the Series B Preferred Stock have priority over the Company's common stock with

regard to the payment of dividends and, as such, the Company may not pay dividends on or repurchase, redeem, or otherwise

acquire for consideration shares of its common stock unless dividends for the Series B Preferred Stock have been declared

for that period, and sufficient funds have been set aside to make payment. The Series B Preferred Stock was immediately

redeemable upon issuance at the Company's option at a redemption price equal to $100,000 per share, plus any declared and

unpaid dividends. Except in certain limited circumstances, the Series B Preferred Stock does not have any voting rights.

In December 2012, the Company authorized 5,000 shares and issued 4,500 shares of Perpetual Preferred Stock, Series E, no

par value and $100,000 liquidation preference per share (the Series E Preferred Stock). The Series E Preferred Stock has no

stated maturity and will not be subject to any sinking fund or other obligation of the Company to redeem, repurchase or retire

the shares. Dividends on the shares are noncumulative and, if declared, will accrue and be payable quarterly at a rate per

annum of 5.875%. Shares of the Series E Preferred Stock have priority over the Company's common stock with regard to the

payment of dividends and rank equally with the Company's outstanding Perpetual Preferred Stock, Series A and Series B and,

as such, the Company may not pay dividends on or repurchase, redeem, or otherwise acquire for consideration shares of its

common stock unless dividends for the Series E Preferred Stock have been declared for that period, and sufficient funds have

been set aside to make payment. The Series E Preferred Stock is redeemable, at the option of the Company, on any dividend

payment date occurring on or after March 15, 2018, at a redemption price equal to $100,000 per share, plus any declared and

unpaid dividends, without regard to any undeclared dividends. Except in certain limited circumstances, the Series E Preferred

Stock does not have any voting rights.

The Company repurchased its Series C and D Cumulative Perpetual Preferred Stock from the U.S. Treasury in March 2011.

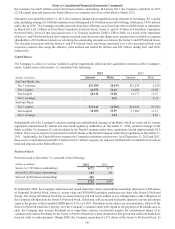

In September 2011, the U.S. Treasury sold, in a public auction, a total of 17.9 million of the Company's warrants to purchase

11.9 million shares of SunTrust common stock at an exercise price of $44.15 per share (Series B warrants) and 6 million shares

of SunTrust common stock at an exercise price of $33.70 per share (Series A warrants). The warrants were issued by SunTrust

to the U.S. Treasury in connection with its investment in SunTrust Banks, Inc. under the CPP and have expiration dates of

November 2018 (Series B) and December 2018 (Series A). In conjunction with the U.S. Treasury's auction, the Company

acquired 4 million of the Series A warrants for $11 million and retired them.

Common and Preferred Dividends

The Company remains subject to certain restrictions on its ability to increase the dividend on common shares as a result of

participating in the U.S. Treasury’s CPP. If the Company increases its dividend above $0.54 per share per quarter prior to the

tenth anniversary of its participation in the CPP, then the anti-dilution provision within the warrants issued in connection with

the Company’s participation in the CPP will require the exercise price and number of shares to be issued upon exercise to be

proportionately adjusted. The amount of such adjustment is determined by a formula and depends in part on the extent to

which the Company raises its dividend. The formulas are contained in the warrant agreements which were filed as exhibits

to Form 8-K as filed on September 23, 2011.

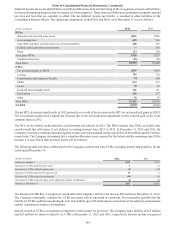

During the years ended December 31, 2012, 2011, and 2010, SunTrust paid cash dividends on perpetual preferred stock totaling

$12 million, $67 million, and $239 million, respectively. In 2012, the dividend per share for Series A and Series B perpetual

preferred stock was $4,067 and $4,027, respectively. SunTrust also declared and paid common dividends totaling $107 million,

or $0.20 per common share, $64 million, or $0.12 per common share, and $20 million, or $0.04 per common share, during

the years ended December 31, 2012, 2011, and 2010, respectively.