SunTrust 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

166

quarter of 2012, the Company was informed of the commencement of an investigation by the HUD regarding origination

practices for FHA loans.

Although the timing and volume has varied, repurchase and make whole requests have increased over the past several

years. Repurchase requests from GSEs, Ginnie Mae, and non-agency investors, for all vintages, were $1.7 billion, $1.7

billion, and $1.1 billion during the years ended December 31, 2012, 2011, and 2010, respectively, and on a cumulative

basis since 2005 totaled $7.1 billion. The majority of these requests are from GSEs, with a limited number of requests

from non-agency investors. Repurchase requests from non-agency investors were $22 million, $50 million, and $55 million,

during the years ended December 31, 2012, 2011, and 2010, respectively. Additionally, loans originated during 2006 -

2008 have consistently comprised the vast majority of total repurchase requests during the past three years.

Freddie Mac is re-examining loans originated in 2004-2005. Of the 2004-2005 loans sold to the GSEs, only approximately

15% were sold to Freddie Mac and the Company believes the existing reserve is sufficient to cover any incremental demands

relating to these years.

The repurchase and make whole requests received have been primarily due to material breaches of representations related

to compliance with the applicable underwriting standards, including borrower misrepresentation and appraisal issues. STM

performs a loan by loan review of all requests and contests demands to the extent they are not considered valid.

At December 31, 2012, the unpaid principal balance of loans related to unresolved requests previously received from

investors was $655 million, comprised of $639 million from the GSEs and $16 million from non-agency investors.

Comparable amounts at December 31, 2011, were $590 million, comprised of $578 million from the GSEs and $12 million

from non-agency investors.

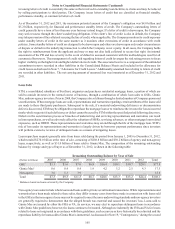

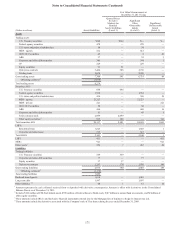

A significant degree of judgment is used to estimate the mortgage repurchase liability as the estimation process is inherently

uncertain and subject to imprecision. Recent information received from the GSEs, as well as the Company's recent

experience related to full file requests and repurchase demands, enhanced the Company's ability to estimate future losses

attributable to the remaining expected demands on currently delinquent loans sold to the GSEs prior to 2009. As a result,

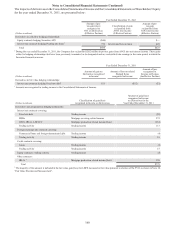

the Company increased the reserve during the year ended December 31, 2012. As of December 31, 2012 and 2011, the

Company's estimate of the liability for incurred losses related to all vintages of mortgage loans sold totaled $632 million

and $320 million, respectively. The liability is recorded in other liabilities in the Consolidated Balance Sheets, and the

related repurchase provision is recognized in mortgage production related income/(loss) in the Consolidated Statements

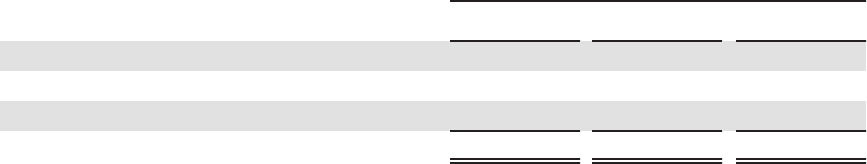

of Income. The following table summarizes the changes in the Company’s reserve for mortgage loan repurchases:

Year Ended December 31

(Dollars in millions) 2012 2011 2010

Balance at beginning of period $320 $265 $200

Repurchase provision 713 502 456

Charge-offs (401)(447)(391)

Balance at end of period $632 $320 $265

During the years ended December 31, 2012 and 2011, the Company repurchased or otherwise settled mortgages with

unpaid principal balances of $769 million and $789 million, respectively, related to investor demands. As of December 31,

2012 and 2011, the carrying value of outstanding repurchased mortgage loans, net of any allowance for loan losses, totaled

$240 million and $252 million, respectively, of which $41 million and $134 million, respectively, were nonperforming.

The Company normally retains servicing rights when loans are transferred. As servicer, the Company makes representations

and warranties that it will service the loans in accordance with investor servicing guidelines and standards which include

collection and remittance of principal and interest, administration of escrow for taxes and insurance, advancing principal,

interest, taxes, insurance, and collection expenses on delinquent accounts, loss mitigation strategies including loan

modifications, and foreclosures. The Company recognizes a liability for contingent losses when MSRs are sold, which

totaled $12 million and $8 million as of December 31, 2012 and 2011, respectively. The liability is inclusive of a reserve

for costs associated with foreclosure delays of loans serviced for GSEs.

Contingent Consideration

The Company has contingent payment obligations related to certain business combination transactions. Payments are

calculated using certain post-acquisition performance criteria. The potential obligation and amount recorded as a liability