SunTrust 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

133

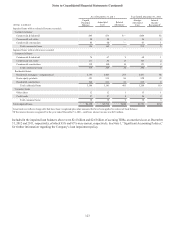

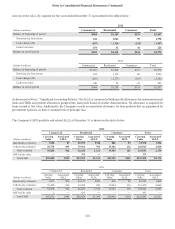

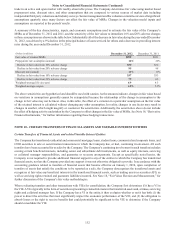

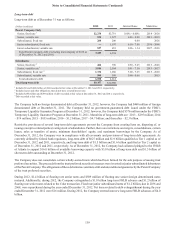

Below is a summary of transfers of financial assets to VIEs for which the Company has retained some level of continuing

involvement.

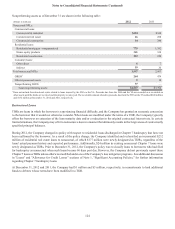

Residential Mortgage Loans

The Company typically transfers first lien residential mortgage loans in conjunction with Ginnie Mae, Fannie Mae,

and Freddie Mac securitization transactions whereby the loans are exchanged for cash or securities that are readily

redeemed for cash proceeds and servicing rights. The Company sold residential mortgage loans to these entities,

which resulted in pre-tax gains of $1.0 billion, $397 million, and $588 million, including servicing rights for the

years ended December 31, 2012, 2011, and 2010, respectively. These gains are included within mortgage production

related income/(loss) in the Consolidated Statements of Income. These gains include the change in value of the loans

as a result of changes in interest rates from the time the related IRLCs were issued to the borrowers but do not include

the results of hedging activities initiated by the Company to mitigate this market risk. See Note 16, “Derivative

Financial Instruments,” for further discussion of the Company’s hedging activities. As seller, the Company has made

certain representations and warranties with respect to the originally transferred loans, including those transferred

under Ginnie Mae, Fannie Mae, and Freddie Mac programs, and those representations and warranties are discussed

in Note 17, “Reinsurance Arrangements and Guarantees.”

In a limited number of securitizations, the Company has received securities representing retained interests in the

transferred loans in addition to cash and servicing rights in exchange for the transferred loans. The received securities

are carried at fair value as either trading assets or securities AFS. As of December 31, 2012 and 2011, the fair value

of securities received totaled $98 million and $104 million, respectively, and were valued using a third party pricing

service.

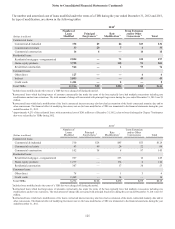

The Company evaluated these securitization transactions for consolidation under the VIE consolidation guidance.

As servicer of the underlying loans, the Company is generally deemed to have power over the securitization. However,

if a single party, such as the issuer or the master servicer, effectively controls the servicing activities or has the

unilateral ability to terminate the Company as servicer without cause, then that party is deemed to have power. In

almost all of its securitization transactions, the Company does not have power over the VIE as a result of these rights

held by the master servicer. In certain transactions, the Company does have power as the servicer; however, the

Company does not also have an obligation to absorb losses or the right to receive benefits that could potentially be

significant to the securitization. The absorption of losses and the receipt of benefits would generally manifest itself

through the retention of senior or subordinated interests. Total assets as of December 31, 2012 and 2011, of the

unconsolidated trusts in which the Company has a VI are $445 million and $529 million, respectively. No events

have occurred during the year ended December 31, 2012, that would change the Company's previous conclusion that

it is not the primary beneficiary of any of these securitization entities.

The Company’s maximum exposure to loss related to the unconsolidated VIEs in which it holds a VI is comprised

of the loss of value of any interests it retains and any repurchase obligations it incurs as a result of a breach of its

representations and warranties. Discussion of the Company's representations and warranties is included in Note 17,

“Reinsurance Arrangements and Guarantees.”

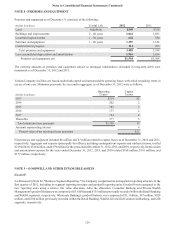

Commercial and Corporate Loans

The Company has involvement with CLO entities that own commercial leveraged loans and bonds, certain of which

were transferred by the Company to the CLOs. In addition to retaining certain securities issued by the CLOs, the

Company also acts as collateral manager for these CLOs. The securities retained by the Company and the fees received

as collateral manager represent a VI in the CLOs, which are considered to be VIEs. The Company has determined

that it is the primary beneficiary of and, thus, has consolidated one of these CLOs as it has both the power to direct

the activities that most significantly impact the entity’ s economic performance and the obligation to absorb losses

and the right to receive benefits from the entity that could potentially be significant to the CLO. The Company's

involvement with the CLO includes receiving fees for its duties as collateral manager, including eligibility for

performance fees as well as ownership in one of the senior interests in the CLO and certain preference shares of the

CLO. Substantially all of the assets and liabilities of the CLO are loans and issued debt, respectively. The loans are

classified within LHFS at fair value and the debt is included within long-term debt at fair value on the Company’s

Consolidated Balance Sheets (see Note 18, “Fair Value Election and Measurement,” for a discussion of the Company’ s

methodologies for estimating the fair values of these financial instruments). At December 31, 2012, the Company’s

Consolidated Balance Sheets reflected $319 million of loans held by the CLO and $286 million of debt issued by

the CLO. At December 31, 2011, the Company’s Consolidated Balance Sheets reflected $315 million of loans held

by the CLO and $289 million of debt issued by the CLO. The Company is not obligated, contractually or otherwise,

to provide financial support to this VIE nor has it previously provided support to this VIE. Further, creditors of the