SunTrust 2012 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

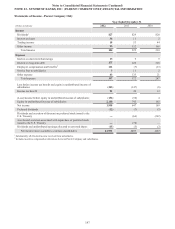

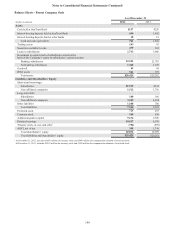

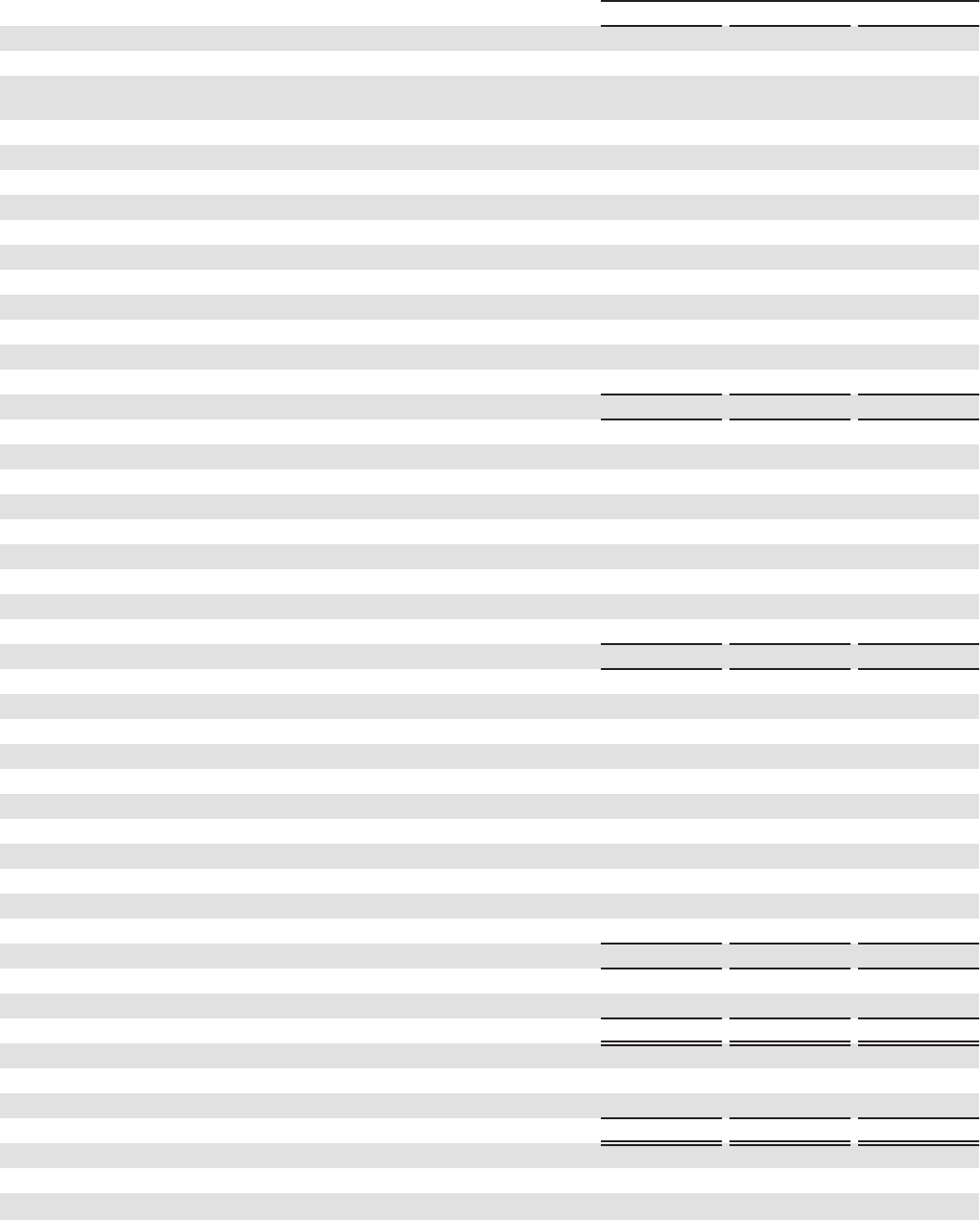

Notes to Consolidated Financial Statements (Continued)

199

Statements of Cash Flows - Parent Company Only

Year Ended December 31

(Dollars in millions) 2012 2011 2010

Cash Flows from Operating Activities:

Net income $1,958 $647 $189

Adjustments to reconcile net income to net cash provided by/(used in) operating

activities:

Equity in undistributed income of subsidiaries (2,110) (745) (185)

Depreciation, amortization and accretion 10 17 15

Deferred income tax provision/(benefit) 18 (56) (7)

Excess tax benefits from stock-based compensation (11) — —

Stock option compensation and amortization of restricted stock compensation 35 44 66

Net loss/(gain) on extinguishment of debt 15 (3) 1

Net securities gains (6) (92) (38)

Net gain on sale of assets —— (18)

Contributions to retirement plans (26) (8) (8)

Net (increase)/decrease in other assets (190) (192) 38

Net increase in other liabilities 369 130 123

Net cash provided by/(used in) operating activities 62 (258) 176

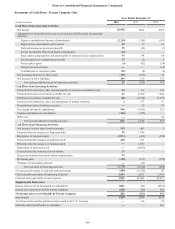

Cash Flows from Investing Activities:

Proceeds from maturities, calls, and repayments of securities available for sale 65 61 164

Proceeds from sales of securities available for sale 47 6,700 7,664

Purchases of securities available for sale (68) (2,374) (7,737)

Proceeds from maturities, calls, and repayments of trading securities 2137 97

Proceeds from sales of trading securities —75 79

Net change in loans to subsidiaries 940 (3,185) 221

Capital contributions to subsidiaries (150) (250) —

Other, net —— 22

Net cash provided by investing activities 836 1,164 510

Cash Flows from Financing Activities:

Net increase in other short-term borrowings 935 463 5

Proceeds from the issuance of long-term debt 15 1,749 —

Repayment of long-term debt (3,073) (482) (350)

Proceeds from the issuance of preferred stock 438 103 —

Proceeds from the issuance of common stock —1,017 —

Repurchase of preferred stock —(4,850) —

Proceeds from the exercise of stock options 15 — —

Excess tax benefits from stock option compensation 11 — —

Dividends paid (119) (131) (259)

Purchase of outstanding warrants —(11) —

Net cash used in financing activities (1,778) (2,142) (604)

Net (decrease)/increase in cash and cash equivalents (880) (1,236) 82

Cash and cash equivalents at beginning of period 1,641 2,877 2,795

Cash and cash equivalents at end of period $761 $1,641 $2,877

Supplemental Disclosures:

Income taxes received from/(paid to) subsidiaries $621 ($2) ($338)

Income taxes (paid)/received by Parent Company (605) (66) 406

Net income taxes received/(paid) by Parent Company $16 ($68) $68

Interest paid $189 $246 $233

Accretion of discount for preferred stock issued to the U.S. Treasury —80 25

Noncash capital contribution to subsidiary —— 997