SunTrust 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

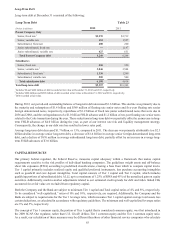

In 2011, we initiated and completed certain elements of our January 2011 capital plan, including issuing $1.0 billion of common

stock and $1.0 billion of senior debt. We then used the proceeds from those offerings, as well as other available funds, to

repurchase $3.5 billion of Fixed Rate Cumulative Preferred Stock, Series C, and $1.4 billion of Fixed Rate Cumulative

Preferred Stock, Series D, that we had issued to the U.S. Treasury under the TARP’s CPP in 2008. As a result of the repurchase

of Series C and D Preferred Stock, we incurred a one-time non-cash charge to net income/(loss) available to common

shareholders of $74 million related to accelerating the outstanding discount accretion on the Series C and D Preferred Stock.

In 2011, the U.S. Treasury sold, in a public auction, warrants to purchase 11.9 million shares of SunTrust common stock at

an exercise price of $44.15 per share ("Series B" warrants) and 6 million shares of SunTrust common stock at an exercise

price of $33.70 per share ("Series A" warrants). We had issued the warrants to the U.S. Treasury in connection with its

investment under the CPP. The warrants have expiration dates of November 2018 (Series B) and December 2018 (Series A).

In conjunction with the auction, we reacquired and retired 4 million of the Series A warrants for $11 million.

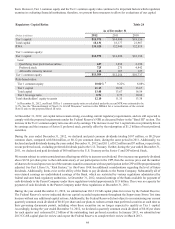

The composition of our capital elements is likely to be impacted by the Dodd-Frank Act in at least two ways over the next

several years. First, the Dodd-Frank Act authorizes the Federal Reserve to enact “prudential” capital requirements which

may require greater capital levels than presently required and which may vary among financial institutions based on size, risk,

complexity, and other factors. As we expected, the Federal Reserve used this authority in its 2012 NPR seeking to implement

the Basel III capital requirements, although this authority is not limited to the Basel III requirements. Second, a portion of

the Dodd-Frank Act (sometimes referred to as the Collins Amendment) directs the Federal Reserve to adopt new capital

requirements for certain bank holding companies, including us, which are at least as stringent as those applicable to insured

depositary institutions, such as SunTrust Bank. We expect that the Federal Reserve will apply these to us over a 3-year period

beginning January 1, 2013, and that, as a result, as of January 1, 2016, approximately $627 million in principal amount of

Parent Company trust preferred and other hybrid capital securities currently outstanding will no longer qualify for Tier 1

capital treatment at that time. We will consider changes to our capital structure as these new regulations are published and

become applicable to us.

Preferred Stock Issuance

In 2011, we issued 1,025 shares of Perpetual Preferred Stock, Series B, no par value and $100,000 liquidation preference per

share (the Series B Preferred Stock). The Series B Preferred Stock has no stated maturity and will not be subject to any sinking

fund or other obligation of SunTrust. Dividends on the Series B Preferred Stock, if declared, will accrue and be payable

quarterly at a rate per annum equal to the greater of three-month LIBOR plus 0.65%, or 4.00%. Dividends on the shares are

noncumulative. Shares of the Series B Preferred Stock have priority over our common stock with regard to the payment of

dividends. As such, we may not pay dividends on or repurchase, redeem, or otherwise acquire for consideration shares of our

common stock unless dividends for the Series B Preferred Stock have been declared for that period, and sufficient funds have

been set aside to make payment. The Series B Preferred Stock was immediately redeemable upon issuance at our option at a

redemption price equal to $100,000 per share, plus any declared and unpaid dividends. Except in certain limited circumstances,

the Series B Preferred Stock does not have any voting rights.

In December 2012, we issued 4,500 shares of Perpetual Preferred Stock, Series E, no par value and $100,000 liquidation

preference per share (the Series E Preferred Stock). The Series E Preferred Stock has no stated maturity and will not be subject

to any sinking fund or other obligation of SunTrust to redeem, repurchase or retire the shares. Dividends on the shares are

noncumulative and, if declared, will accrue and be payable quarterly at a rate per annum of 5.875%. Shares of the Series E

Preferred Stock have priority over our common stock with regard to the payment of dividends and will rank equally with our

outstanding Perpetual Preferred Stock, Series A and Series B. As such, we may not pay dividends on or repurchase, redeem,

or otherwise acquire for consideration shares of our common stock unless dividends for the Series E Preferred Stock have

been declared for that period, and sufficient funds have been set aside to make payment. The Series E Preferred Stock is

redeemable, at the our option, on any dividend payment date occurring on or after March 15, 2018, at a redemption price

equal to $100,000 per share, plus any declared and unpaid dividends, without regard to any undeclared dividends. Except in

certain limited circumstances, the Series E Preferred Stock does not have any voting rights.

See Note 13, "Capital" to the Consolidated Financial Statements in this Form 10-K for additional information on our preferred

stock.

Basel III

In 2010, the BCBS announced new regulatory capital requirements (commonly referred to as “Basel III”) aimed at substantially

strengthening existing capital requirements, through a combination of higher minimum capital requirements, new capital

conservation buffers, and more stringent definitions of capital and exposure. Basel III would impose a new "Common Equity

Tier 1" requirement of up to 7%, comprised of a minimum of 4.5% plus a capital conservation buffer of up to 2.5%. The