SunTrust 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

3

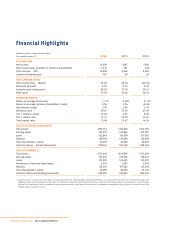

2012 Financial Highlights

• Earnings per average common diluted share of

$3.59 compared to $0.94 in 2011. 2012 earnings

included $1.40 per share from a series of

strategic actions announced in September that

improved our risk prole and strengthened

our balance sheet. Excluding these actions,

our core earnings more than doubled.

• The advantages of SunTrust’s diverse business

model were evident throughout the year. While

the low interest rate environment presented

challenges for banks to meaningfully grow net

interest income, strength in our noninterest

income led to increased overall revenue.

• Concurrently, expenses were tightly managed

and essentially stable over the prior year.

This was aided by the successful, and early,

completion of our 2011 commitment to

eliminate $300 million from our expense base.

• The multi-year improvement in our credit

metrics also continued — and in many

instances accelerated — in 2012. Most

notable was an almost 50% year-over-year

decline in nonperforming loans.

• Core lending and deposit trends were favorable

as evidenced by 6% growth in both average loans

and average lower-cost deposits.

• Lastly, capital continued to grow, and the Tier 1

common equity ratio reached an all-time high

of 10%.

The result of our proactive efforts to improve our

competitive position was apparent in the favorable

trends in our primary business segments.

Consumer Banking and Private Wealth Management

• A hallmark of SunTrust is our service quality and

the client loyalty that it garners. During 2012,

SunTrust again earned the #1 ranking in client

loyalty among retail consumers. Recognizing

that clients also value the convenience of self-

service offerings, we completed the installation

of more than 1,700 ATMs with deposit imaging

capabilities and introduced SunTrust Mobile

Deposit — both of which have resulted in

signicant increases in users and transactions.

• Core lending and deposit trends were also

favorable for this business segment; average

noninterest-bearing deposits increased 20% from

2011, and average loan balances were up 5%.