SunTrust 2012 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

141

the Company has $627 million in trust preferred securities outstanding. In January 2013, the Company submitted its 2013

CCAR capital plan and expects the Federal Reserve to complete its review of the plan by March 2013.

During the year ended December 31, 2011, the Company initiated and completed certain elements of its January 2011 capital

plan, including issuing a $1.0 billion common stock offering and a $1.0 billion senior debt offering, which pays 3.60% interest

and is due in 2016. The Company used the proceeds from these offerings, as well as from other available funds to repurchase

in March 2011, $3.5 billion of Fixed Rate Cumulative Preferred Stock, Series C, and $1.4 billion of Fixed Rate Cumulative

Preferred Stock, Series D, that was issued to the U.S. Treasury under the TARP’s CPP in 2008. As a result of the repurchase

of Series C and D Preferred Stock, the Company incurred a one-time non-cash charge to net income/(loss) available to common

shareholders of $74 million related to accelerating the outstanding discount accretion on the Series C and D Preferred Stock.

The discount associated with the Series C and D Preferred Stock was being amortized over a five-year period from each

respective issuance date using the effective yield method and totaled $6 million and $25 million during 2011 and 2010,

respectively.

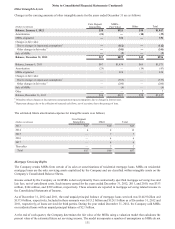

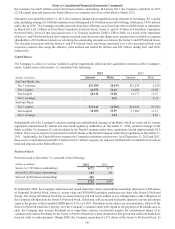

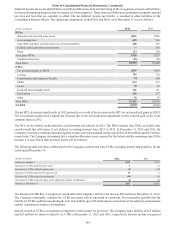

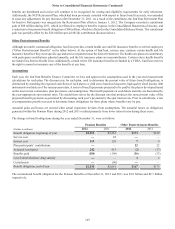

Capital Ratios

The Company is subject to various regulatory capital requirements which involve quantitative measures of the Company’s

assets. Capital ratios at December 31, consisted of the following:

2012 2011

(Dollars in millions) Amount Ratio Amount Ratio

SunTrust Banks, Inc.

Tier 1 common $13,509 10.04% $12,254 9.22%

Tier 1 capital 14,975 11.13 14,490 10.90

Total capital 18,131 13.48 18,177 13.67

Tier 1 leverage 8.91 8.75

SunTrust Bank

Tier 1 capital $15,121 11.38% $14,026 10.70%

Total capital 18,056 13.59 17,209 13.13

Tier 1 leverage 9.23 8.69

Substantially all of the Company’s retained earnings are undistributed earnings of the Bank, which are restricted by various

regulations administered by federal and state bank regulatory authorities. At December 31, 2012, retained earnings of the

Bank available for payment of cash dividends to the Parent Company under these regulations totaled approximately $1.8

billion. There was no capacity for payment of cash dividends to the Parent Company under these regulations at December 31,

2011. Additionally, the Federal Reserve requires the Company to maintain cash reserves. As of December 31, 2012 and 2011,

these reserve requirements totaled $1.9 billion and $1.7 billion, respectively and were fulfilled with a combination of cash on

hand and deposits at the Federal Reserve.

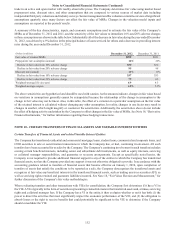

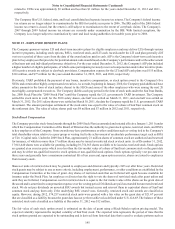

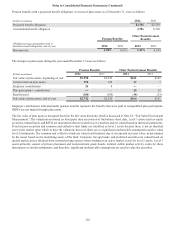

Preferred Stock

Preferred stock at December 31, consisted of the following:

(Dollars in millions) 2012 2011

Series A (1,725 shares outstanding) $172 $172

Series B (1,025 shares outstanding) 103 103

Series E (4,500 shares outstanding) 450 —

$725 $275

In September 2006, the Company authorized and issued depositary shares representing ownership interests in 5,000 shares

of Perpetual Preferred Stock, Series A, no par value and $100,000 liquidation preference per share (the Series A Preferred

Stock). The Series A Preferred Stock has no stated maturity and will not be subject to any sinking fund or other obligation of

the Company. Dividends on the Series A Preferred Stock, if declared, will accrue and be payable quarterly at a rate per annum

equal to the greater of three-month LIBOR plus 0.53%, or 4.00%. Dividends on the shares are noncumulative. Shares of the

Series A Preferred Stock have priority over the Company’s common stock with regard to the payment of dividends and, as

such, the Company may not pay dividends on or repurchase, redeem, or otherwise acquire for consideration shares of its

common stock unless dividends for the Series A Preferred Stock have been declared for that period and sufficient funds have

been set aside to make payment. During 2009, the Company repurchased 3,275 shares of the Series A Preferred Stock. In