SunTrust 2012 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

178

are other, more significant, variables that drive changes in the fair values of the loans, including interest rates and

general conditions in the principal markets for the loans.

Corporate and other LHFS

As discussed in Note 10, “Certain Transfers of Financial Assets and Variable Interest Entities,” the Company has

determined that it is the primary beneficiary of a CLO vehicle, which resulted in the Company consolidating the

loans of that vehicle. Because the CLO trades its loans from time to time and to fairly present the economics of the

CLO, the Company elected to carry the loans of the CLO at fair value. For the years ended December 31, 2012, 2011,

and 2010, the Company recognized in the Consolidated Statements of Income gains of $10 million, losses of $4

million, and gains of $21 million, respectively, due to changes in fair value attributable to borrower-specific credit

risk. The Company obtains fair value estimates for substantially all of these loans using a third party valuation service

that is broadly used by market participants. While most of the loans are traded in the markets, the Company does not

believe the loans qualify as level 1 instruments, as the volume and level of trading activity is subject to variability

and the loans are not exchange-traded, such that the Company believes that level 2 is more representative of the

general market activity for the loans.

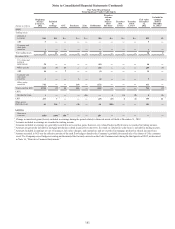

LHFI

Level 3 LHFI predominantly includes mortgage loans that are deemed not marketable, largely due to borrower defaults

or the identification of other loan defects. The Company values these loans using a discounted cash flow approach

based on assumptions that are generally not observable in the current markets, such as prepayment speeds, default

rates, loss severity rates, and discount rates. These assumptions have an inverse relationship to the overall fair value.

Level 3 LHFI also includes mortgage loans that are valued using collateral based pricing. Changes in the applicable

housing price index since the time of the loan origination are considered and applied to the loan's collateral value.

An additional discount representing the return that a buyer would require is also considered in the overall fair value.

Other Intangible Assets

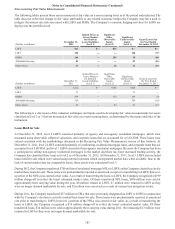

Other intangible assets that the Company records at fair value are the Company’s MSR assets. The fair values of MSRs are

determined by projecting cash flows, which are then discounted to estimate an expected fair value. The fair values of MSRs

are impacted by a variety of factors, including prepayment assumptions, discount rates, delinquency rates, contractually

specified servicing fees, servicing costs, and underlying portfolio characteristics. For additional information, see Note 9,

"Goodwill and Other Intangible Assets." The underlying assumptions and estimated values are corroborated by values received

from independent third parties based on their review of the servicing portfolio. Because these inputs are not transparent in

market trades, MSRs are considered to be level 3 assets.

Other Assets/Liabilities, net

The Company’s other assets/liabilities that are carried at fair value on a recurring basis include IRLCs that satisfy the criteria

to be treated as derivative financial instruments, derivative financial instruments that are used by the Company to economically

hedge certain loans and MSRs, and the derivative that the Company obtained as a result of its sale of Visa Class B shares.

The fair value of IRLCs on residential LHFS, while based on interest rates observable in the market, is highly dependent on

the ultimate closing of the loans. These “pull-through” rates are based on the Company’s historical data and reflect the

Company’s best estimate of the likelihood that a commitment will ultimately result in a closed loan. As pull-through rates

increase, the fair value of IRLCs also increases. Servicing value is included in the fair value of IRLCs, and the fair value of

servicing is determined by projecting cash flows which are then discounted to estimate an expected fair value. The fair value

of servicing is impacted by a variety of factors, including prepayment assumptions, discount rates, delinquency rates,

contractually specified servicing fees, servicing costs, and underlying portfolio characteristics. Because these inputs are not

transparent in market trades, IRLCs are considered to be level 3 assets.

During the years ended December 31, 2012 and 2011, the Company transferred $882 million and $271 million, respectively,

of IRLCs out of level 3 as the associated loans were closed.

The Company is exposed to interest rate risk associated with MSRs, IRLCs, residential LHFS, and residential LHFI reported

at fair value. The Company may hedge these exposures with a combination of derivatives, including MBS forward and option

contracts, interest rate swap and swaption contracts, futures contracts, and eurodollar options. The Company estimates the

fair values of such derivative instruments consistent with the methodologies discussed herein under “Derivative contracts”

and accordingly these derivatives are considered to be level 2 instruments.

During the second quarter of 2009, in connection with its sale of Visa Class B shares, the Company entered into a derivative

contract whereby the ultimate cash payments received or paid, if any, under the contract are based on the ultimate resolution