SunTrust 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

Notes to Consolidated Financial Statements (Continued)

129

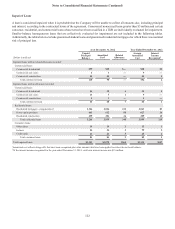

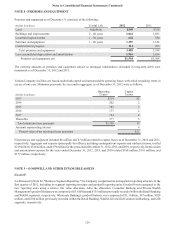

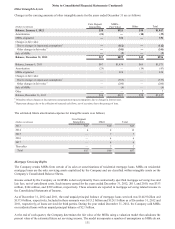

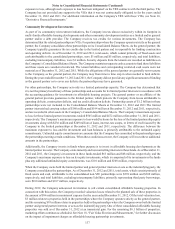

NOTE 8 - PREMISES AND EQUIPMENT

Premises and equipment as of December 31 consisted of the following:

(Dollars in millions) Useful Life 2012 2011

Land Indefinite $349 $358

Buildings and improvements 2 - 40 years 1,041 1,033

Leasehold improvements 1 - 30 years 622 580

Furniture and equipment 1 - 20 years 1,357 1,322

Construction in progress 111 105

Total premises and equipment 3,480 3,398

Less accumulated depreciation and amortization 1,916 1,834

Premises and equipment, net $1,564 $1,564

The carrying amounts of premises and equipment subject to mortgage indebtedness (included in long-term debt) were

immaterial as of December 31, 2012 and 2011.

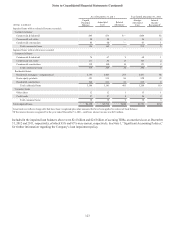

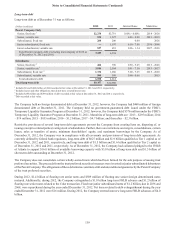

Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in

excess of one year. Minimum payments, by year and in aggregate, as of December 31, 2012 were as follows:

(Dollars in millions)

Operating

Leases

Capital

Leases

2013 $214 $2

2014 202 2

2015 185 2

2016 177 2

2017 154 2

Thereafter 377 5

Total minimum lease payments $1,309 15

Amounts representing interest 4

Present value of net minimum lease payments $11

Net premises and equipment included $6 million and $7 million related to capital leases as of December 31, 2012 and 2011,

respectively. Aggregate rent expense (principally for offices), including contingent rent expense and sublease income, totaled

$219 million, $184 million, and $179 million for the years ended December 31, 2012, 2011, and 2010, respectively. Depreciation

and amortization expense for the years ended December 31, 2012, 2011, and 2010 totaled $188 million, $181 million, and

$177 million, respectively.

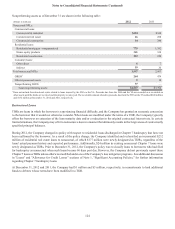

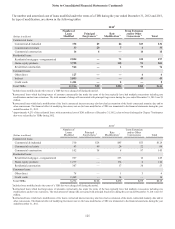

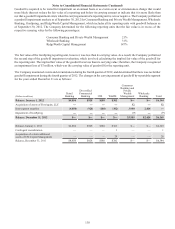

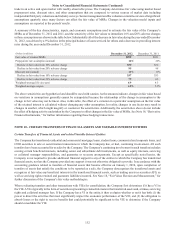

NOTE 9 – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

As discussed in Note 20, "Business Segment Reporting," the Company reorganized its management reporting structure in the

first quarter of 2012, including its segment reporting structure and goodwill reporting units. Goodwill was reassigned to the

new reporting units using a relative fair value allocation. After the allocation, Consumer Banking and Private Wealth

Management's goodwill balance was comprised of $3.6 billion and $335 million previously recorded within the Retail Banking

and W&IM segments, respectively. Wholesale Banking's goodwill balance was comprised of $1.3 billion, $47 million, $928

million, and $180 million previously recorded within the Retail Banking, W&IM, Diversified Commercial Banking, and CIB

segments, respectively.