SunTrust 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79

profitability. Our Operational Risk Management function oversees an enterprise-wide framework intended to identify, assess,

control, monitor, and report on operational risks Company-wide. These processes support our goals in seeking to minimize

future operational losses and strengthen our performance by optimizing operational capital allocation.

Operational Risk Management is overseen by our CORO, who reports directly to the CRO. The operational risk governance

structure includes an operational risk manager and support staff within each line of business and corporate function. These

risk managers are responsible for execution of risk management within their areas in compliance with CRM's policies and

procedures.

Market Risk Management

Market risk refers to potential losses arising from changes in interest rates, foreign exchange rates, equity prices, commodity

prices, and other relevant market rates or prices. Interest rate risk, defined as the exposure of NII and MVE to adverse

movements in interest rates, is our primary market risk and mainly arises from the structure of our balance sheet, which

includes all loans. Variable rate loans, prior to any hedging related actions, are approximately 57% of total loans and after

giving consideration to hedging related actions, are approximately 43% of total loans.

We are also exposed to market risk in our trading instruments carried at fair value. ALCO meets regularly and is responsible

for reviewing our open positions and establishing policies to monitor and limit exposure to market risk.

Market Risk from Non-Trading Activities

The primary goal of interest rate risk management is to control exposure to interest rate risk, within policy limits approved

by the Board. These limits and guidelines reflect our tolerance for interest rate risk over both short-term and long-term horizons.

No limit breaches occurred during 2012.

The major sources of our non-trading interest rate risk are timing differences in the maturity and repricing characteristics of

assets and liabilities, changes in the shape of the yield curve, and the potential exercise of explicit or embedded options. We

measure these risks and their impact by identifying and quantifying exposures through the use of sophisticated simulation

and valuation models, which, as described in additional detail below, are employed by management to understand NII at risk

and MVE at risk. These measures show that our interest rate risk profile is slightly asset sensitive.

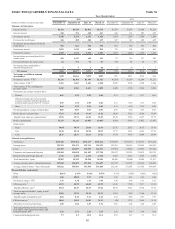

MVE and NII sensitivity are complementary interest rate risk metrics and should be viewed together. NII sensitivity captures

asset and liability repricing mismatches for the first year inclusive of forecast balance sheet changes and is considered a shorter

term measure, while MVE sensitivity captures mismatches within the period end balance sheets through the financial

instruments' respective maturities and is considered a longer term measure.

A positive NII sensitivity in a rising rate environment indicates that over the forecast horizon of one-year, asset based income

will increase more quickly than liability based expense due to balance sheet composition. A negative MVE sensitivity in a

rising rate environment indicates that value of the financial assets will decrease more than the value of financial liabilities.

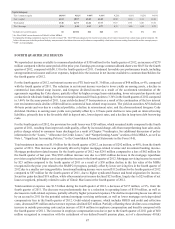

One of the primary methods that we use to quantify and manage interest rate risk is simulation analysis, which we use to

model NII from assets, liabilities, and derivative positions under various interest rate scenarios and balance sheet structures.

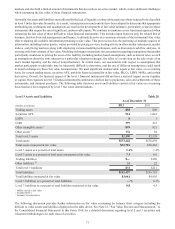

This analysis measures the sensitivity of NII over a two year time horizon, which differs from the interest rate sensitivities

in Table 29 which is prescribed to be over a one year time horizon. Key assumptions in the simulation analysis (and in the

valuation analysis discussed below) relate to the behavior of interest rates and spreads, the changes in product balances and

the behavior of loan and deposit clients in different rate environments. This analysis incorporates several assumptions, the

most material of which relate to the repricing characteristics and balance fluctuations of deposits with indeterminate or non-

contractual maturities.

As the future path of interest rates cannot be known in advance, we use simulation analysis to project NII under various

interest rate scenarios including implied forward and deliberately extreme and perhaps unlikely scenarios. The analyses may

include rapid and gradual ramping of interest rates, rate shocks, basis risk analysis, and yield curve twists. Each analysis

incorporates what management believes to be the most appropriate assumptions about client behavior in an interest rate

scenario. Specific strategies are also analyzed to determine their impact on NII levels and sensitivities.

In 2007, we elected to carry $6.8 billion of fixed rate debt and receive fixed/pay floating interest rate swaps at fair value in

accordance with applicable accounting standards. This change resulted in a material impact to our NII sensitivity profiles as

the income on the fair value swaps was no longer being reflected in net interest margin, but in trading income. As a result, to

better illustrate our interest rate sensitivity from an economic perspective we previously disclosed the impact of including the

fair value swaps in our NII sensitivity profiles separately. These fair value debt and swap balances have declined to $1.2