SunTrust 2012 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

147

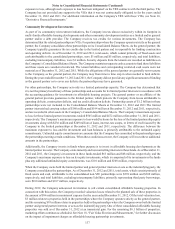

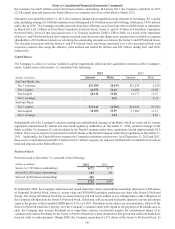

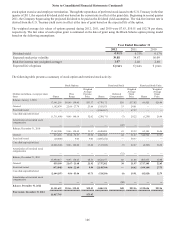

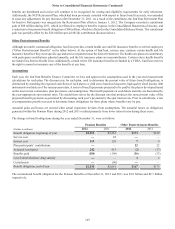

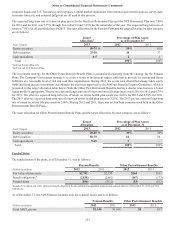

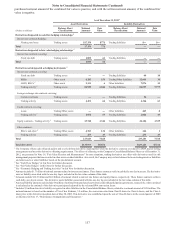

The following table presents information on stock options by range of exercise prices at December 31, 2012:

(Dollars in millions, except per share data)

Options Outstanding Options Exercisable

Range of Exercise

Prices

Number

Outstanding

as of

December 31, 2012

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Aggregate

Intrinsic

Value

Number

Exercisable

as of

December 31, 2012

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Aggregate

Intrinsic

Value

$9.06 to 49.46 5,065,080 $20.30 6.39 $49 2,771,191 $16.66 5.05 $39

$49.47 to 64.57 1,893,710 54.67 0.38 — 1,893,710 54.67 0.38 —

$64.58 to 150.45 6,352,862 72.60 2.28 — 6,352,862 72.60 2.28 —

13,311,652 $50.15 3.57 $49 11,017,763 $55.45 2.65 $39

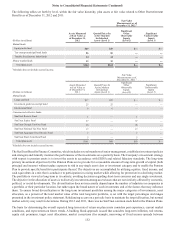

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the Company’s

closing stock price on the last trading day of 2012 and the exercise price, multiplied by the number of in-the-money stock options)

that would have been received by the option holders had all option holders exercised their options on December 31, 2012. This

amount changes based on the fair market value of the Company’ s stock. Total intrinsic value of options exercised for the year

ended December 31, 2012 was $15 million and less than $1 million for the years ended December 31, 2011 and 2010. Total fair

value, measured as of the grant date, of restricted shares vested was $31 million, $55 million, and $85 million, for the years ended

December 31, 2012, 2011, and 2010, respectively.

As of December 31, 2012 and 2011, there was $67 million and $63 million, respectively, of unrecognized stock-based compensation

expense related to nonvested stock options, restricted stock, and RSUs. The unrecognized stock compensation expense as of

December 31, 2012 is expected to be recognized over a weighted average period of 2.17 years.

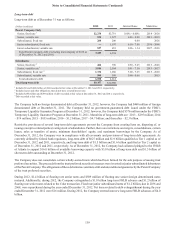

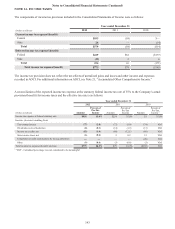

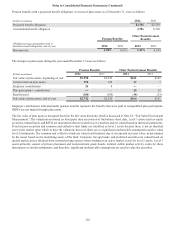

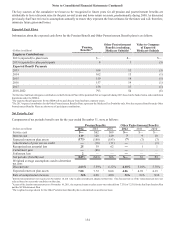

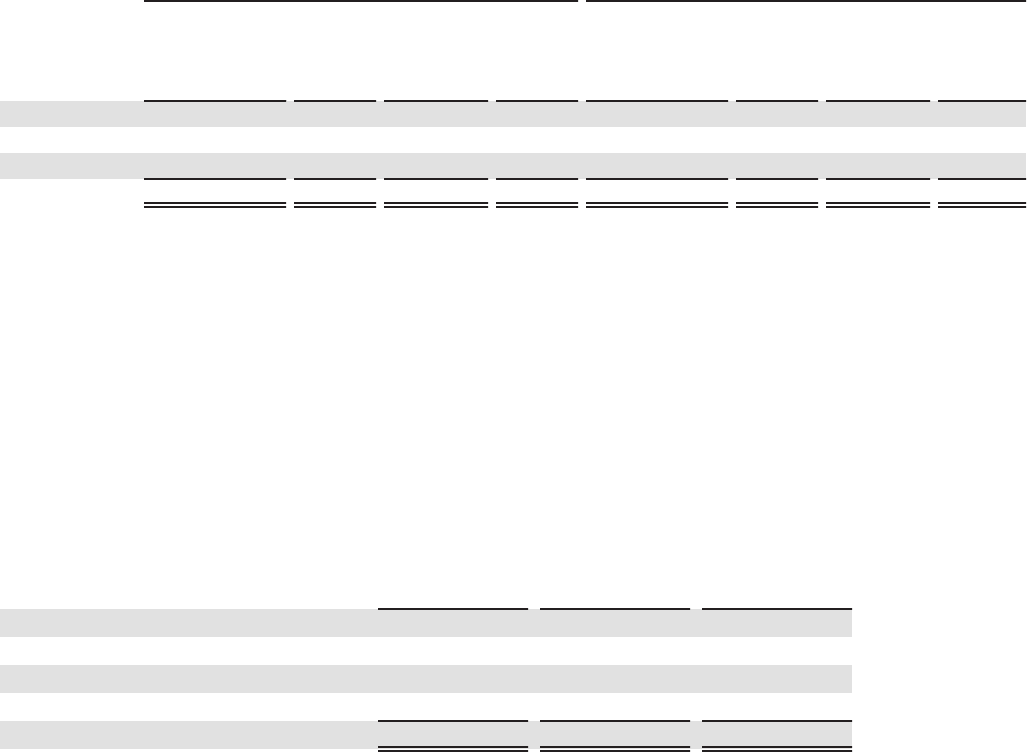

Stock-based compensation expense recognized in noninterest expense for the year ended December 31, was as follows:

(Dollars in millions) 2012 2011 2010

Stock-based compensation expense:

Stock options $11 $15 $14

Restricted stock 30 32 42

RSUs 27 10 —

Total stock-based compensation expense $68 $57 $56

The recognized stock-based compensation tax benefit was $26 million, $22 million, and $21 million for the years ended December

31, 2012, 2011, and 2010, respectively.

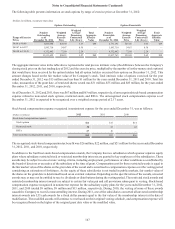

In addition to the SunTrust stock-based compensation awards, the Company has two subsidiaries which sponsor separate equity

plans where subsidiary restricted stock or restricted membership interests are granted to key employees of the subsidiaries. These

awards may be subject to one or more vesting criteria, including employment, performance or other conditions as established by

the board of directors or executive of the subsidiary at the time of grant. Compensation cost for these restricted awards is equal to

the fair market value of the shares on the grant date of the award and is amortized to compensation expense over the vesting period

considering an estimation of forfeitures. As the equity of these subsidiaries is not traded in public markets, fair market value of

the shares on the grant date is determined based on an external valuation. Depending on the specific terms of the awards, unvested

awards may or may not be entitled to receive dividends or distributions during the vesting period. The restricted stock awards and

restricted membership interest awards are subject to certain fair value put and call provisions subsequent to vesting. Stock-based

compensation expense recognized in noninterest expense for the subsidiary equity plans for the years ended December 31, 2012,

2011, and 2010 totaled $8 million, $8 million and $13 million, respectively. During 2010, the vesting of some of these awards

caused the Company to record a noncontrolling interest. During 2011, one of the subsidiaries converted all unvested membership

interest awards into LTI cash awards for a fixed dollar amount equal to the fair value of the membership interest at the date of

modification. The modified awards will continue to vest based on their original vesting schedule, and compensation expense will

be recognized based on the higher of the original grant date value or the modified value.