SunTrust 2012 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

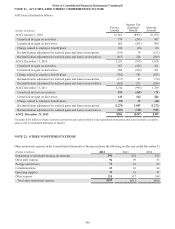

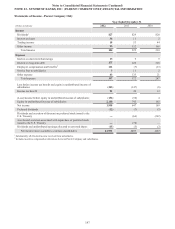

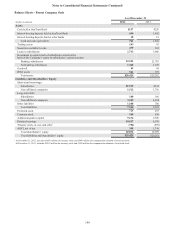

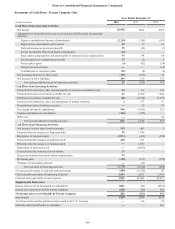

Notes to Consolidated Financial Statements (Continued)

192

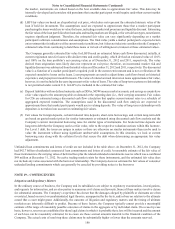

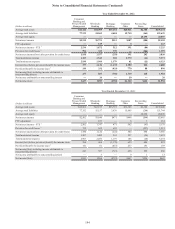

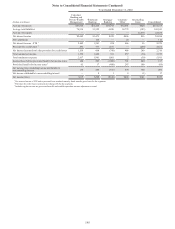

NOTE 20 - BUSINESS SEGMENT REPORTING

The Company has three segments used to measure business activity: Consumer Banking and Private Wealth Management,

Wholesale Banking, and Mortgage Banking, with the remainder in Corporate Other. The business segments are determined

based on the products and services provided or the type of customer served, and they reflect the manner in which financial

information is evaluated by management. The segment structure was revised during the first quarter of 2012 from the six

segments the Company utilized during 2011. The revised segment structure was in conjunction with organizational changes

made throughout the Company that were announced during the fourth quarter of 2011 and implemented in the first quarter of

2012. The following is a description of the new segments and their composition.

The Consumer Banking and Private Wealth Management segment is made up of two primary businesses: Consumer Banking

and Private Wealth Management.

• Consumer Banking provides services to consumers through an extensive network of traditional and in-store branches,

ATMs, the internet (www.suntrust.com), and telephone (1-800-SUNTRUST). Financial products and services offered

to consumers include consumer deposits, home equity lines, consumer lines, indirect auto, student lending, bank

card, and other consumer loan and fee-based products. Consumer Banking also serves as an entry point for clients

and provides services for other lines of business.

• Private Wealth Management provides a full array of wealth management products and professional services to both

individual and institutional clients including brokerage, professional investment management, and trust services to

clients seeking active management of their financial resources. Private Wealth Management's primary businesses

include Private Banking, STIS, IIS, and GenSpring. Private Banking offers a full array of loan and deposit products

to clients. STIS offers discount/online and full service brokerage services to individual clients. IIS includes Employee

Benefit Solutions, Foundations & Endowments Specialty Group, and Escrow Services. GenSpring provides family

office solutions to ultra high net worth individuals and their families. Utilizing teams of multi-disciplinary specialists

with expertise in investments, tax, accounting, estate planning and other wealth management disciplines, GenSpring

helps families manage and sustain their wealth across multiple generations.

The Wholesale Banking segment includes the following five businesses:

• CIB offers a wide array of traditional banking products (lending and treasury management services) and investment

banking services. CIB serves clients in the larger corporate and commercial middle markets. The Investment Banking

Group generally serves clients with greater than $750 million in annual revenues and is focused on selected industry

sectors: consumer and retail, energy, financial services and technology, healthcare, and media and communications.

The Corporate Banking Group generally serves clients with annual revenue ranging from $100 million to $750

million. Comprehensive investment banking products and services are provided by STRH to clients in both Wholesale

Banking and Private Wealth Management, including strategic advice, raising capital, and financial risk management.

• Commercial & Business Banking (formerly named Diversified Commercial Banking) offers an array of traditional

banking products and investment banking services as needed for the Company's small business clients, commercial

clients, dealer services (financing dealer floor plan inventories), and not-for-profit and government entities.

• Commercial Real Estate provides financial solutions for commercial real estate developers and investors, including

construction, mini-perm, and permanent real estate financing, as well as tailored financing and equity investment

solutions for community development and affordable housing projects delivered through SunTrust Community

Capital. Equipment lease financing solutions (through SunTrust Equipment Finance & Leasing) as well as corporate

insurance premium financing (through Premium Assignment Corporation) are also managed within this business.

• RidgeWorth, an SEC registered investment advisor, serves as investment manager for the RidgeWorth Funds as well

as individual clients. RidgeWorth is also a holding company with ownership in other institutional asset management

boutiques offering a wide array of equity and fixed income capabilities. These boutiques include Ceredex Value

Advisors, Certium Asset Management, Seix Investment Advisors, Silvant Capital Management, StableRiver Capital

Management, and Zevenbergen Capital Investments.

• Treasury & Payment Solutions provides all SunTrust business clients with services required to manage their payments

and receipts combined with the ability to manage and optimize their deposits across all aspects of their business.

Treasury & Payment Solutions operates all electronic and paper payment types, including card, wire transfer, ACH,

check, and cash, plus provides clients the means to manage their accounts electronically online both domestically

and internationally.