SunTrust 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

173

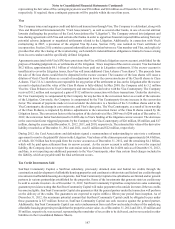

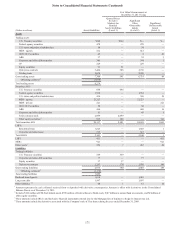

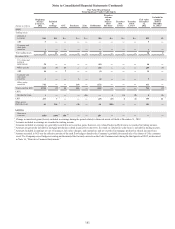

The following tables present the change in fair value during the years ended December 31, 2012, 2011, and 2010, of financial

instruments for which the FVO has been elected, as well as MSRs. The tables do not reflect the change in fair value attributable

to the related economic hedges the Company used to mitigate the market-related risks associated with the financial instruments.

Generally, the changes in the fair value of economic hedges are also recognized in trading income, mortgage production related

income/(loss), or mortgage servicing-related income, as appropriate, and are designed to partially offset the change in fair

value of the financial instruments referenced in the tables below. The Company’s economic hedging activities are deployed

at both the instrument and portfolio level.

Fair Value Gain/(Loss) for the Year Ended

December 31, 2012, for Items Measured at Fair Value

Pursuant to Election of the FVO

(Dollars in millions)

Trading

Income

Mortgage

Production

Related

Income/

(Loss) 1

Mortgage

Servicing

Related

Income

Total

Changes in

Fair Values

Included in

Current-

Period

Earnings 2

Assets

Trading loans $8 $— $— $8

LHFS 10 1,043 —1,053

LHFI 120—21

MSRs —31 (353) (322)

Liabilities

Brokered time deposits 5— — 5

Long-term debt (65) — — (65)

1 For the year ended December 31, 2012, income related to LHFS includes $882 million from IRLCs, which includes $304 million related to MSRs recognized

upon the sale of loans reported at fair value. For the year ended December 31, 2012, income related to MSRs includes $31 million of MSRs recognized

upon the sale of loans reported at LOCOM.

2 Changes in fair value for the year ended December 31, 2012, exclude accrued interest for the period then ended. Interest income or interest expense on

trading loans, LHFS, LHFI, brokered time deposits, and long-term debt that have been elected to be carried at fair value are recorded in interest income or

interest expense in the Consolidated Statements of Income.

Fair Value Gain/(Loss) for the Year Ended

December 31, 2011, for Items Measured at Fair Value

Pursuant to Election of the FVO

(Dollars in millions)

Trading

Income

Mortgage

Production

Related

Income/

(Loss) 1

Mortgage

Servicing

Related

Income

Total

Changes in

Fair Values

Included in

Current-

Period

Earnings 2

Assets

Trading loans $21 $— $— $21

LHFS (10) 450 — 440

LHFI 3 11 — 14

MSRs — 7 (733) (726)

Liabilities

Brokered time deposits 32 — — 32

Long-term debt (12) — — (12)

1 For the year ended December 31, 2011, income related to LHFS includes $271 million from IRLCs, which includes $217 million related to MSRs recognized

upon the sale of loans reported at fair value. For the year ended December 31, 2011, income related to MSRs includes $7 million of MSRs recognized upon

the sale of loans reported at LOCOM.

2 Changes in fair value for the year ended December 31, 2011, exclude accrued interest for the period then ended. Interest income or interest expense on

trading loans, LHFS, LHFI, brokered time deposits, and long-term debt that have been elected to be carried at fair value are recorded in interest income or

interest expense in the Consolidated Statements of Income.