SunTrust 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

170

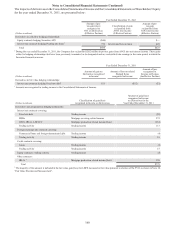

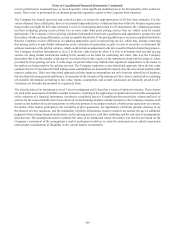

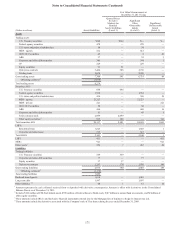

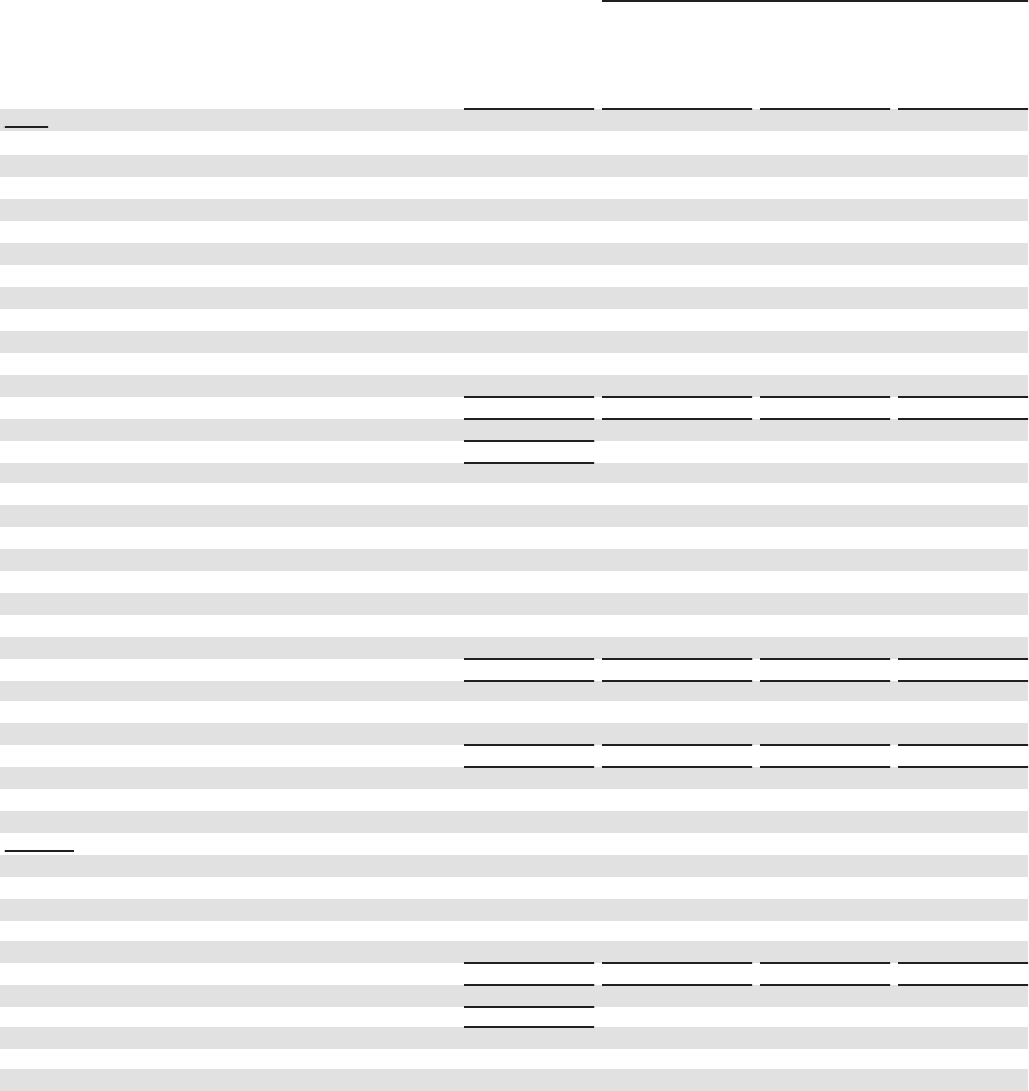

Recurring Fair Value Measurements

The following tables present certain information regarding assets and liabilities measured at fair value on a recurring basis

and the changes in fair value for those specific financial instruments in which fair value has been elected.

Fair Value Measurements at

December 31, 2012 Using

(Dollars in millions) Assets/Liabilities

Quoted Prices In

Active

Markets for

Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets

Trading assets:

U.S. Treasury securities $111 $111 $— $—

Federal agency securities 462 — 462 —

U.S. states and political subdivisions 34 — 34 —

MBS - agency 432 — 432 —

CDO/CLO securities 55 — 3 52

ABS 36 — 31 5

Corporate and other debt securities 567 — 566 1

CP 28 — 28 —

Equity securities 100 100 — —

Derivative contracts 2,635 183 2,452 —

Trading loans 2,319 — 2,319 —

Gross trading assets 6,779 394 6,327 58

Offsetting collateral 1(730)

Total trading assets 6,049

Securities AFS:

U.S. Treasury securities 222 222 — —

Federal agency securities 2,069 — 2,069 —

U.S. states and political subdivisions 320 — 274 46

MBS - agency 18,169 — 18,169 —

MBS - private 209 — — 209

ABS 216 — 195 21

Corporate and other debt securities 46 — 41 5

Other equity securities 2702 69 — 633

Total securities AFS 21,953 291 20,748 914

LHFS:

Residential loans 2,924 — 2,916 8

Corporate and other loans 319 — 319 —

Total LHFS 3,243 — 3,235 8

LHFI 379 — — 379

MSRs 899 — — 899

Other assets 3178 2 44 132

Liabilities

Trading liabilities:

U.S. Treasury securities 582 582 — —

Corporate and other debt securities 173 — 173 —

Equity securities 9 9 — —

Derivative contracts 1,656 — 1,656 —

Gross trading liabilities 2,420 591 1,829 —

Offsetting collateral 1(1,259)

Total trading liabilities 1,161

Brokered time deposits 832 — 832 —

Long-term debt 1,622 — 1,622 —

Other liabilities 3,4 46 — 15 31

1 Amount represents the cash collateral received from or deposited with derivative counterparties. Amount is offset with derivatives in the Consolidated

Balance Sheets as of December 31, 2012.

2 Includes $229 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank stock, $69 million in mutual fund investments, and $2 million of

other equity securities.

3 These amounts include IRLCs and derivative financial instruments entered into by the Mortgage line of business to hedge its interest rate risk.

4 These amounts include the derivative associated with the Company's sale of Visa shares during the year ended December 31, 2009, certain CDS, and

contingent consideration obligations related to acquisitions.