SunTrust 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

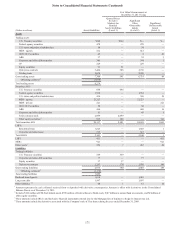

Notes to Consolidated Financial Statements (Continued)

161

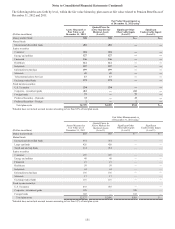

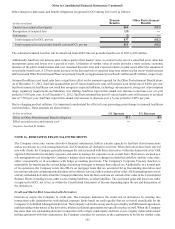

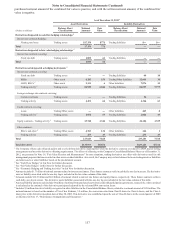

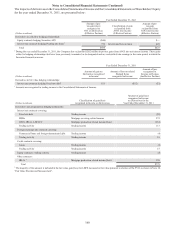

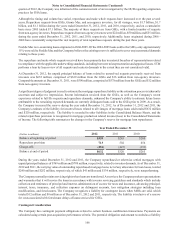

The impacts of derivatives on the Consolidated Statements of Income and the Consolidated Statements of Shareholders’ Equity

for the year ended December 31, 2010, are presented below:

Year Ended December 31, 2010

(Dollars in millions)

Amount of pre-

tax gain/(loss)

recognized in

OCI on Derivatives

(Effective Portion)

Classification of gain

reclassified from

AOCI into Income

(Effective Portion)

Amount of pre-

tax gain

reclassified from

AOCI into Income

(Effective Portion)

Derivatives in cash flow hedging relationships:

Equity contracts hedging Securities AFS ($101) $—

Interest rate contracts hedging Floating rate loans1903 Interest and fees on loans 487

Total $802 $487

1 During the year ended December 31, 2010, the Company also reclassified $130 million in pre-tax gains from AOCI into net interest income. These gains

related to hedging relationships that have been previously terminated or de-designated and are reclassified into earnings in the same period in which the

forecasted transaction occurs.

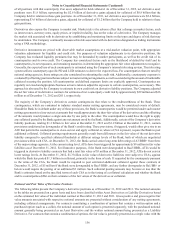

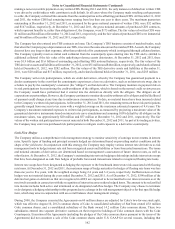

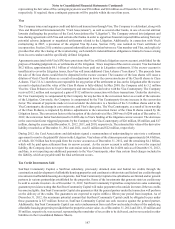

(Dollars in millions)

Classification of gain/(loss)

recognized in Income on Derivatives

Amount of gain/(loss)

recognized in Income

on Derivatives for the

Year Ended December 31, 2010

Derivatives not designated as hedging instruments:

Interest rate contracts covering:

Fixed rate debt Trading income ($64)

Corporate bonds and loans Trading income (1)

MSRs Mortgage servicing related income 444

LHFS, IRLCs, LHFI-FV Mortgage production related income/(loss) (176)

Trading activity Trading income 304

Foreign exchange rate contracts covering:

Foreign-denominated debt and commercial loans Trading income (94)

Trading activity Trading income 7

Credit contracts covering:

Loans Trading income (2)

Trading activity Trading income 10

Equity contracts - trading activity Trading income (53)

Other contracts:

IRLCs 1Mortgage production related income/(loss) 392

Total $767

1 Amount is included in the fair value gain/(loss) for LHFS measured at fair value pursuant to election of the FVO, as shown in Note 18, "Fair Value Election

and Measurement".

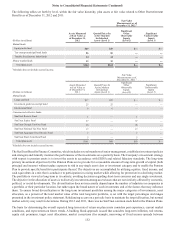

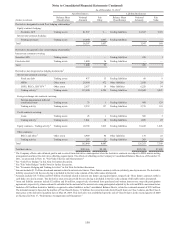

Credit Derivatives

As part of its trading businesses, the Company enters into contracts that are, in form or substance, written guarantees:

specifically, CDS, swap participations, and TRS. The Company accounts for these contracts as derivatives and, accordingly,

recognizes these contracts at fair value, with changes in fair value recognized in trading income in the Consolidated Statements

of Income.

The Company writes CDS, which are agreements under which the Company receives premium payments from its counterparty

for protection against an event of default of a reference asset. In the event of default under the CDS, the Company would

either net cash settle or make a cash payment to its counterparty and take delivery of the defaulted reference asset, from which

the Company may recover all, a portion, or none of the credit loss, depending on the performance of the reference asset. Events

of default, as defined in the CDS agreements, are generally triggered upon the failure to pay and similar events related to the

issuer(s) of the reference asset. As of December 31, 2012 and 2011, all written CDS contracts reference single name corporate

credits or corporate credit indices. When the Company has written CDS, it has generally entered into offsetting CDS for the

underlying reference asset, under which the Company paid a premium to its counterparty for protection against an event of

default on the reference asset. The counterparties to these purchased CDS are generally of high creditworthiness and typically

have ISDA master netting agreements in place that subject the CDS to master netting provisions, thereby mitigating the risk

of non-payment to the Company. As such, at December 31, 2012 and 2011, the Company did not have any significant risk of