SunTrust 2012 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

190

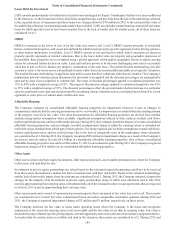

required foreclosure file review. However, on January 7, 2013, the Company, as well as nine other mortgage servicers, entered

into an agreement with the OCC and the Federal Reserve to end the independent foreclosure review process and accelerate

remediation of loans included in the review. Pursuant to the agreement, the Company will make a cash payment of $63 million

(which has been accrued in the Company's financial results) to fund lump-sum payments to borrowers who faced a foreclosure

action on their primary residence between January 1, 2009 and December 31, 2010, and commit $100 million to affect loss

mitigation or other foreclosure prevention actions. Lump-sum payments to borrowers will be administered by an independent

agent approved by the Federal Reserve. The amount of payment to a borrower will be determined pursuant to a Financial

Remediation Framework jointly established by the OCC and the Federal Reserve based on circumstances surrounding the

foreclosure activity. OCC and Federal Reserve Financial Remediation Framework guidance released in June 2012 provides

that lump-sum payments can range from $500 to, in the most egregious cases, $125,000 plus an amount equal to the equity

in the home. As a result of the agreement, the Company will no longer be required to incur the consulting and legal costs of

the independent third parties providing file review, borrower outreach, and legal services associated with the Consent Order

foreclosure file review. Redacted versions of the action plans and the Company's engagement letter with the independent

foreclosure consultant are available on the Federal Reserve's website. The full text of the Consent Order is available on the

Federal Reserve's website and was filed as Exhibit 10.25 to the Company's Annual Report on Form 10-K for the year ended

December 31, 2011. As a result of the Federal Reserve's review of the Company's residential mortgage loan servicing and

foreclosure processing practices that preceded the Consent Order, the Federal Reserve announced that it would impose a civil

money penalty. At this time, no such penalty has been imposed, and the amount and terms of such a potential penalty have

not been finally determined. The Company's accrual for expected costs related to a potential settlement with the U.S. and the

States Attorneys General regarding certain mortgage servicing claims (which is discussed below at "United States and States

Attorneys General Mortgage Servicing Claims") includes the expected incremental costs (if any) of a civil money penalty

relating to the Consent Order.

A Financial Guaranty Insurance Company

The Company has reached a settlement with a financial guaranty insurance company relating to second lien mortgage loan

repurchase claims for a securitization that the financial guaranty insurance company guaranteed under an insurance policy.

The Company had previously accrued the full amount of the confidential settlement that was reached.

Putative ERISA Class Actions

Company Stock Class Action

Beginning in July 2008, the Company and certain officers, directors, and employees of the Company were named in a putative

class action alleging that they breached their fiduciary duties under ERISA by offering the Company's common stock as an

investment option in the SunTrust Banks, Inc. 401(k) Plan (the “Plan”). The plaintiffs purport to represent all current and

former Plan participants who held the Company stock in their Plan accounts from May 2007 to the present and seek to recover

alleged losses these participants supposedly incurred as a result of their investment in Company stock.

The Company Stock Class Action was originally filed in the U.S. District Court for the Southern District of Florida, but was

transferred to the U.S. District Court for the Northern District of Georgia, Atlanta Division, (the “District Court”) in November

2008.

On October 26, 2009, an amended complaint was filed. On December 9, 2009, defendants filed a motion to dismiss the

amended complaint. On October 25, 2010, the District Court granted in part and denied in part defendants' motion to dismiss

the amended complaint. Defendants and plaintiffs filed separate motions for the District Court to certify its October 25, 2010

order for immediate interlocutory appeal. On January 3, 2011, the District Court granted both motions.

On January 13, 2011, defendants and plaintiffs filed separate petitions seeking permission to pursue interlocutory appeals with

the U.S. Court of Appeals for the Eleventh Circuit (“the Circuit Court”). On April 14, 2011, the Circuit Court granted defendants

and plaintiffs permission to pursue interlocutory review in separate appeals. The Circuit Court subsequently stayed these

appeals pending decision of a separate appeal involving The Home Depot in which substantially similar issues are presented.

On May 8, 2012, the Circuit Court decided this appeal in favor of The Home Depot. We await further direction from the

Circuit Court.

Mutual Funds Class Action

On March 11, 2011, the Company and certain officers, directors, and employees of the Company were named in a putative

class action alleging that they breached their fiduciary duties under ERISA by offering certain STI Classic Mutual Funds as

investment options in the Plan. The plaintiff purports to represent all current and former Plan participants who held the STI

Classic Mutual Funds in their Plan accounts from April 2002 through December 2010 and seeks to recover alleged losses

these Plan participants supposedly incurred as a result of their investment in the STI Classic Mutual Funds. This action was

pending in the U.S. District Court for the Northern District of Georgia, Atlanta Division (the “District Court”). On June 6,

2011, plaintiff filed an amended complaint, and, on June 20, 2011, defendants filed a motion to dismiss the amended complaint.